IndusInd Bank Credit Card

IndusInd Bank offers credit cards that provide a range of benefits. You can choose from credit cards that provide travel, fuel, and dining benefits.

We found 3 IndusInd Bank Credit Cards

See More

Fee Details

- 1st Year - ₹ 0

- 2nd Year Onwards - ₹ 0

Joining Perks

- No joining perks

Rewards

- All category spends: ₹150 = 1.5 points

Documents

- PAN card

- Aadhaar number

What you'll love

No joining fee. No annual fee. No hidden fee. It’s lifetime FREE

Redeem reward points towards cash credit (1RP = ₹0.40)

Redeem reward points towards non-cash credit (1RP = ₹0.60)

Comprehensive insurance benefits

1% fuel-surcharge waiver at petrol bunks on transactions between ₹500 & ₹3,000, up to ₹100 per billing cycle

Multiple reward redemption options including IndusMoments, airline miles on Krisflyer, cash credit and pay with rewards

Redeem up to 10,000 reward points against KrisFlyer Miles in a month

Up to ₹2,000 off on booking flights via Air India with a VISA card*

Current month offers:*

10% off on Swiggy Instamart (min. spend of ₹500)

10% off on Eazydiner (min. spend of ₹2,000)

15% off at Apollo Pharmacy

₹500 off on Lifestyle (min. spend of ₹2,499)

₹150 off on Ajio (min. spend of ₹1,299)

8% off on flight bookings on Ixigo

Think about

Fuel transactions will not accrue reward points

Max. 2,500 reward points allowed for cash redemption per month, w.e.f 1st Sep 2024

Min. 500 reward points required for redemption towards cash credit & airline miles

*Limited validity. T&C apply

- Click for Card Monthly Offers

Up To 4 X Points On Shopping

See More

Fee Details

- 1st Year - ₹ 0

- 2nd Year Onwards - ₹ 0

Joining Perks

- No joining perks

Rewards

- Department stores: ₹ 100 = 4 points

- Consumer durables/electronic items: ₹ 100 = 2 points

- Restaurants: ₹ 100 = 1.5 points

- Books: ₹ 100 = 1.5 points

- Others: ₹ 100 = 0.5 points

Documents

- PAN card

- Aadhaar number

What you'll love

Earn up to 8X Reward Points on select merchant categories

Lifetime FREE - no joining fee or annual fee

Flexibility to choose your Reward Plans to match your lifestyle

1% fuel-surcharge waiver at petrol bunks on transactions between ₹500 & ₹3,000, up to ₹100 per billing cycle

Redeem reward points towards cash credit (1RP = ₹0.40)

Redeem reward points towards non-cash credit (1RP = ₹0.50)

0.5 points on every ₹ 100 spent on all other categories

Multiple reward redemption options including IndusMoments, airline miles, cash credit and Pay with Rewards

Redeem up to 10,000 reward points against KrisFlyer Miles in a month

Comprehensive insurance benefits

Up to ₹2,000 off on booking flights via Air India with a VISA card*

Current month offers:*

10% off on Swiggy Instamart (min. spend of ₹500)

10% off on Eazydiner (min. spend of ₹2,000)

15% off at Apollo Pharmacy

₹500 off on Lifestyle (min. spend of ₹2,499)

₹150 off on Ajio (min. spend of ₹1,299)

8% off on flight bookings on Ixigo

Think about

Fuel transactions will not accrue reward points

Max. 2,500 reward points allowed for cash redemption per month, w.e.f 1st Sep 2024

Min. 500 reward points required for redemption towards cash credit & airline miles

*Limited validity. T&C apply

- Click for Card Monthly Offers

Buy 1 Get 1 Offer On Book My Show

See More

Fee Details

- 1st Year - ₹ 0

- 2nd Year Onwards - ₹ 0

- APR - 46% per annum

Joining Perks

- Oberoi gift voucher

- Vouchers from MontBlanc & premium brands

Rewards

- Weekday spends: ₹100 = 1 point

- Weekend spends: ₹100 = 2 points

Documents

- KYC - PAN, address proof and ID proof

- Photograph, salary slip/form 16

What you'll love

'Buy 1, Get 1' offer - 3 FREE movie tickets on BookMyShow every month & additional ₹ 50 off on selecting F&B option

₹ 2,400 additional savings on fuel surcharge

4,000 bonus points on annual spends of ₹ 6 lakhs or more

Discounted forex markup of 1.8% on all foreign currency transactions

Redeem reward points for cash credit, airline miles on Vistara/InterMiles or vouchers/merchandise from IndusMoments catalogue

1 complimentary domestic lounge visit per quarter

Complimentary first-year EazyDiner Prime Membership

24x7 concierge & Auto Assist services

Free golf rounds & lessons once a quarter at prestigious golf clubs

Travel insurance & air accident coverage

Think about

Fuel surcharge waiver applicable on min. fuel transaction of ₹ 400 & max. transaction of ₹ 4,000

Each card comes with premium privileges and exclusive lifestyle bonuses to enrich your daily life. Moreover, IndusInd Bank offers added benefits like reward points, concierge services, and enticing discounts across various categories, making every purchase more valuable. Whether you are a frequent traveller or a dining enthusiast, there's a card tailored to elevate your lifestyle.

Best IndusInd Bank Credit Cards in India 2026

BankBazaar is an official IndusInd Bank partner, so you can apply for these cards on the BankBazaar website.

Features and Benefits of IndusInd Bank Credit Cards

IndusInd Platinum RuPay Credit Card

Experience the perfect blend of digital convenience and the trusted benefits of a credit card with the IndusInd Bank Platinum RuPay Credit Card. Designed for today’s modern lifestyle, it enables seamless UPI transactions, attractive reward earnings, and essential protection benefits -all without any joining or annual charges. A smart, reliable choice for those who value simplicity, flexibility, and everyday rewards.

Key Features and Benefits

- UPI Payments: Easily link your credit card to major UPI applications such as BHIM, Google Pay, and PhonePe. Enjoy the ease of making payments directly from your credit card account without the need for a physical card.

