HDFC Bank Car Loan Application Status

The loan status of the car loan can be checked both online and offline. Net banking, calling customer care, and visiting the bank branch are some of the ways by which the status of the car loan can be checked.

HDFC Car Loan Status

Before applying for a car loan at HDFC Bank, you must ensure that the eligibility criteria are met. Your credit score, income, and age are some of the factors that determine the eligibility criteria.

In case your credit score is good, HDFC banks offers car loans at low interest rates. Therefore, your Equated Monthly Instalments (EMIs) will also be low.

By checking the loan status, you can know whether the process is on track. In case of any issues, you can call the HDFC Bank's customer care to resolve them.

The process is also simple and can be completed in a few steps. The loan status for a new car loan as well as a used car loan can be checked .

The easiest way to know the loan status is to check it online. Basic information such as your application number, date of birth, and mobile number may be required to check the status of the car loan.

Apart from the application status, the complete loan status can also be checked online. Your EMIs can also be paid online. Checking the status online helps in saving time and can also be completed from the comfort of your home or office.

Different Methods to Check HDFC Bank Car Loan Status

If you have applied for an HDFC Car Loan, the status of the loan can be checked from the comfort of your office or home. Due to the various options provided by HDFC Bank, you will be able to track the status of the application as well as stay updated with your loan details with ease.

The different methods by which the status of the car loan can be checked are mentioned below:

- Via Offline Mode

- Via Net Banking

- Via HDFC Status Check Link

Offline Mode

You can check the status of the loan by contacting HDFC Customer Care. You will need to visit the HDFC customer care page and call the appropriate number from the options that are provided.

The procedure to check the status of the loan by contacting HDFC Customer Care is mentioned below:

Visiting Bank Branch

You can visit the bank branch and provide your application details to the concerned officer to check the status of the car loan.

Via Net Banking

In case you are an existing HDFC Bank customer, you will be able to check the status of the car loan by using the bank's net banking portal. The process to check the status of the loan is very simple and saves time.

The procedure to check the status of the loan by using the net banking portal is mentioned below:

- Visit the official website of HDFC Bank.

- Click on 'Login'.

- Select 'NetBanking' and click on 'Login'.

- On the next page, click on 'Continue To Netbanking'.

- Next, enter the User ID/Customer ID and click on 'Continue'.

- Next, enter the IPIN and click on 'Login'.

- On the next page, click on 'Loans'.

- Next, click on 'Enquire'.

- On the next page, you must enter the application number to check the status of the loan.

Process to Register for Net Banking to Check the Car Loan Status

Various benefits are provided in case you have access to HDFC Bank's net banking portal. Several details of the loan can also be accessed with the help of the net banking portal.

The details can be accessed from the comfort of your office or home. In case you have a car loan with HDFC Bank and do not have a current or savings account, the below-mentioned procedure must be followed to register for the net banking facility:

- Visit the official website of HDFC Bank.

- Click on 'Login'.

- Next, select 'Loan Account Login' and click on 'Register'.

- On the next page, you will need to enter a User ID, the loan account number, your date of birth, and the last EMI amount paid.

- Next, you must enter the new password according to the instructions that have been provided. The new password must be entered twice.

- Click on 'Submit'.

- An OTP will be sent to your registered mobile number.

- Enter the OTP and click on continue to access your loan account details via net banking.

Via HDFC Status Check Link

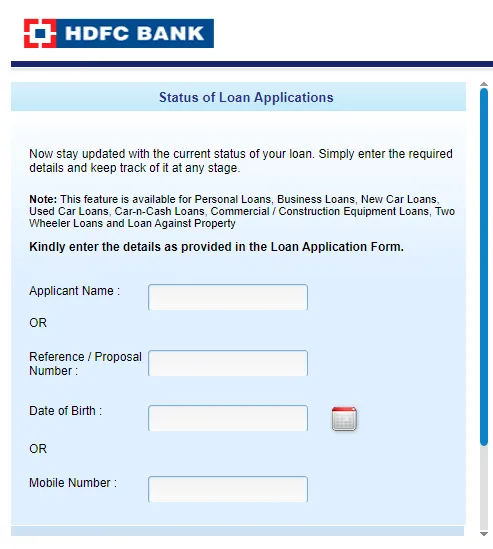

The process to check the car loan status by using the HDFC Status Check Link is very simple and only basic information will need to be provided.

Apart from the car loan status, the status of Loan Against Property, Two-Wheeler Loans, Commercial/Construction Equipment Loans, Car-n-Cash Loan, Used Car Loans, Business Loan, and Personal Loans can be checked with the help of the HDFC Status Check Link. The step-by-step procedure to check the status of the car loan by using the HDFC Status Check Link is mentioned below:

- Visit the HDFC Status Check Link page.

- Next, enter the Applicant Name or Reference/Proposal Number.

- Next, enter your date of birth or mobile number.

- Click on 'Submit'.

- The status of the loan will be displayed on the screen.

FAQs on HDFC Bank Car Loan Application Status

- Is it possible to make a part payment of the EMI amount?

No, the entire EMI amount must be paid.

- Is it possible to pay the overdue amount while making the EMI payment?

Yes, you can pay the overdue amount while making the EMI payment.

- Is it possible to reset the password in case I have forgotten it?

Yes, in case you have forgotten the password, it can be reset online.

- Is it possible to pre-pay the entire loan amount?

Yes, you can pre-pay the loan amount after the completion of 6 months.

- Is it mandatory to provide a guarantor when I apply for a car loan?

No, it is not mandatory to provide a guarantor. However, if you do not meet the credit criteria, the bank may ask for a guarantor to be provided.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.