HDFC Car Loan Eligibility Calculator

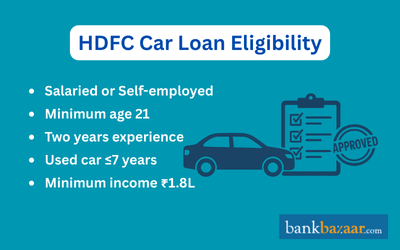

HDFC Bank offers car loans to both salaried and self-employed individuals for new, pre-owned, and loan-against-car categories. Your eligibility depends on factors such as age, income, employment type, and credit score.

HDFC Bank offers quick and flexible car loan options tailored for different customer needs. You can choose from three HDFC car loan categories designed to match your requirements and income profile:

- HDFC New Car Loan – Ideal for purchasing a brand-new vehicle with up to 100% on-road financing and flexible repayment of up to 8 years.

- HDFC Pre-Owned Car Loan – Designed for certified used cars, offering fast approvals, transparent pricing, and easy documentation.

- HDFC Loan Against Car – Perfect for customers who want to leverage their existing car to access funds at competitive interest rates.

HDFC ensures quick approvals, minimal paperwork, and complete transparency, making the car loan process simple, secure, and convenient for every borrower.

🔹 HDFC New Car Loan Eligibility

Particulars | Salaried Individuals | Self-Employed / Business Owners |

Age Limit | 21 – 60 years | 21 – 65 years |

Minimum Income | ₹35,000 – ₹50,000 per month | ₹4 lakh per annum (gross income) |

Work Experience / Business Vintage | Minimum 2 years, with 1 year in current job | Minimum 2 years in business |

Loan Tenure | Up to 8 years | Up to 8 years |

Financing | Up to 100% of on-road price | Up to 100% of on-road price |

Credit Score | Minimum 750 recommended | Minimum 750 recommended |

🔹 HDFC Pre-Owned Car Loan Eligibility

Particulars | Eligibility Criteria |

Eligible Applicants | Salaried, self-employed, partnership, or private limited companies |

Age Limit | 21 – 65 years |

Minimum Income | ₹2 lakh per annum |

Experience / Business Vintage | Minimum 2 years of stable income |

Car Age Limit | Vehicle should not exceed 8 years old at loan maturity |

Loan-to-Value (LTV) | Up to 80% of car value |

🔹 HDFC Loan Against Car Eligibility

Particulars | Eligibility Criteria |

Eligible Applicants | Salaried or self-employed owners of registered cars |

Age Limit | 21 – 65 years |

Minimum Income | ₹2 lakh per annum |

Vehicle Criteria | Car age should not exceed 5 years |

Loan Amount | Based on vehicle valuation and customer credit profile |

🚗 Factors Affecting HDFC Car Loan Eligibility

Your HDFC Car Loan Eligibility depends on key factors such as your credit score, income, and financial stability. Understanding these can help you qualify for a higher loan amount with better terms.

1️⃣ Credit Score (CIBIL Score): A credit score of 750 or above improves approval chances and can help you secure a lower interest rate. Pay EMIs and credit card bills on time to maintain a strong score.

2️⃣ Age: Applicants must be 21 years or older. The loan should be fully repaid before the age of 65 years.

3️⃣ Income: Your income determines how much loan you’re eligible for. Higher, stable income leads to better loan offers. You can also add a co-applicant’s income to boost eligibility.

4️⃣ Existing Debts: Keep your debt-to-income ratio low by clearing other EMIs and credit card dues. Lower liabilities improve eligibility and reduce rejection risk.

💡 How to Increase Your HDFC Car Loan Eligibility

- Maintain a CIBIL score above 750.

- Pay off existing debts before applying.

- Add a co-applicant to combine incomes.

- Choose a shorter loan tenure to enhance approval chances.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.