- Rewards: Earn 2 Reward Points for every Rs.100 spent on UPI transactions, making your everyday purchases even more rewarding. For non-UPI spends, earn 1 Reward Point for every Rs.100 spent, ensuring that you benefit no matter how you choose to pay.

- Fees: Enjoy true peace of mind with Nil joining fees and Nil annual charges, making it a lifetime free credit card without any hidden costs or conditions.

- Fuel: Benefit from a 1% fuel surcharge waiver at petrol pumps across India, allowing you to save more on your fuel expenses while enjoying the convenience of cashless transactions (Terms and Conditions apply).

- Redemptions: Redeem your Reward Points effortlessly across a wide array of options including shopping vouchers, travel bookings, lifestyle experiences, and more. Flexibility ensures that your rewards are as valuable as your spending.

- Travel Insurance: Gain access to complimentary travel insurance cover, giving you additional protection during both domestic and international trips for extra peace of mind.

- Fraud Protection: Shop, travel, and transact with complete confidence, backed by advanced fraud detection and purchase protection mechanisms designed to safeguard your interests.

- Reward Limits: Effective 1st September 2024, the maximum Reward Points eligible for cash redemption will be capped at 2,500 points per calendar month, maintaining a fair and rewarding structure.

- Point Value: From 15th December 2024, the value of each Reward Point redeemed for non-cash options (excluding airmiles) will be set at Rs.0.60, ensuring transparency and continued value from your rewards.

EazyDiner Credit Card

The IndusInd Bank EazyDiner Credit Card brings you exclusive savings, instant discounts, and accelerated rewards across dining, shopping, and entertainment. With a host of lifestyle benefits and premium experiences, it is the perfect companion for those who live to savour every moment.

Key Features and Benefits

- Dining Rewards: Earn 10 Reward Points for every Rs.100 spent on dining, shopping, and entertainment, making every outing more rewarding.

- Welcome Benefits: Get a complimentary 12-month EazyDiner Prime membership worth Rs.2,495. Access guaranteed discounts of 25% to 50% at over 2,000+ premium restaurants and bars, along with exclusive Prime-only perks.

- Bonus EazyPoints: Receive 2,000 bonus EazyPoints as a welcome gift, which can be redeemed towards luxury hotel stays or free meals.

- Luxury Stay Voucher: Enjoy a Rs.5,000 stay voucher for The Postcard Hotel, offering curated, luxurious escapes at exquisite destinations across India and beyond.

- Instant Redemption: Instantly redeem your Reward Points against restaurant bills via the PayEazy option on the EazyDiner App, for extra discounts while dining.

- Contactless Payments: Use the card’s contactless feature for quick, secure, and hassle-free payments by simply tapping at any merchant accepting contactless cards.

- Lounge Access: Avail two complimentary domestic airport lounge visits every calendar quarter, ensuring comfort and luxury during your travels.

- Entertainment Offers: Enjoy two complimentary movie tickets every month (worth Rs.200 each) on BookMyShow, enhancing your weekend plans.

- Fuel Benefits: Get a 1% fuel surcharge waiver at petrol stations across India, making your commutes more economical (Terms and Conditions apply).

- Maximising Benefits: Combine Prime membership discounts, EazyDiner card discounts, and Reward Points redemption to maximise your savings every time you dine.

- Worldwide Acceptance: Shop effortlessly at over 10 lakh merchants in India and over 30 million outlets globally that accept standard or contactless card payments.

- Security: Experience peace of mind with robust fraud protection and safe online shopping capabilities.

Nexxt Credit Card

Discover the future of payments with the IndusInd Bank Nexxt Credit Card, India’s first interactive credit card with built-in LED lights. Designed to put flexibility at your fingertips, it allows you to choose how you pay at the point of sale, with the press of a button. Whether it’s credit, EMI, or reward points, the choice is yours.

Key Features and Benefits

- India’s First Interactive Card: Equipped with LED indicators and tactile buttons, this innovative card allows you to switch between payment options — Credit, EMI, or Rewards — directly at POS terminals for in-store transactions.

- Flexible EMI Options: Choose to convert your purchases into EMIs of 6, 12, 18, or 24 months at a 12% interest rate, simply by selecting your desired tenure using the EMI button at checkout.

- Reward Points: Earn 1 Reward Point for every Rs.150 spent on your card. Points are redeemable across a wide range of partners or can be used to pay outstanding bills via Points+Pay.

- Complimentary Movie Tickets: Enjoy two free movie tickets every month (worth up to Rs.200 each) on BookMyShow, adding value to your entertainment experiences.

- Fuel Surcharge Waiver: Receive a 1% waiver on fuel surcharges at petrol pumps across India, offering added savings on your daily commute.

- Comprehensive Travel Insurance: Stay protected while travelling with coverage that offers peace of mind on both domestic and international trips.

- Global Acceptance: Use your card across 10 lakh merchant outlets in India and over 30 million worldwide, wherever card payments are accepted.

- Contactless Payments: Make quick, secure purchases with tap-to-pay functionality at terminals that support contactless transactions.

- Secure and Convenient: Whether online or offline, your transactions are backed by robust safety measures and fraud protection features.

- No Reward Expiry: Your reward points do not expire, giving you the flexibility to accumulate and redeem them whenever it suits you.

- Pay with Points at POS: Opt to pay using your accumulated reward points at the point of sale, wherever enabled, making everyday spending more rewarding.

IndusInd Bank Samman RuPay Credit Card

Tailored exclusively for government sector employees, the IndusInd Bank Samman RuPay Credit Card seamlessly blends modern convenience with essential everyday benefits. With integrated UPI functionality, guaranteed cashback, and lifestyle perks, it brings understated value to your day-to-day expenses.

Key Features and Benefits

- UPI-Enabled Credit Card: Make seamless payments via UPI by linking your Samman RuPay Credit Card on apps like BHIM, PhonePe, Paytm, and Google Pay. Enjoy the simplicity of QR-based payments with the added benefit of earning rewards.

