PAN Card KYC - Verification, Status, and Importance

What is PAN KYC?

PAN Card KYC (Know Your Customer) is a process used by financial institutions, including banks and mutual funds, to verify the identity of an individual using their Permanent Account Number (PAN). This process ensures that the person’s identity is authenticated and compliant with regulatory requirements.

Let's understand the concept of KYC and how to check PAN Card KYC status, and how to verify PAN KYC online/offline and more.

What is KYC?

To prevent fraud and compromising of security, many websites have introduced KYC or Know Your Customer as an added security measure to their systems.

To enhance security and prevent fraud, many websites have implemented Know Your Customer (KYC) as an additional measure. KYC allows companies, particularly banks, to verify the identity of their customers.

Through this process, banks gain access to key details such as your Aadhaar information, fingerprints, and digital signature, all with your consent. This procedure plays a crucial role in improving security.

The primary objective of KYC is to protect against online fraud, money laundering, and identity theft, ensuring that the customer’s identity is accurately verified and secure.

KYC with PAN Card

Among the various documents which need to be submitted as KYC, a PAN Card is one of them. To verify your identity and that you are a tax-paying citizen of the country, you must provide your PAN Card as a proof of income and proof of identity.

The PAN Card is issued to you by the Income Tax Department of India which enables you to file your taxes and tax returns to prove that you are above the tax bracket and that you are a regular tax-paying citizen of the country. A PAN Card is a must for most of your financial transactions such as opening a bank account, investing in mutual funds, etc.

However, during the recent Union Budget, the government has stressed on Aadhaar Card and PAN Card interchangeability where if you do not hold a PAN Card, you can still go ahead with various financial transitions with your Aadhaar Card.

How to Check PAN Card KYC Status?

After you have submitted all the documents and the KYC form online, you can check the status of your KYC online with these steps.

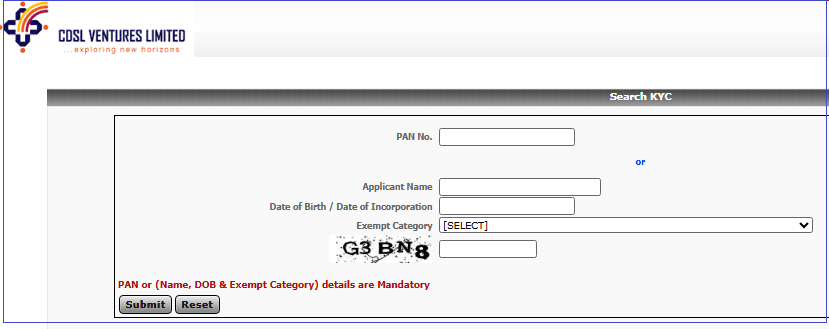

Step 1 - Visit the KRA website of the Central Depository Service Limited.

Step 2 - You can check the status of your KYC with either your date of birth or PAN Card.

Step 3 - Enter your PAN Card details and click on 'submit'.

Step 4 - If the KYC has been verified, the status will be displayed as MF-Verified by CVLMF.

Step 5 - However, if the KYC is verified, it will show 'Pending'.

Situations - Where your KYC is Required?

Know Your Customer (KYC) is required in various situations to ensure compliance with regulatory standards and enhance security measures. KYC is important for the following:

- Opening a New Bank Account: Banks require KYC documentation to verify the identity and address of individuals opening new accounts.

- Applying for a Loan or a Credit/Debit Card: Financial institutions mandate KYC procedures to assess the creditworthiness of applicants and mitigate the risk of fraudulent transactions.

- Investing in Mutual Funds: Mutual fund companies require KYC compliance to authenticate investors' identities and comply with regulatory requirements.

- Opening a Locker at a Bank: Banks necessitate KYC verification to grant access to safe deposit lockers, ensuring the security of the contents stored within.

- Making Changes to Beneficiaries or Signatories: Any alterations to beneficiaries or signatories on accounts necessitate KYC verification to validate the identity and authority of the individuals involved.

- Insufficient Documentation: In cases where existing documents held by the bank are insufficient, additional KYC verification may be required. This could involve sending a representative to collect the necessary details for additional proof and security.

Documents Required for eKYC of PAN Card

In addition to the KYC form and a passport-sized photograph, the following documents must be submitted:

- Identity Proof: Driving license/Voter ID/Bank passbook/PAN Card/Passport photocopy/Aadhaar Card

- Address Proof : Latest mobile or landline bill/Passport photocopy/Latest bank passbook/Voter ID/Driving licence/Latest electricity bill/Latest Demat account statement/Ration card/Aadhaar card/Rental agreement

How to Verify PAN Card KYC Online?

KYC can be done very easily through the online process by filling out an online KYC form. You can follow the given below steps to complete your KYC online:

Step 1 - You can visit the SEBI website and log in to your account

Step 2 - Then click on the option “Know Your Customer (KYC) Registration Agency.”

Step 3 - Now create your profile by filling in the necessary details

Step 4 - Enter the PAN and Aadhaar Card information and then upload a self-certified copy of your Aadhaar card.

Step 5 - Submit the form online, and you will receive an OTP on your registered mobile number.

