SBI Two-Wheeler Insurance Policy

SBI General Insurance Limited stands as a prominent figure in India's insurance industry. Established in 2001 as a government-owned entity, it solidified its position through collaboration with the State Bank of India and Insurance Australia Group in 2010, merging to offer comprehensive insurance services.

This union brought significant value to sectors like bike insurance and other insurance products. The company operated smoothly until 2018 when it opted to divest 30% of its stakes. Presently, 26% of its shares belong to IAG, with Axis Assets Management Co. holding the remaining 4%.

SBI General Insurance has extended its reach, particularly in bike insurance and other services, across the nation. It has established a significant presence with approximately 22,000 branches spread across 110 cities and 10 branches in rural areas. The company's commitment to excellence is evident in its achievement of an IA rating for providing top-notch claim settlement services. As it expands, SBI General Insurance remains focused on its mission to deliver straightforward and innovative insurance solutions, address customer concerns effectively, and develop a sustainable business model for the future.

SBI General Two-Wheeler Insurance Policy

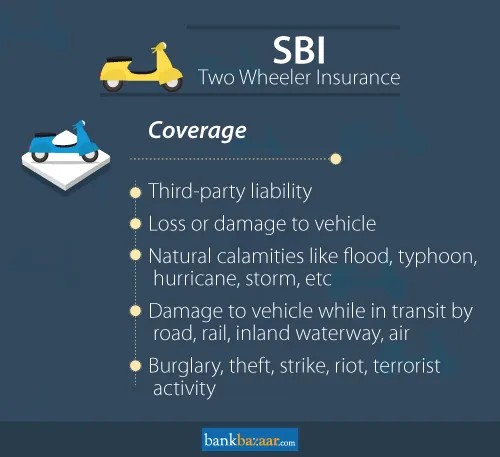

SBI Two-wheeler Insurance Policy focuses on providing robust protection, the policy includes coverage against third-party liability, ensuring that you are financially protected in case of any unfortunate incidents involving third parties.

In addition to the basic coverage, SBI offers a range of valuable add-ons to enhance your insurance coverage. These add-ons include Return to Invoice, which ensures that you receive the full value of your two-wheeler in case of theft or total loss. The Protection of No Claim Bonus (NCB) add-on helps you maintain your NCB discount even after making a claim, thereby reducing your future premiums. The Nil Depreciation add-on ensures that you receive compensation for the full value of parts replaced during repairs without any deduction for depreciation.

Furthermore, the policy also provides protection against a wide range of man-made and natural calamities. Whether it's damage due to accidents, theft, vandalism, fire, floods, or any other unforeseen events, your two-wheeler is covered under SBI's policy.

Features | Coverage |

Personal Accident Cover | Up to Rs. 15 lakh |

Third-Party Insurance Property Damage | Up to Rs. 1 lakh |

Assistance for Claim Settlement | Available 24x7 |

Own Damage Cover | Determined by the IDV of the Two-wheeler |

Key Features of SBI General Two-Wheeler Insurance

- SBI General Two-wheeler Insurance policy ensures comprehensive protection for your two-wheeler against a wide range of man-made and natural calamities.

- It also enhances coverage with add-ons such as Return to Invoice, Protection of NCB, Nil Depreciation, and more.

- It provides protection for third-party liability.

Coverage Offered Under SBI General Two-Wheeler Insurance Policy

- Third-party liability arising due to an accident is covered under the policy. The policy also covers loss or damage to the vehicle.

- Third-party Liability: The policy protects the policyholder against legal and financial liabilities resulting from any bodily injury or death of a third person, or damages caused to their property.

- Damage or loss to the vehicle: The bike insurance policy offered by SBI General covers the insured against damage or loss caused to the vehicle due to any of the below-mentioned reasons:

- Explosion, fire, self-ignition, damages caused by accident.

- Damage caused to the vehicle in transit (road, rail, air, waterway or elevator).

- Damages caused to the vehicle as a result of natural calamities such as earthquakes, lightning, typhoons, floods, hurricanes, inundations, cyclones, tempests, hailstorms, landslides, and rockslides.

- Damage or loss caused to the vehicle due to theft, burglary, riot, malicious acts, strike, and terrorist activity.

- The policy provides personal accident cover of Rs.1 lakh for owner of the vehicle/driver of the vehicle (holding a valid driving license).

- The policy provides a cover of Rs.1 lakh for the pillion rider. The limit can be increased with a personal accident add-on cover.

Exclusions Under SBI General Two-Wheeler Insurance Policy

The two wheeler insurance policy does not cover the following instances involving your motorcycle or scooter:

- Normal wear and tear of the vehicle due to passage of time

- Depreciation in the value of the vehicle

- Consequential loss or damage to the vehicle

- Electrical or mechanical breakdown

- Vehicle used against the limitations of use

- Damage caused to the vehicle by a driver not holding a valid driving license

- Damage caused to the vehicle by a person driving the motorcycle/scooter under the influence of alcohol or drugs

- Damage or loss caused to the vehicle due to mutiny, war, or nuclear risk

Long-Term SBI Two-Wheeler Insurance Policy

SBI General Insurance offers long-term two-wheeler insurance policy that can be availed for up to 3 years. The policy covers third-party liabilities as well as damage or loss to the vehicle during the tenure of the policy. Here are the important features of the SBI General multi-year bike insurance policy:

- No hassles of renewing the insurance policy every year.