- Cashback on Retail Spends: Earn 1% cashback on all retail transactions up to Rs.20,000 per statement cycle - delivering monthly savings of up to Rs.200.

- Complimentary Movie Ticket: Receive one free movie ticket worth up to Rs.200 every six months through BookMyShow, perfect for a relaxing break from your routine.

- Railway Surcharge Waiver: Enjoy a 1% waiver on railway ticket surcharge for transactions up to Rs.5,000 whether booking online or at the counter.

- Fuel Surcharge Waiver: Save 1% on fuel surcharges across petrol stations nationwide, rewarding you for every kilometre.

- Nil Cash Advance Fee: Withdraw cash in emergencies without incurring additional cash advance charges, offering financial flexibility when you need it most.

- Travel Insurance Cover: Travel with peace of mind with built-in insurance benefits that protect you on the go.

- Exclusive to Government Sector Employees: This card is available only for those employed in government roles -reflecting a bespoke offering for a deserving segment.

IndusInd Bank Platinum Visa Credit Card

The IndusInd Bank Platinum Visa Credit Card offers exclusive benefits tailored to those who seek luxury, convenience, and flexibility in their financial lifestyle. With generous reward points, premium services, and enhanced protection, this card is designed for individuals who value quality and excellence in every aspect of their purchases. Whether you are shopping, travelling, or dining, the Platinum Visa Credit Card elevates your experience, providing unmatched privileges.

Key Benefits and Features

- Reward Points: Earn 1.5 reward points on every Rs.150 spent on retail purchases with the Platinum Visa Credit Card. These points can accumulate quickly, offering you ample opportunities to redeem them for premium rewards or air miles, making every transaction more rewarding.

- Fuel Surcharge Waiver Enjoy a 1% fuel surcharge waiver at all petrol stations across India. This benefit ensures you save money every time you refuel your vehicle, making it an excellent advantage for frequent travellers or anyone who drives regularly.

- Complimentary Air Accident Insurance Cover: The Platinum Visa Credit Card offers complimentary air accident insurance cover of up to Rs.25 lakhs.

- No Cash Advance Fee for Withdrawals: The Platinum Visa Credit Card allows you to withdraw cash without any fees, offering more flexibility when you need immediate funds. This benefit adds convenience and reduces the cost associated with emergency cash withdrawals, providing a seamless experience.

- Reward Redemption Value: The reward points earned can be redeemed at excellent value, with 1 RP = Rs.0.60 for non-cash redemptions (from 1st March 2024) and 1 RP = Rs.0.40 for cash credit redemption. This makes it easy for you to maximise your benefits, whether you’re looking to save on purchases or settle your credit card bills.

- Maximum Reward Points for Cash Redemption: You can redeem up to 2,500 reward points for cash credit every calendar month, effective from 1st September 2024. This ensures that your points are put to the best use, allowing you to lower your credit card balance or use them for other redemptions without worrying about point limits.

- Redeem Points for Air Miles, Cash Credit, or Gifts: Enjoy flexible redemption options through www.indusmoments.com. You can redeem your points for air miles, cash credit to pay your outstanding balance, or gifts from a selection of luxury brands, giving you the flexibility to choose rewards that suit your lifestyle.

- Complimentary Montblanc Privileges: As a cardholder, enjoy exclusive access to Montblanc’s premium products, including watches, leather goods, and writing instruments. Montblanc is synonymous with craftsmanship and elegance, offering you a unique opportunity to own high-quality items that reflect sophistication.

- The Postcard Hotel Benefits: Experience curated luxury stays at The Postcard Hotel, with its collection of boutique hotels and exclusive locations. Indulge in extraordinary experiences, from intimate getaways to unforgettable vacations, ensuring you enjoy comfort and luxury at every step.

- Exclusive Vouchagram Premium Offers: Access premium gifting and experiences with Vouchagram Premium. Whether it’s for a special occasion or an indulgence for yourself, Vouchagram lets you gift experiences that are memorable and exceptional, elevating your gifting game to new heights.

- BookMyShow Offer Discontinued from 1st October 2022: Please note that the BookMyShow offer on the IndusInd Bank Platinum Visa Credit Card was discontinued from 1st October 2022. However, other valuable benefits and offers continue to enrich your cardholder experience.

- Insurance: Personal Air Accident Cover up to Rs.25 Lakhs: In addition to air accident cover, the Platinum Visa Credit Card offers comprehensive travel insurance benefits, providing you with protection during your journeys. This is a crucial benefit for frequent flyers who want to ensure their safety and financial security while travelling.

- Flexible Payment Options for EMI: The Platinum Visa Credit Card allows you to convert your purchases into easy EMIs, providing flexible repayment terms.

- No Annual Fee on Select Fee Plans: Depending on the plan you choose, the IndusInd Bank Platinum Visa Credit Card comes with no annual fee on select fee plans.

EazyDiner IndusInd Bank Platinum Credit Card

The EazyDiner IndusInd Bank Platinum Credit Card is a collaboration between IndusInd Bank and EazyDiner, designed for food lovers who enjoy both dining and rewards. With special privileges like discounts at top restaurants, accelerated reward points, and exclusive access to EazyDiner Prime, this card enhances your culinary experiences. Whether dining out, ordering in, or staying at luxury hotels, it brings a new level of sophistication to your lifestyle.

Key Benefits and Features

- 3-Month EazyDiner Prime Membership Worth Rs.1,095: The card comes with a complimentary 3-month EazyDiner Prime membership, valued at Rs.1,095. This membership provides guaranteed discounts ranging from 25% to 50% at over 2,000 premium restaurants and bars across India, unlocking exceptional dining experiences for cardholders.

- Instant 20% Discount on Payments via EazyDiner App: Enjoy an extra 20% discount (up to Rs.500) every time you make a payment through the EazyDiner app using the Platinum Credit Card. This instant discount adds significant savings on your restaurant bills, making it an ideal choice for frequent diners.

