Instant PAN Card through Aadhaar

Obtaining a quick e-PAN has gotten much easier, and it can now be done for free in as little as 10 minutes. And, like a PAN Card, this e-PAN can be used for any reason.

Paying income tax, submitting income tax returns (ITR), opening a bank account or Demat account, applying for a debit or credit card, and so on, all require a PAN Card, and the e-PAN can be used in the same way as a traditional PAN Card for these purposes.

Steps to Apply for an Instant PAN Card with Aadhaar

To apply for instant PAN with an Aadhaar Card, follow the simple steps mentioned below

- Step 1 - Open the official website of the Income Tax department.

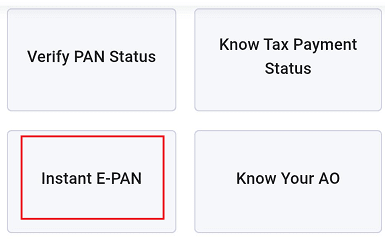

- Step 2 - Click the 'Quick links section.

- Step 3 - Next, select the 'Instant PAN through Aadhar' button.

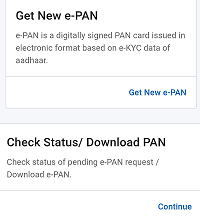

- Step 4 - Then, click the 'Get New PAN' section. You will be redirected to a new page.

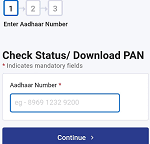

- Step 5 - On this new page, enter your Aadhar number.

- Step 6 - Next, type in the captcha code in the required box.

- Step 7 - Then, click the 'Generate Aadhaar OTP ,You will receive an OTP in your registered phone number.

- Step 8 - Enter the OTP in the required box. Next, select the 'Validate Aadhaar OTP and Continue' button.

- Step 9 - You will be redirected to a new page. Fill up your Aadhaar details and click the 'Submit PAN Request' option.

- Step 10 - You will get an acknowledgement number that you can use to check your PAN allotment status.

Requirements for Instant PAN

The following are the basic requirements for obtaining an e-PAN with Aadhaar based e-KYC:

- Valid Aadhaar number that has not been linked with a PAN Card

- Mobile number linked with Aadhaar card

- Applicant must not already have PAN

Steps to Check the Status and Download Instant PAN

If you want to check the status of your instant PAN or want to download the instant PAN, then follow the steps mentioned below:

Step 1 - Open the official website of the Income Tax department.

Step 2 - Click on the 'Quick Links' section.

Step 3 - Next, select the 'Instant PAN through Aadhaar' option.

Step 4 - Then, click on the 'Check Status/Download PAN' option.

Step 5 - You will be redirected to a new page. Enter your Aadhaar number and captcha code in the required boxes. Then click the 'Submit' button.

Step 6 - You will get an OTP on your registered phone number. Enter this OTP and select the 'Submit' option to proceed further.

Step 7 - You will be taken to a new webpage, where you will be able to track the status of your PAN allotment request.

Step 8 - If your PAN allocation was successful, a PDF link to download your PAN file will be generated within 10 minutes.

Note: Your PAN is contained in a password-protected PDF file. To open the PDF file, you will have to enter your date of birth in the 'DDMMYYYY' format.

Benefits of Instant PAN through Aadhaar

1. Fast and convenient: PAN is generated instantly, usually within 10 minutes.

2. Paperless process: No paperwork required; The application is completed online.

3. Free: There is no cost to apply for instant PAN using Aadhaar.

4. Easy verification: Aadhaar-based E-KYC simplifies the verification process.

5. Environmentally friendly: Reduces the need for paper and cardboard.

FAQs on Instant PAN Card through Aadhaar

- How can I get Instant e PAN Card using Aadhaar?

You can get an instant e-PAN Card using Aadhar online from the Income Tax Department's website.

- What distinguishes a PAN Card from an instant PAN Card?

A digital PAN Card that is just as valid as a physical one is the instant e-PAN. To receive a quick e-PAN, you must consider the following requirements: A PAN card has never been issued to you. On the date of your quick e-PAN request, you should not be a minor.

- Which is preferable, physical PAN or ePAN?

E-PANs are sent to applicants free of charge in PDF format, with the first applicants receiving one. 3. An easy, paperless, 10-minute process can be followed to obtain an E-Pan with the same value as a physical PAN Card. However, taxpayers will not receive physical PAN Cards under this arrangement.

- Can I obtain my PAN Card right away?

With an Aadhar card for e-KYC, you can get a free quick e-PAN in ten minutes. A QR code with the applicant's details is included in the PDF. Aadhaar, a linked cell phone number, being older than 18, and having the correct Aadhaar details are requirements for eligibility.

- Is an instant e-PAN Card legally valid?

Yes, Instant e-PAN Card, is legally valid and equivalently to physical .

- Can I use my Aadhaar number to download my PAN Card?

Applicants who have registered for an instant e-PAN Card using their Aadhaar number on the Income Tax e-filing website can get their e-PAN through the website. The quick e-PAN card download is free of cost.

- Can I use Aadhar to check my PAN Card?

Using the Aadhaar card number, you can look up a PAN number by going to the Income Tax Department's official website.

Select the 'Instant PAN through Aadhar' option found under the 'Quick Links' section.

- Do PAN cards come in two days?

Although your PAN number will be sent to you in less than 48 hours, the actual card will not arrive at your home for at least 15 to 20 days.

- Is PAN and Aadhaar connected?

The process of linking your PAN with Aadhaar is now required. Because it will enable the processing of your income tax returns, this procedure is crucial. The Aadhaar PAN linkage process is carried out automatically for new PAN Card applicants.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.