Car Loan EMI Calculator

Car Loan EMI Calculator lets you quickly calculate your monthly EMI, interest rates, and loan eligibility. Whether purchasing a new or used car, it ensures accurate results and helps you find the best car loan offers.

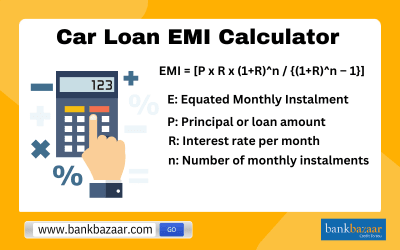

Car Loan EMI Calculation Formula

The EMI for any type of loan is essentially calculated using a formula. The formula is as follows:

E = P x R x (1+R)^n / {(1+R)^n – 1}

where ‘E’ stands for the EMI you owe,‘P’stands for the principal amount,‘R’stands for the interest rate applicable to your car loan,and ‘n’stands for the tenure of the car loan (in months).

Bank-Wise Car Loan Interest Rates Comparison

Compare car loan interest rates from top lenders and choose the best option for your needs.

Name of the bank | Interest Rate (p.a.) |

8.70% p.a. onwards | |

9.15% p.a. onwards | |

9.10% p.a. onwards | |

8.70% p.a. onwards | |

9.00% p.a. onwards | |

9.10% p.a. onwards | |

9.40% p.a. onwards | |

8.75% p.a. onwards |

Note: GST rates will be applicable over and above the rates charges mentioned above.

What is a Car Loan EMI Calculator?

Nowadays, it is much easier to buy your dream car due to the various car loan schemes offered by different lenders. Car loans are offered at attractive interest rates and a repayment tenure of up to 8 years.

Various banks and third-party websites offer a Car Loan EMI Calculator that allows you to calculate the Equated Monthly Instalments (EMIs) that must be paid. The Car Loan EMI calculator offered by BankBazaar is simple to use and is free.

Basic details such as the repayment tenure, principal amount, and the rate of interest must be entered to calculate the Car Loan EMI. You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month for your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

How to Use the Car Loan EMI Calculator

The procedure that must be followed to use the Car Loan EMI calculator offered by BankBazaar is mentioned below:

- The calculator can be found on the top of this page. The first step would be to select the loan amount.

- Next, select the repayment tenure.

- Enter the rate of interest

- Enter the processing fee. The results will be displayed immediately.

You can check the principal amount and the interest that is being paid every year. The calculator also provides the outstanding balance at the end of every year.

Benefits of Using BankBazaar’s EMI Calculator

The main benefits of using a car loan EMI calculator are mentioned below:

- Break-Up of the Due Amount is Provided: The car loan EMI calculator helps you calculate the processing fees, interest that is paid, the total amount that must be paid, and the principal amount.

- Your Budget can be Planned: Once you know the EMI that must be paid, you can plan your budget accordingly. In case the loan amount that is being availed is large, you may think of opting for a longer tenure. These details can be determined by using the car loan EMI calculator.

- Accuracy: For the details that are being provided on the calculator, the results that are displayed are accurate. Manual calculations may not provide accurate results.

- Saves Time: The main aim of the Car Loan EMI calculator is to save time. Once the relevant details are entered, the results are displayed almost immediately.

- No Limit: There is no limit to the number of times the calculator can be used. Therefore, you use the calculator with different variants. This can help you choose the best lender and the down payment that must be paid.

- Compare: As there is no limit to the number of times that the calculator can be used, you can compare the EMIs for different values.

Ready to buy your dream car? Use our Car Loan EMI Calculator to estimate your monthly payments and apply online for the best car loan deals today!

Factors Affecting Car Loan EMI Calculation

Car loans are offered at fixed as well as floating interest rates. The fixed rate will remain unchanged for the tenure of the loan, but the floating rate is subject to change from time to time.

The different factors that can affect interest rates include applicable taxes, liquidity, inflation, etc.

Car Loan EMI Types: Fixed vs Floating Rate Comparison

EMI Calculation Type | Description | Example |

Fixed Rate EMI Calculation |

|

|

Floating Rate EMI Calculation |

|

|

Note: This loan's interest rate is variable, meaning it can fluctuate up or down based on the market.

FAQs on Car Loan EMI Calculator

- What is Equated Monthly Installment?

Secured loans like home loans and car loans, and unsecured loans like personal loans are repaid through Equated Monthly Installments (EMI).

- What is the best tenure for a car loan?

The best tenure for a car loan is 3-5 years, balancing affordable EMIs and minimizing total interest.

- Can I reduce my car loan EMI?

You can reduce your car loan EMI by opting for a longer tenure, making a larger down payment, or refinancing the loan.

- What factors affect car loan EMI calculation?

Car loan EMIs are influenced by the type of interest rate fixed or floating. While fixed rates stay constant, floating rates can change based on factors like inflation, liquidity, tax policies, and RBI regulations, which in turn affect your monthly EMI.

- Which bank offers the lowest car loan interest rate?

Banks like Union Bank of India and Canara Bank offer competitive car loan interest rates starting from 8.70% p.a.

- What are the benefits of using an online Car Loan EMI Calculator?

The results are instant and accurate whereas manual EMI calculations are prone to human error and are time consuming. You can also input varying combinations of the loan amount, loan tenure, and interest rates to get revised results.

- Are there any charges levied to use a car loan EMI calculator?

No charges are levied to use a car loan EMI calculator.

- How does a Car Loan Repayment Table Help You Understand Your EMI?

A car loan repayment table helps you understand your EMI by showing a clear breakdown of principal and interest payments over the loan tenure.

- What details must be entered to get the results in case a car loan EMI calculator is used?

The interest rate, processing fee, loan amount, and tenure must be entered to get the results in case a car loan EMI calculator is used.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.