- Earn 2 Reward Points for Every Rs.100 Spent: The EazyDiner Platinum Credit Card allows you to earn up to 2 reward points for every Rs.100 spent. These reward points can be redeemed instantly for discounts on restaurant bills or through the EazyDiner app, offering a quick and rewarding way to save while dining.

- Welcome Bonus of 500 EazyPoints: As a new cardholder, you receive a welcome bonus of 500 EazyPoints. These points can be redeemed for dining offers, hotel stays, and other exclusive rewards, providing immediate value from the moment you receive your card.

- Milestone Benefit of 2000 Reward Points: After spending Rs.30,000 within 90 days, you earn 2,000 additional EazyPoints. This milestone benefit gives you an excellent opportunity to enjoy more rewards and discounts on future dining experiences, helping you make the most of your card.

- Lifetime Free Card (LTF): The EazyDiner Platinum Credit Card is available without any joining or annual fees, making it a lifetime-free (LTF) card. This ensures that you enjoy premium benefits and rewards without the burden of recurring charges, making it a valuable addition to your wallet.

- 1% Fuel Surcharge Waiver at All Fuel Stations in India: The card provides a 1% fuel surcharge waiver at all fuel stations in India, which helps you save on fuel costs while travelling. This benefit is perfect for those who frequently use their car and want to optimise spending.

- Instant Redemption of Reward Points Against Restaurant Bills: With the EazyDiner Platinum Credit Card, you can redeem your reward points instantly against restaurant bills through PayEazy. This feature ensures that you can save while you dine out, offering a seamless way to use your accumulated points for discounts on your dining experiences.

- Exclusive EazyDiner Prime Renewal Benefit: Upon spending Rs.30,000 within 90 days, your EazyDiner Prime membership is renewed for an additional 3 months. This keeps you enjoying Prime-exclusive benefits such as further discounts, priority reservations, and more.

- Contactless Payments for Faster and Secure Transactions: The card features a contactless payment option, enabling you to make fast, secure purchases with just a tap at participating merchant locations. This is an ideal feature for busy lifestyles, allowing you to pay swiftly for anything, from shopping to dining.

- Premium Dining Experiences with Special Offers: Enjoy curated dining experiences with access to exclusive offers, discounts, and rewards at top-tier restaurants. The card ensures that your culinary adventures are enhanced, giving you the flexibility to choose from a wide variety of dining options, both locally and nationally.

- Online Shopping and E-Commerce Benefits: In addition to dining, the card can be used for online shopping, movie ticket bookings, and utility bill payments. You can enjoy the same ease of use and rewards across all your spending categories, further enhancing the card's versatility.

- Access to Luxury Hotel Stays with EazyPoints: EazyDiner members can redeem their points for luxury hotel stays, allowing you to enjoy relaxing getaways at premium hotels and resorts. This feature ensures that your card doesn’t just cater to your dining needs but also enriches your travel experiences.

IndusInd Bank Legend Credit Card

The IndusInd Bank Legend Credit Card offers an unparalleled experience for those who demand the best in life. Tailored to meet the needs of affluent individuals, this card delivers luxury perks, exclusive benefits, and generous rewards that elevate every aspect of your lifestyle from travel to dining. Indulge in the finest rewards, concierge services, and special offers designed for ultimate convenience and luxury.

Key Benefits and Features

- 2 Reward Points for Every Rs.100 Spent on Weekends: This premium card rewards you with 2 reward points for every Rs.100 spent on weekends, allowing you to earn points more quickly on your leisure and weekend shopping or dining activities. This makes it ideal for those who love to make the most of their weekend spending.

- 1.8% Discounted Foreign Currency Mark-up: The card provides a 1.8% discounted foreign currency mark-up on international transactions. This feature allows you to save significantly on foreign currency exchange fees when you travel abroad, making your international purchases more affordable.

- 1% Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver at fuel stations across India, helping you reduce costs during long drives or regular commutes. This benefit is particularly valuable for those who frequently travel by car, ensuring you save every time you fill up.

- 3000 Bonus Reward Points on Annual Spend of Rs.5 Lakh: Earn 3,000 bonus reward points when you spend Rs.5 lakh or more in a year. This milestone benefit offers extra rewards for those who use their Legend Credit Card extensively, making it even more rewarding to engage with the card on a regular basis.

- Luxe Gift Card for Premium Brands: The Luxe Gift Card gives you access to a curated collection of over 30 luxury and premium brands across 360+ stores in 30 cities across India. This unique perk opens the door to exclusive shopping experiences and premium lifestyle indulgences.

- Complimentary Priority Pass Membership for You and Your Partner: Receive complimentary Priority Pass membership for both you and a companion. This membership provides access to over 1,300 airport lounges globally, ensuring that your travel experiences are more comfortable and luxurious, no matter where you go.

- Complimentary Movie Tickets Every Month: The Legend Credit Card offers 2,400 points worth of movie tickets per year, which translates to one free movie ticket each month. This benefit adds a layer of entertainment value to your card, allowing you to enjoy a night at the cinema on the house.

- Exclusive Legend Concierge Service: The Legend Concierge Service is available to assist you with personal requests, travel bookings, event reservations, and more. Whether it’s arranging a special dinner or finding tickets to a sold-out concert, the concierge is there to ensure your needs are met with elegance and efficiency.

- Exclusive Travel and Lifestyle Benefits: The card comes with a host of exclusive travel and lifestyle benefits, such as discounted rates at luxury hotels, car rental services, and more. These curated experiences ensure that your travels are always luxurious and hassle-free.

- Contactless Payments for Speed and Security: The contactless feature on the Legend Credit Card enables you to make fast and secure payments by simply tapping your card at participating merchant locations. This feature ensures a seamless transaction experience, whether you’re shopping in-store or making a quick purchase.

