PAN Card Fees and Charges 2026

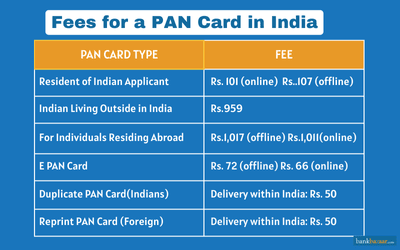

PAN Card fees in 2026 vary depending on the application type and communication mode. When PAN application is submitted through PAN centres, the fee for Indian residents is around ₹107 for physical cards and ₹72 for e-PAN. On the other hand, the fee for foreign applicants is around ₹1017 for physical cards and ₹72 for e-PAN.

A PAN Card is an invaluable resource in India, with everyone involved in trade or business of any kind expected to have it. Every taxpayer in the country should compulsorily have a PAN, with the government levying a penalty on those who indulge in financial transactions without it.

Owning a PAN Card is not an expensive affair, with the government imposing minimal charges on individuals. These charges are determined based on the address of an individual, with a higher cost for PAN Cards, which need to be sent outside the country.

Fees and Charges for a New PAN Card in India

The fees and charges applicable to apply for a new or updated PAN through different modes for those who are residing within India are given below:

Submission Mode | Physical PAN Card (Fee inclusive of taxes) | e-PAN Only (Fee inclusive of taxes) |

Through TIN Facilitation Centres/PAN Centres or Online with physical documents | ₹107 | ₹ 72 |

Online application using paperless (digital) mode | ₹ 101 | ₹ 66 |

Fees and Charges for Duplicate PAN Card in India

In case you misplace your PAN Card, or you want to request reprint of your PAN Card (without any changes), you can apply through UTIITSL website directly.

The fee for reprinting the PAN Card will be as follows:

- ₹50 (including taxes) if your PAN Card is delivered to an Indian address.

- ₹959 (including taxes) if it is sent to an address outside India.

Note: PAN Card will be delivered to the address updated in your PAN records.

Fees for New/Reprinted PAN Card for Individuals Residing Abroad

A booming Indian economy has attracted a number of foreign players who are keen on carrying out business in the country. A PAN is mandatory for such entities, be it an organization or an individual and they are required to go through the same process as a resident of India.

The fees and charges applicable to apply for a new or updated PAN through different modes for those who are residing outside India are given below:

Submission Mode | Physical PAN Card (Fee inclusive of taxes) | e-PAN Only (Fee inclusive of taxes) |

Through TIN Facilitation Centers/PAN Centers or Online with physical documents | ₹1017 | ₹72 |

Online application using paperless (digital) mode | ₹1011 | ₹66 |

PAN Card Fees for e-PAN Card

Applicants now have the option to opt only for e-PAN Card and not request for a physical card. There are no charges to get an instant e-PAN if you apply through the Income Tax Department’s e-filing portal using your Aadhaar number. You will receive the e-PAN in PDF format by email. However, if you apply for an e-PAN through the NSDL or UTIITSL websites, the fees will be:

Application Type | Fee (Including Taxes) |

Applying through PAN centres or uploading documents online | ₹72 |

Online submission via paperless process | ₹66 |

How to Pay PAN Card Fee?

There are two modes of payment by which an individual can make the payment for the PAN Card application. These are as follows:

1. Pay PAN Card Fee Via Online Mode

- Go to the official website of NSDL or UTIITSL.

- Fill in form 49A with the required details.

- Pay the processing fee online and submit the form.

2. Pay PAN Card Fee Via Offline Mode

- Visit the office of UTIITSL or PAN Centre and ask for Form 49A.

- Fill in the required details on the form and submit the required documents.

- Pay the required fee at the PAN Centre.

Modes of Payment for PAN Charges

The following modes of payments are permitted for PAN, with the communication address of an individual determining what modes are available to him/her.

- Communication Address Within India - Individuals with a communication address within the Indian Territory can pay via Credit/Debit cards, Demand Drafts, or through Net Banking. One should keep in mind that payment through Debit Card/Credit cards will attract an additional charge of up to 2% on the application fee, generally charged by the bank. The bank could also impose applicable taxes over and above the fee charged for a PAN. Payment by Demand Drafts are accepted only if the DD is in favor of "NSDL PAN" (NSDL is now known as Protean eGov Technologies Limited), payable at Mumbai. Payment through Net Banking will attract a surcharge of ₹4 plus service tax, to be borne by an applicant.

- Communication Address Outside India - Individuals or companies with a communication address outside India can pay for the PAN Card either through Credit/Debit card or Demand Drafts. The DD should be in favor of "NSDL- PAN", payable only in Mumbai. Payment by Credit or Debit card will attract additional bank-imposed charges to the tune of 2% plus service tax. Additionally, one might also incur conversion or exchange charges imposed by the bank to initiate such payment.

Individuals Permitted to Make PAN Payments on Behalf of Others

The Government of India permits others to make payment (Credit/Debit card and Net Banking) on behalf of a PAN applicant, depending on who is applying for a PAN Card.

- Individual Applicants - In case of individual applicants, either the applicant himself/herself or his immediate family can pay the application fee.

- Hindu Undivided Families - In case of Hindu Undivided Families only the Karta of the said HUF can make payments.

- Companies/Firms - Any Director or Partner of a firm can make payment on their behalf.

- Trusts/Associations - In the case of trusts, associations, local authorities, etc., payment can be made only by an authorized signatory as per the rules of the Income Tax Act .

Refund Policy for PAN Card Rejection

There are chances for the PAN application of an individual to be rejected, either on grounds of incorrect/incomplete information or failure to adhere to the instructions. In such cases, applicants should remember that there is no provision for a fee refund and that they can reapply for the PAN by correcting the wrong information, using the same payment details.

Related Articles on PAN Card

FAQs on PAN Card Fees

- How much is charged for issuing a duplicate PAN Card?

The fee for obtaining the duplicate PAN Card is ₹50 (including taxes) within India. If PAN Card is delivered outside India, the fee is ₹959 (including taxes).

- What are the accepted payment methods for foreigners applying for PAN Cards?

Foreign individuals residing outside India can make payments using debit/credit cards, demand drafts, or net banking. The bank may impose an additional charge of up to 2% for card payments.

- What are the fees associated with obtaining a PAN Card?

The charges for obtaining a physical PAN Card within India is ₹107, while for outside India is ₹1017. For acquiring an e-PAN the fee is ₹66 for both Indian and foreign address.

- What are the accepted payment methods for Indians or NRIs applying for PAN Cards?

Payments can be made using debit/credit cards, Demand Drafts (DD), or net banking. The bank may impose an additional charge of up to 2% for card payments. A payment through DD should be made to NSDL PAN. And payment through net banking incurs a surcharge of ₹4 plus GST.

- Are there any additional fees for applying for PAN online?

No, there are no extra charges for using PAN online.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.