PAN Card Eligibility

Permanent Account Number or PAN, as it is commonly known should be owned by every taxpayer in the country and anyone who wishes to do business in India. The government has made it mandatory for entities to quote PAN Card for a number of transactions and anyone indulging in these transactions should compulsorily have a PAN. A taxpayer or assessee can apply for a PAN on behalf of others, including minors.

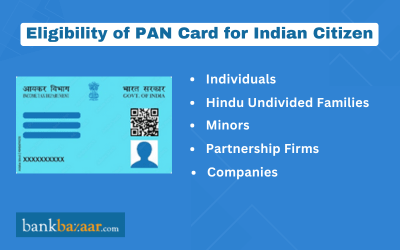

PAN Card Eligibility Criteria and Documents Required for Indian Citizens

There are different eligibility criteria and documents required for Indian citizens who wish to own a PAN, depending on whether the PAN is required by an individual, firm, enterprise, association, etc. The basic criteria are mentioned below.

- Individuals - The applicant should be a citizen of India with a valid address, date of birth and ID proof. This proof can be either a passport, driving license, Aadhar, Voter Id card, etc.

- Hindu Undivided Families - The Karta (head) of a Hindu Undivided Family can apply for a PAN on behalf of the family by providing a valid ID, address proof and date of birth for all members of the family. The Karta is also expected to mention the father's name in order to apply for a PAN.

- Minors - A parent/guardian can apply for a PAN on behalf of a minor by providing a valid address proof and ID of the parent/guardian.

- Indian citizens residing abroad - If the applicant is an Indian citizen who resides outside the country, he/she should provide a copy of his/her bank account statement in the present country of residence as address proof.

- Mentally challenged individuals - There are cases where a mentally challenged individual might require a PAN and in this case a representative can apply on his/her behalf. The representative will have to provide details of such an applicant (ID proof, address proof and date of birth) plus his/her (representative's) details.

- Companies - Companies which need a PAN should be registered with the Registrar of Companies and should provide a copy of their registration certificate.

- Partnership Firms/Limited Liability Partnerships - These entities should be registered with the relevant government authorities and should submit a copy of their registration certificate.

- Trusts - Trusts which are registered can apply for a PAN by submitting a copy of their trust deed or registration certificate.

- Associations/Local authorities - Registered associations or local authorities can apply for a PAN by submitting a copy of their agreement or registration certificate.

- Artificial Juridical Person - Such entities can apply for a PAN by submitting proof of their identity and address, either in the form of government documents or registration certificates.

- Entities with no office in India - Firms, companies, trusts, artificial juridical authorities, etc. with no office in India need to apply by submitting their ID proof and address. This proof can be either in the form of their registration certificate from the country in which they are located, attested by the Indian Embassy/Consulate of that country. In case this is not available they need to get a registration certificate in India or approval documents from relevant authorities.

Note: Indian applicants can apply for a PAN by using Form 49A

PAN Card Eligibility Criteria and Documents Required for Foreign Citizens

Foreign citizens and organizations who are keen on setting up base in India need to satisfy a few basic eligibility criteria and submit the following documents in order to obtain a PAN.

- Foreign citizen (Individual) - Individual foreign citizens who wish to apply for a PAN can do so by providing relevant ID and address proofs. This can be either their passport, PIO card, citizenship ID number, etc.

- Companies - Foreign companies can apply for a PAN by furnishing a copy of their Registration Certificate from the country where an applicant is present. This should be attested by the Indian Embassy/Consulate/High Commission in that country. A copy of the registration certificate approved by Indian authorities in India will also suffice as proof for PAN.

- Firms/Associations/Trusts - Such entities can apply for a PAN if they are registered and have a registration certificate from the country where they are located. This registration certificate should be attested by the Indian Embassy or Consulate or High Commission in that country.

Note: Foreign entities can apply for a PAN by using Form 49AA, with the eligibility criteria and documents required staying the same regardless of whether a foreign applicant is located inside India or outside while applying for a PAN.

PAN Card – Importance

Given below are some reasons to apply for a PAN Card

- In case jewellery is purchased above is a certain limit, it is mandatory to provide the PAN Card.

- PAN Card must be provided for investments of ₹50,000 and above.

- To sell the car.

- In case ₹50,000 and more is deposited in the bank account.

- In case the restaurant bill is ₹25,000 and more.

- In case you buy or sell an immovable that costs ₹5 lakh and above.

- To open a bank account.

- PAN Card can be submitted as proof of identity.

- To file Income Tax Returns

Who Does Not Need a PAN Card?

The below-mentioned entities need not apply for a PAN Card

- Individuals who have an income that is not taxable need not apply for a PAN Card. Form 60 can be submitted in case they wish to invest in mutual funds.

- For certain transactions, NRIs need not provide the PAN Card.

- Minors need to apply for a PAN Card

Related Articles on PAN Cards

FAQs on PAN Card Eligibility

- Which form must Indian companies fill out in order to be eligible to apply for PAN Cards?

Form 49A, which requests a PAN Card, must be completed and submitted by Indian companies.

- Can an NRI apply for PAN Card in India?

A non-resident Indian (or "NRI") may apply for a PAN by submitting Form No. 49A to the PAN application center of UTIITSL or Protean (formerly NSDL e-Gov), together with the necessary paperwork and fees.

- Can minors apply for PAN Card?

A minor should have a PAN Card if they are a nominee for property or have interests in their name. They may apply on behalf of their parents.

- Why do we need a PAN Card?

PAN Card is needed to fill all the taxes in India.

- Is it possible to apply for a PAN Card online?

Yes, you can apply for a PAN Card online.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.