- Annual Reward Points Value of Rs.5,400: On average, cardholders can earn Rs.5,400 worth of reward points annually by spending Rs.30,000 per month. These points can be redeemed for a variety of benefits, including vouchers, air miles, or cashback, offering you versatile ways to use your rewards.

- Discounted Foreign Currency Mark-up: The card’s 1.8% discounted foreign currency mark-up ensures that every international purchase is more affordable, making it an ideal choice for frequent travellers who want to save on overseas spending.

IndusInd Bank Pinnacle Credit Card

The IndusInd Bank Pinnacle Credit Card is a symbol of luxury and excellence, designed for those who demand nothing but the best. Offering an exclusive suite of travel, lifestyle, and golf privileges, this card ensures you experience the finest in every aspect of life. With unparalleled rewards and benefits, the Pinnacle Credit Card is crafted for individuals who view excellence as a daily expectation, not a luxury.

Key Benefits and Features

- 2.5 Reward Points for Every Rs.100 Spent: The Pinnacle Credit Card rewards you generously with 2.5 reward points for every Rs.100 spent on your card. This attractive earning rate ensures that your everyday purchases quickly add up to meaningful rewards, whether for travel, lifestyle, or luxury experiences.

- Complimentary Golf Games and Lessons at Select Golf Courses: Enjoy a complimentary golf game and lesson at select prestigious golf courses each month, effective from 13th March 2025. This unique benefit enhances your sporting lifestyle, providing an elite golfing experience as part of your membership.

- Priority Pass Membership for International Lounge Access: From 13th March 2025, the card provides one complimentary international lounge visit each calendar quarter through Priority Pass. This benefit adds convenience and comfort to your travel, offering you access to exclusive airport lounges globally.

- Complimentary Movie Tickets (Buy One, Get One Free): Enjoy a complimentary movie ticket with the purchase of one, three times a month. This valuable perk lets you experience the latest films with friends or family while saving on entertainment costs.

- Complimentary Private Golf Lessons and Hole-in-One Insurance: Receive 20,000 reward points towards private golf lessons and hole-in-one insurance. This comprehensive offering ensures you are equipped to excel in your game while safeguarding your valuable assets on the course.

- Luxe Gift Card for Premium Shopping: The Luxe Gift Card offers access to over 30 luxury brands across 360+ stores in 30 cities in India. Indulge in premium shopping experiences at renowned global brands, adding an exclusive touch to your lifestyle.

- Complimentary Annual Priority Pass Membership: Receive a complimentary Priority Pass membership, along with access for your partner. This benefit grants access to over 1,300 airport lounges worldwide, ensuring you travel with ease and luxury every time.

- Complimentary Movie Tickets Thrice a Month: The Pinnacle Credit Card offers 7,200 worth of complimentary movie tickets, valid for three movies per month. Enjoy regular cinematic indulgence with this exciting perk, bringing added entertainment to your routine.

- Fuel Surcharge Waiver: Enjoy additional savings on fuel surcharge, making it easier for you to keep your vehicle running while reducing everyday costs at fuel stations across India. This benefit ensures a more economical travel experience.

- Exclusive Concierge and Travel Assistance: The Pinnacle Credit Card offers a range of premium concierge services to help you with everything from restaurant reservations to travel bookings and lifestyle arrangements. Whether for business or leisure, enjoy dedicated support that elevates your experience.

- Annual Reward Points Value of Rs.4,050: With an average monthly spend of Rs.30,000, you can earn an annual value of Rs.4,050 worth of reward points. These points can be redeemed for a variety of benefits, including luxury shopping, travel rewards, and exclusive experiences.

IndusInd Bank Tiger Credit Card

The IndusInd Bank Tiger Credit Card is designed for the bold and adventurous, offering you an identity, privileges, and rewards that only a select few can enjoy. With an impressive suite of benefits tailored to the modern, discerning customer, the Tiger Credit Card brings you an elevated lifestyle, featuring exclusive rewards and luxury perks.

Key Benefits and Features

- 6X Accelerated Reward Points: Earn up to 6X Accelerated Reward Points on every Rs.100 spent, providing a superior rewards rate that enhances the value of your everyday purchases. The more you spend, the more you earn, giving you the chance to redeem your points for various luxurious rewards.

- 1.5% Discounted Forex Mark-up Fee: Benefit from a reduced forex mark-up fee of 1.5% on international transactions, making your foreign spends more cost-effective and convenient.

- Complimentary Golf Game or Lesson per Quarter: Enjoy one complimentary golf game or lesson every quarter, enhancing your golfing experience at select courses and ensuring you stay at the top of your game.

- Complimentary Lounge Access:

- 2 Complimentary Domestic Lounge Visits per Quarter

- 2 Complimentary International Lounge Visits per Year Access exclusive airport lounges, both domestically and internationally, with the Priority Pass membership. Enjoy comfort and luxury while waiting for your flights.

- Complimentary Movie Ticket on BookMyShow: Receive one complimentary movie ticket worth up to Rs.500 every six months, redeemable on BookMyShow. This benefit ensures that you can enjoy the latest films without the cost.

- Cash Redemption of Reward Points: From 1st September 2024, the maximum reward points allowed for cash redemption will be limited to 5000 points per calendar month. However, with the rewards multiplier system, you can still accumulate substantial points for future redemptions.

IndusInd Bank Platinum Aura Edge Visa Credit Card

The IndusInd Bank Platinum Aura Edge Credit Card is designed to offer seamless, fast, and secure transactions with its contactless payment feature. Whether you’re making everyday purchases, dining out, or booking travel, this card provides the convenience of contactless payments while offering a range of premium benefits to complement your lifestyle.

Key Benefits and Features

- Contactless Payment Feature:Make fast, secure payments simply by waving your card at merchant locations that accept contactless payments. Enjoy seamless, frictionless transactions at millions of outlets worldwide.

- Up to 8X Reward Points:Earn up to 8X Reward Points on select merchant categories. With the flexibility to choose from four reward plans, you can maximise your points on categories that matter most to you.