- Continued protection for 2 or 3 years at discounted premium.

- In case of a total loss claim made during the first or second year of the policy, unused premium will be refunded on pro-rata basis.

- No effect of change in service tax on premium

SBI General Insurance Claim Settlement Process

In case you decide to make a claim on your motor insurance policy, here are the steps to follow to do the same:

Step 1 - Contact SBI General Insurance on their helpline number 1800 22 1111 (toll-free number) or SMS "CLAIM" to 561612 to receive your reference number.

Step 2 - A SBI General Insurance representative will get in touch with you and give you all the information you require, including the list of papers you'll need to start the claim process.

Step 3 - The claims executive/claims manager will reach out to you within 24 hours of intimating the claim.

Step 4 - Submit the required documents to the claims executive/claims manager who will verify the documents against the originals.

Step 5 - Within 30 days following the final survey and the receipt of the paperwork, the insurance company will start the claim process and conclude it (as per the IRDA policyholders interest regulation 2017)

SBI Two-Wheeler Insurance Customer Care Contact Details

For any concerns or queries related to two-wheeler insurance policy offered by SBI General Insurance, you may reach out to the customer care executives using the details mentioned below:

SBI Customer Care Telephone Number/Mobile: 1800 22 1111.

SBI Branch Offices in Important Cities

Within 30 days following the final survey and the receipt of the paperwork, the insurance company will start the claim process and conclude it (as per the IRDA policyholders interest regulation 2017)

Following is the list of branch offices of SBI General Insurance in important Indian cities:

City | Branch Address |

Ahmedabad | SBI General Insurance Co Ltd., 1st Floor, Shukan Business Center, Near Swastik Cross Roads, C.G. Road, Navrangpura, Ahmedabad - 380009 |

Andaman & Nicobar Island | 2nd Floor, Raj Complex, Old Pahargaon (Junglighat), Dollygunj, SBI Dollygunj Branch on the Ground Floor, Port Blair 744103, Andaman & Nicobar Island. |

Bengaluru | SBI General Insurance Co Ltd., Ground & 1st Floor, No.3/1, Rukmini Towers, Platform Road, Seshadripuram, Bengaluru 560 020 |

Chandigarh | SBI General Insurance Co Ltd., SCO NO. 457-458, First & 2nd Floors, Sector 35-C, Chandigarh-160035 |

Chennai | SBI General Insurance Co Ltd., Ground and Mezzanine Floors Greams Dugar, New No.64, Old No.149, Greams Road, Chennai - 60000 |

Gandhinagar | SBI General Insurance Co Ltd., F-19, 1st Floor, Meghmalhar Complex, Plot no. 16, Sector - 11, Gandhinagar - 382001, Gujarat |

Hisar | SBI General Insurance Co Ltd., SCO-149, 1st Floor, Red Square Market, CUE-1, Near State Bank of India (Mandi Branch), Hisar - 125001 Haryana |

Hubli | SBI General Insurance Co Ltd., V. A. Kalburgi Hallmark, 2nd Floor, Desai Cross, Pinto Road, Deshpande Nagar, Hubli - 580 029 (Karnataka) |

Hyderabad | Shop no. 11, 1st Floor, Sai Vikram Towers, H No. 15-21-36 & 42, Balaji Nagar Colony, Kukatpally, Ranga Reddy District, Hyderabad - 500076 |

Hyderabad | SBI General Insurance Co Ltd., Shop no. 11, 1st Floor, Sai Vikram Towers, H No. 15-21-36 & 42, Balaji Nagar Colony, Kukatpally, Ranga Reddy District, Hyderabad - 500076 |

Hyderabad | SBI General Insurance Co Ltd., 3rd Floor, Ozone Commercial Complex, 6-3-669/1, Punjagutta Main Road, Hyderabad - 500082 |

Jalandhar | SBI General Insurance Co Ltd., 1st Floor, Above SBI Main Branch, Near Hotel Skylark, Civil Lines , Jalandhar 144 001 |

Jhansi | 2nd Floor, Ram Sewak Kankane Bhawan, Station Road, Near Elite Crossing, Above PNB, Civil Lines, Jhansi Postal code: 284 001 |

Kochi | SBI General Insurance Co Ltd., DD Trade Tower, 3C, 3rd Floor, Kaloor- Kadavanthra Road, Kaloor, Kochi (Cochin) - 682 036, Kerala |

Kolkata | SBI General Insurance Co Ltd., 4th Floor, 'B' Block, Apeejay House, 15, Park Street, Kolkata-700 016 |

Kota | SBI General Insurance Co Ltd., 2nd Floor, 390 Shopping Center, Ghode Wala Baba Chauraha, Kota - 324 007 Rajasthan |

Madurai | SBI General Insurance Co Ltd., S S Tower, 2nd Floor, 78/4, Bye Pass Road, Madurai - 625 010 Tamil Nadu |