Step 6 - Use the OTP to verify your account and make sure that your mobile number is linked to your Aadhaar and PAN.

How to Verify PAN Card KYC Offline?

Offline PAN Card KYC provides a reliable alternative to the online process, offering a method for individuals who prefer physical documentation. Here is how to complete the offline PAN Card KYC:

Step 1 - Visit the CDSL Ventures website and download the Know Your Customer form to your computer or obtain a physical copy from a bank branch.

Step 2 - Fill in all required fields on the KYC form accurately and legibly. Ensure that all details provided match those on your PAN Card and other supporting documents.

Step 3 - Sign the KYC form in the designated space to certify the accuracy of the information provided.

Step 4 - Attach a copy of your PAN Card and a self-attested proof of address to the completed KYC form. If your address requires attestation, it can be done by a third party, though it's not mandatory if valid proof of address is provided. Accepted documents for proof of address include government-issued IDs such as Voter ID, Passport, or Aadhaar Card.

Step 5 - Affix a recent passport-sized photograph to the designated area on the KYC form.

Step 6 - Take the completed KYC form along with the attached documents to a bank branch. Bank staff will conduct physical verification to authenticate the information provided and update your KYC details.

Aadhaar Based KYC

Now PAN KYC can be done through your Adhaar card. Here are the steps given below:

- You can complete your KYC using Aadhaar biometric information.

- A bank executive will come to your place for the process.

- You will need to provide a copy of your Aadhaar Card and PAN Card.

- The executive will scan your fingerprint and match your details.

- This way your KYC will be completed, and you can check PAN Card update status through the CSDL website.

Importance of PAN Card in KYC

The PAN Card holds significant importance in the KYC process for several reasons:

- Government Regulations: Indian government regulations mandate that all income-earning individuals and non-individual entities possess a PAN Card. Compliance with these regulations is essential for conducting financial transactions legally.

- Identity Authentication: The primary purpose of the PAN Card is to authenticate the identity of individuals and entities involved in financial activities. Its unique identification number helps verify the identity of the PAN cardholder, thereby ensuring transparency and accountability in financial transactions.

- Preventing Discrepancies: Utilizing the PAN Card for KYC updates is crucial because it serves as a vital document for verifying the holder's identity. By cross-referencing PAN details with other KYC information, financial institutions can detect and prevent potential discrepancies or fraudulent activities.

- Insights into Financial Activities: PAN Cards provide valuable insights into significant financial activities such as salary deposits, high-value asset purchases, and tax payments. By linking these activities to the PAN Card, financial institutions can assess the financial profile and behaviour of individuals and entities, contributing to risk management and regulatory compliance.

Related Articles on PAN Card

FAQs on PAN Card KYC

- What is the significance of a PAN Card in the KYC process?

The PAN Card holds significant importance in the KYC process as it serves as a primary identifier for individuals engaging in financial transactions. It provides a unique identification number that helps verify the identity of the PAN Card holder, thereby ensuring transparency and accountability in financial transactions.

- How does PAN Card KYC differ from Aadhaar card KYC in terms of documentation and verification process?

While both PAN Card and Aadhaar Card are commonly used for KYC purposes, they differ in terms of documentation and verification processes. PAN Card KYC primarily involves providing a copy of the PAN Card along with other supporting documents, while Aadhaar card KYC typically requires biometric authentication or OTP-based verification in addition to document submission. Additionally, some institutions may accept either a PAN Card or an Aadhaar Card for KYC, while others may require both for enhanced verification.

- Where can the KYC form be procured?

Individuals can procure the KYC form from their broker or financial consultant. Additionally, they can also download the same from a mutual fund company's website.

- What does 'Customer' mean according to KYC?

According to KYC regulations, a customer is seen to be an entity or individual that has an account or business relationship with a bank.

- What are the documents required for KYC?

Documents may vary for each bank and financial institution based on the requirements but the most commonly requested documents for KYC are proof of identity and address is required. These can include, PAN Card, Passport, Voter ID, Utility bills, Birth Certificate, Driving License, etc.

- Is there a fee to check my PAN KYC status?

No, there are no costs or charges associated with checking your PAN Card KYC status.

- Is there a validity period for PAN Card KYC verification, or is it a one-time process?

PAN Card KYC verification is typically considered a one-time process, meaning that once your PAN Card details are verified for KYC purposes, they remain valid indefinitely. However, it's essential to keep your KYC information updated, especially in case of any changes such as address or contact details, to ensure compliance with regulatory requirements.

- Can I complete my PAN KYC online?

Yes, you can complete your PAN KYC online, and you only need your Aadhaar Card for this.

- Can I link multiple bank accounts with the same PAN Card for KYC purposes?

Yes, you can link multiple bank accounts with the same PAN Card for KYC purposes.

- In case certain details are changed such as an address, will KYC form have to be submitted again?

Yes, in case the address or other important details about the customer's identity has changed, the KYC form will have to be filled out and submitted again.

- Is an email address required to receive an e-PAN?

Yes, a valid email ID must be provided in the PAN application form in order to receive e-PAN Card .

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.