- Fuel Surcharge Waiver:Save on fuel purchases with a 1% Fuel Surcharge Waiver. This benefit makes filling up your vehicle more economical.

- Reward Plans:Choose from four reward plans based on your lifestyle:

- Platinum Aura Shop Plan

- Platinum Aura Home Plan

- Platinum Aura Travel Plan

- Platinum Aura Party Plan Each plan is tailored to help you earn rewards on your preferred spending categories, such as shopping, dining, travel, and entertainment.

- Welcome Gift:Enjoy special welcome benefits, including discount vouchers from leading brands such as Amazon, Flipkart, Uber, Apollo Pharmacy, and more (applicable on select fee plans).

- Online Shopping and Utility Bill Payments:Use the Platinum Aura Edge Card for online purchases, movie tickets, utility bill payments, and more. Enjoy the added security and convenience of the contactless feature.

- Effortless Transactions:Simply tap your card at merchant locations that accept contactless payments, and enjoy quick, secure transactions without needing to swipe or enter a PIN for low-value purchases.

- Global Acceptance:The card can be used at over 10 lakh merchant outlets in India and more than 30 million outlets globally. It’s also compatible with all standard card payment terminals.

- Platinum Aura Edge Travel Plan:Enjoy exclusive travel benefits tailored for the frequent traveller, including access to airport lounges and more.

- Platinum Aura Edge Assurance Plan:Get comprehensive insurance coverage and protection with this plan, adding an extra layer of security to your card usage.

IndusInd Bank Avios Visa Infinite Credit Card

The IndusInd Bank Avios Visa Infinite Credit Card is a premium, metal credit card designed for the discerning traveller who seeks to elevate their international travel experience. With the flexibility to choose your preferred airline loyalty programme and destination, this card offers you the opportunity to collect Avios, which can be redeemed for a range of travel-related benefits.

Key Benefits and Features

- Customised Airline Loyalty Programme: You can choose your Airline.Select between Qatar Airways Privilege Club or British Airways Executive Club for your preferred loyalty programme.

- Maximise Benefits: Tailor your rewards to your frequent international destination to maximise your travel rewards and benefits.

- Earn Avios and Enjoy Travel Rewards: Collect Avios as you spend, with the opportunity to earn up to 36,000 bonus Avios annually. Redeem your Avios for flight tickets, hotel stays, car rentals, and other exciting travel-related rewards.

- Concierge Service: Gain access to dedicated concierge services for all your travel, lifestyle, and personal assistance needs.

- Airport Meet-and-Greet: Enjoy complimentary meet-and-greet services and a discount of 25% on fast-track immigration at over 450 destinations worldwide.

- Luxury Transfers: Get 20% off on luxury airport transfers via the Visa Airport Limo Transfer Program, available in key cities globally.

- Welcome Bonus: Choose your preferred loyalty programme and receive a welcome bonus of 20,000 Avios after the payment of the joining fee.

- Qatar Airways Privilege Club

- British Airways Executive Club

- Renewal Benefits: Enjoy milestone benefits on card renewal to enhance your travel experiences year after year.

- Contactless Payment: A contactless feature for easy, fast, and secure transactions at merchant locations. Simply tap your card to make purchases at over 10 lakh merchant outlets in India and more than 30 million outlets globally.

- Earn Avios: Earn Avios with every transaction, allowing you to collect points faster, whether you’re shopping, dining, or travelling.

- Redeem Your Avios: Avios can be redeemed for free flight tickets, upgrades, hotel stays, and car rentals at select international locations.

- Visa Offers: Airport Meet & Greet: Enjoy a 25% discount on retail rates for airport fast track services at over 450 global destinations.

- Visa Airport Limo Transfer: Avail of 20% off on luxury airport transfer services in major cities worldwide.

- Convenient Transactions: The IndusInd Bank Avios Visa Infinite Credit Card is a chip-based contactless card, allowing for fast, convenient, and secure payments simply by tapping your card at merchant locations.

- Global Acceptance: The card is accepted at millions of outlets globally, ensuring that you can use it for everything from shopping to booking travel, paying utility bills, and withdrawing cash at ATMs worldwide.

IndusInd Credit Card Fees and Charges

Fee Type | Charges |

Add-on Card Fee | Nil |

Interest Rate | Monthly: 3.83% ; Annually: 46% |

Interest-Free Tenure | 50 days |

Late Payment Charges |

|

Over-limit Charges | 2.5% of over-limit amount, minimum Rs. 500 |

Outstation Cheque Payment | Nil (only IndusInd Bank locations) |

Reissuance/Card Replacement Fee | Rs. 100 |

Overseas Transaction Charges | 3.5% of transaction + currency conversion charges |

Credit Card Payment Cheque Return Charges | Rs. 250 |

Balance Enquiry (Non-IndusInd ATMs) | Rs. 25 |

Cash Withdrawal/Cash Advancement | 2.5% of amount, minimum Rs. 300 |

Railway Booking Surcharges | As applicable on booking website |

Cash Payment Charges | Rs. 100 |

GST Charges | As notified by Ministry of Finance |

Duplicate Statement Charges | Rs. 100 per statement (beyond last 3 months) |

Priority Pass Usage Charges | Up to USD 27 per person per visit |

Issuance Charge | Rs. 3,499 |

Eligibility Criteria to Apply for an IndusInd Bank Credit Card

To apply for an IndusInd Bank credit card, you must meet specific eligibility criteria that help the bank assess your creditworthiness. Meeting these conditions can improve your chances of approval and access to better card options. The eligibility criteria are:

1. Age: Applicants must be at least 18 years of age to be eligible for an IndusInd Bank credit card. While 18 is the minimum age, the upper limit generally falls between 60 and 75 years, depending on the card type and individual applicant profile. This range ensures that the applicant is legally capable of entering into a financial agreement and is likely to have some financial stability.

2. Income: A regular and verifiable income is a key requirement. IndusInd Bank typically mandates a minimum monthly income of Rs. 20,000 for salaried individuals. However, this requirement can vary based on the credit card you are applying for. For instance, entry-level cards like the Platinum RuPay Credit Card may have modest income criteria, while premium offerings like the Avios Visa Infinite Credit Card demand a higher income level. The bank uses income as a benchmark to assess your repayment ability and determine your credit limit.

3. Employment Status: Both salaried professionals and self-employed individuals are eligible to apply for an IndusInd Bank credit card. The key requirement is a stable employment or business history, supported by valid income documentation such as salary slips, bank statements, or income tax returns. A consistent income stream assures the bank of your repayment capacity.

4. Credit Score: Your credit score is one of the most important factors in determining your eligibility. A CIBIL score of 700 or above is generally considered good and increases your chances of approval significantly. A strong credit score reflects a history of timely payments, responsible credit usage, and financial discipline- all of which are valued by the bank. Applicants with high credit scores may also be considered for cards with better benefits and higher limits.

Check Eligibility for IndusInd Bank Credit Cards on BankBazaar

You can check your eligibility to apply for any of the above listed IndusInd Bank credit cards on the BankBazaar website. Just follow the steps listed below:

Step 1: Visit www.bankbazaar.com/indusind-credit-card.html

Step 2: After selecting the preferred IndusInd Bank credit card, click the "Apply Now" button and respond to the prompts.

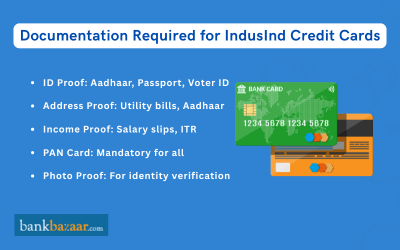

Documents Required to Apply for an IndusInd Bank Credit Card

Applying for a credit card is an important step toward financial freedom, offering ease of transactions and numerous benefits. However, having the right documents in place is crucial to ensure a smooth approval process. Below is a breakdown of the key documents typically required when applying for a credit card.

1. Proof of Identity

To establish your identity and nationality, banks require valid ID proof. Accepted documents include a passport, voter ID, Aadhaar card, or driving licence. These documents help confirm you are who you claim to be.

2. Proof of Address

Banks also need to verify your current residential address. You can submit utility bills such as electricity, water, or gas bills, a rental agreement, passport, or Aadhaar card as valid proof of residence.

3. Proof of Income

Your income documents help the bank assess your ability to repay. Salaried individuals may be asked to submit recent salary slips, Form 16, or income tax returns along with bank statements from the past 3 to 6 months. Self-employed applicants may need to provide income tax returns from the last two years, proof of business continuity, and profit and loss statements.

4. PAN Card

A PAN card is mandatory for all credit card applications as it is essential for tax compliance and financial transactions. It also helps track your credit and spending patterns.

5. Recent Passport-Sized Photograph

Most credit card applications require a recent passport-sized photograph for identity verification and official records.

How to Apply for an IndusInd Bank Credit Card

You can apply for any of the aforementioned IndusInd Bank credit cards on BankBazaar.com. You can also save time by uploading and submitting all relevant documents online. This would also ensure that your application is completed promptly.

- A free chance to get your CIBIL score

- A simple way of checking your eligibility for your desired card

- Instant approval for eligible individuals

- Exciting gifts and other benefits

To Apply for an IndusInd Bank Credit Card, Follow These Steps:

- Step 1: Click the 'Check Eligibility' button placed next to your desired card.

- Step 2: Answer the questions asked and establish your eligibility for that card.

- Step 3: Once on the IndusInd Bank credit card application page, complete the required fields and click "Submit."

- Step 4: You will then be asked to upload the required files. After doing so, click "Submit."

- Step 5: After your application and all necessary supporting materials are successfully submitted, you will be given an application ID number. The similar technique can be used to track the application in 'Track Application'.

Reward Points Offered on Top IndusInd Bank Credit Cards

IndusInd Bank Credit Card Variant | Regular Reward Points | Accelerated/bonus reward points for every Rs.100 spent |

IndusInd Bank Platinum Card | 1.5 reward points for every Rs.100 spent | - |

IndusInd Bank Legend Credit Card |

| 4,000 bonus reward points on spends of Rs.6 lakh within one year from the date of card issuance |

IndusInd Bank Platinum Aura Edge Credit Card |

| - |

IndusInd Bank Signature Visa Credit Card | 1.5 reward points every time you spend Rs.100 | - |

IndusInd Bank Duo Card India's First Debit-Cum-Credit Card |

| - |

IndusInd Bank Crest Credit Card |

| - |

IndusInd Bank Pioneer Heritage Credit Card |

| - |

IndusInd Bank Pioneer Legacy Credit Card | 1.5 Reward Points for every Rs.100 spent | - |

IndusInd Headquarters Address:

IndusInd Bank Limited, 2401 Gen. Thimmayya Road (Cantonment), Pune-411 001, India

Phone: +91 20 3046 1600-609

CIN: L65191PN1994PLC076333.

For shareholder's grievances or issues, you can contact Mr. Raghunath Poojary by dropping a mail at investor@indusind.com

FAQs on IndusInd Bank Credit Cards

- What fees are charged for cash advances on IndusInd Bank credit cards?

Cash advances on IndusInd Bank credit cards attract a fee of 2.5% of the withdrawn amount, subject to periodic review. Interest is charged from the date of the cash advance, so it’s recommended to repay the amount quickly to minimise interest costs.

- What should I do if my IndusInd Bank credit card is lost?

If your IndusInd Bank credit card is lost, immediately report it by calling Phone Banking, sending an SMS, or using the IndusMobile app to block the card and request a replacement.

- How can I block my IndusInd Bank credit card if necessary?

You can block your IndusInd Bank credit card via Phone Banking (18602677777), by submitting a blocking request on IndusNet, using the IndusMobile app, or by sending an SMS with "BLOCK <space> <XXXX>" (last 4 digits of the card) to 5676757 from your registered mobile number.

- Can I redeem the reward points from my IndusInd Bank credit card for cash?

Yes, you can redeem the reward points accumulated on your IndusInd Bank credit card for cash credit to your account. This can be done through the Indus Moments website or by contacting Phone Banking.

- How can I check the reward points balance on my IndusInd Bank credit card?

To check your reward points balance, you can either refer to your latest credit card statement or log into IndusNet (Net Banking) or the IndusMobile app.

- How can I apply for a higher credit limit on my IndusInd Bank credit card?

To request a credit limit increase on your IndusInd Bank credit card, ensure a good credit history, make timely payments, and maintain a low credit utilisation ratio. Demonstrating an increase in your income and having a strong credit score will help your application.

- What are reward points on IndusInd Bank credit cards and how can I use them?

Reward points on IndusInd Bank credit cards are earned through eligible purchases. These points can be redeemed for rewards such as airline miles, gift cards, merchandise, or cash credit. Redemption is available through the Indus Moments website or by contacting Phone Banking.

- Which IndusInd Bank credit cards are offered with no annual fee for life?

IndusInd Bank offers several credit cards with no annual fee for life, including the Legend Credit Card, Platinum RuPay Credit Card, Platinum Visa Credit Card, and Platinum Aura Edge Credit Card, all of which provide various benefits.

- What benefits do IndusInd Bank’s lifetime free credit cards offer?

IndusInd Bank’s lifetime free credit cards come with no annual fees, cashless transactions, enhanced security, and various rewards. Additional benefits include fuel surcharge waivers and exclusive offers on dining, travel, and shopping.

- What is the procedure for withdrawing cash from an IndusInd Bank credit card while minimising fees?

To withdraw cash using your IndusInd Bank credit card, visit an ATM, insert your card, and follow the instructions. A 2.5% cash advance fee applies, and interest is charged from the date of withdrawal. To reduce interest, repay the amount promptly.

FAQs on IndusInd Bank Credit Cards

CRED Partners with IndusInd Bank to launch the CRED IndusInd Bank RuPay Credit Card

CRED has partnered by IndusInd Bank to launch the CRED IndusInd Bank RuPay Credit Card. Five percent reward points on e-commerce transactions and one percent reward points are provided on UPI transactions via CRED Scan and Pay and offline transactions. Sales and marketing will be taken care of by CRED under the partnership. Sovereign, an invite only credit card for India’s elite that features a bespoke 18-karat gold with guilloche engraving, was unveiled by CRED as well.

Types of Credit Card

- Top 10 Credit Cards in India

- Fuel Credit Cards

- Lifetime Free Credit Cards

- Kisan Credit Card

- Student Credit Cards in India

- Shopping Credit Cards

- Contactless Credit Cards

- Travel Credit Cards

- Co-Branded Credit Cards

- Lifestyle Credit Cards

- Rewards Credit Cards

- Business Credit Cards

- NRI Credit Cards

- Cashback Credit Cards

- Lounge Access Credit Cards

Credit Card by Banks

- Axis Bank Credit Card

- HDFC Bank Credit Card

- Kotak Bank Credit Card

- Federal Bank Credit Card

- SBI Credit Cards

- HSBC Credit Card

- IndusInd Bank Credit Card

- RBL Bank Credit Card

- Standard Chartered Credit Card

- YES Bank Credit Card

- Canara Bank Credit Card

- Punjab National Bank Credit Card

- Bank of Baroda Credit Card

- IDBI Credit Card

- Union Bank of India Credit Card

- Bank of India Credit Card

Articles on Credit Card

- How to Check Credit Card Status

- How to Manage Multiple Credit Cards

- Best Credit Card for Poor Credit

- How to get Credit Card without Job

- Credit Card Insurance Benefits

- How to Apply for Lost Credit Card

- Reasons for Credit Card Rejection

- Advantages & Disadvantages of Credit Card

- Difference between Credit Card & Debit Card

Credit Card Customer Care

- SBI Credit Card Customer Care

- HDFC Bank Credit Card Customer Care

- Axis Bank Credit Card Customer Care

- Federal Bank Credit Card Customer Care

- IndusInd Bank Credit Card Customer Care

- PNB Credit Card Customer Care

- RBL Bank Credit Card Customer Care

- Kotak Credit Card Customer Care

- Yes Bank Credit Card Customer Care

- Standard Chartered Credit Card Customer Care

- Canara Bank Credit Card Customer Care

- HSBC Credit Card Customer Care

- Indian Bank Credit Card Customer Care

- Bank of Baroda Credit Card Customer Care

- Bank of India Credit Card Customer Care

- Union Bank of India Credit Card Customer Care

Credit Card Bill Payment

- Credit Card Bill Payment

- SBI Credit Card Bill Payment

- HDFC Credit Card Bill Payment

- Federal Bank Credit Card Bill Payment

- Axis Bank Credit Card Bill Payment

- IndusInd Credit Card Bill Payment

- Kotak Credit Card Bill Payment

- Standard Chartered Credit Card Bill Payment

- RBL Bank Credit Card Bill Payment

- HSBC Credit Card Bill Payment

- PNB Credit Card Bill Payment

- Canara Bank Credit Card Bill Payment

- Bank of Baroda Credit Card Bill Payment

- Bank of India Credit Card Bill Payment

- Union Bank Credit Card Bill Payment

Credit Card Eligibility

- Credit Card Eligibility

- SBI Credit Card Eligibility

- HDFC Credit Card Eligibility

- Federal Bank Credit Card Eligibility

- Axis Bank Credit Card Eligibility

- Yes Bank Credit Card Eligibility

- IndusInd Bank Credit Card Eligibility

- HSBC Credit Card Eligibility

- Kotak Credit Card Eligibility

- Canara Bank Credit Card Eligibility

- Standard Chartered Credit Card Eligibility

- RBL Bank Credit Card Eligibility

- Bank of Baroda Credit Card Eligibility

- Union Bank Credit Card Eligibility

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.