Mangalore | SBI General Insurance Co Ltd., Shop no 4 & 5, 1st FLOOR, Inland Ornate, Navabharath Circle, Mangalore - 575003 Karnataka |

Meerut | SBI General Insurance Co Ltd., 2nd Floor, RPG Tower, 495/1, Mangal Pandey Nagar, Meerut - 250002 Uttar Pradesh |

Mumbai | 1st Floor, Krishna Baug, 101 A Wing, New Maneklal Estate, LBS Road, Opposite Municipal School, Ghatkopar (W), Mumbai - 400 086 Maharashtra |

Mumbai | SBI General Insurance Co Ltd., 1st Floor, Krishna Baug, 101 A Wing, New Maneklal Estate, LBS Road, Opposite Municipal School, Ghatkopar (W), Mumbai - 400 086 |

Mumbai | SBI General Insurance Co Ltd., Bhoomi Saraswathi, 1st Floor, Ganjawala Lane, Opposite Axis Bank, Chamunda Circle, Borivali (w), Mumbai - 400 092 Maharashtra |

Mumbai | SBI General Insurance Co Ltd., 1st Floor, Office no. 107 & 108, Arenja Corner, Plot no. 71, Sector -17, Vashi, Navi Mumbai - 400 703 |

Mumbai | SBI General Insurance Co Ltd., 3rd Floor, Lotus IT Park, Road No. 16, Plot No B - 18, 19, Wagle Industrial Estate, Thane West - 400 604 |

Mumbai | SBI General Insurance Co Ltd., "Natraj", 101, 201 & 301, Junction of Western Express Highway & Andheri Kurla Road, Andheri (East), Mumbai - 400069 |

Mumbai | SBI General Insurance Co Ltd., 3rd Floor - Metro House , Metro Cinema Junction, M.G. Road, Mumbai - 400020 |

New Delhi | SBI General Insurance Co Ltd., DDA Building, 2nd Floor, Vardhman Trade Centre, Nehru Place, New Delhi - 110019 |

New Delhi | SBI General Insurance Co Ltd., 7-B, Ground Floor, Rajendra Park, Pusa Road, Opposite Metro Pillar 153, New Delhi - 110060 |

Noida | SBI General Insurance Co Ltd., 2nd Floor, Plot No. 27, Block - N, Sector 18, Noida - 201301 Uttar Pradesh |

Panaji | 2nd Floor, Myles High Corporate Hub, Patto, Panaji, Goa - 403001 |

Pune | SBI General Insurance Co Ltd., Ground Floor, A-18, Empire Estate, Mumbai - Pune Road, Near Ranka Jewellers, Chinchwad, Pune - 411 019 |

Pune | 1st Floor, K.D. Plaza, 289/6-7, Nehru Road/Shankar Sheth Road, Near 7 Loves Hotel, Near Swargate, Pune - 411042 |

Rajkot | SBI General Insurance Co Ltd., Rajkot - 2nd Floor, Office No. 1, c/o Shri Ramkrupa Dairy Farm, Rajnagar Chowk, Jay Park, Above SBI Rajnagar Branch, Nana Mava Road, Rajkot - 360001 Gujarat |

Srinagar | SBI General Insurance Co Ltd., 1st Floor, Chinar Commercial Complex, Residency Road, Srinagar - 190001 |

Thrissur | SBI General Insurance Co Ltd., 3rd Floor, Sun Tower, Bishop Alapatt Road, East Fort, Thrissur - 680 005 Kerala |

Vadodara | SBI General Insurance Co Ltd., Startrek, 1st Floor, opposite ABS Tower, Old Padra Road, Vadodara- 390007 |

Vellore | SBI General Insurance Co Ltd., 3rd Floor, 94/12, Arni Road, Vellore - 632 001 Tamil Nadu |

Vijayawada | SBI General Insurance Co Ltd., Surya Towers, 1st Floor, 40-1-21/3, M.G.Road, Labbipet, Near Kandhari Hotel, Vijayawada-520010 (Andhra Pradesh) |

Visakhapatnam | 2nd Floor, Dwarakamai, Near SBI Dwarakanagar Branch, Dwaraka Nagar, Visakhapatnam- 53001 |

Know More About Bike Insurance Related Articles

- Paperwork Required When You Buy a Used Motorcycle

- How to Calculate Two Wheeler Insurance Premium in India

- Third Party Two Wheeler Insurance In India

- Vehicle Registration Details in India

- 6 Benefits of Two Wheeler Insurance Renewal

- Steps Involved in Two Wheeler Ownership Transfer

- Zero Depreciation Cover for Bike Insurance

- Tips to Reduce Bike Insurance Premiums

- How to Cancel Two Wheeler Insurance Policy?

- Long Term Two Wheeler Insurance

- Documents Required To Purchase New Two Wheeler

- A Beginner's Guide to Two Wheeler Insurance

- RTO Rules For Vehicle Transfer

FAQs on SBI Two-Wheeler Insurance

- If my vehicle has been financed by State Bank of India, will it be mentioned in my policy document?

Yes, the details of financing will be mentioned under financer details.

- How do I check the status of my SBI Two-wheeler Insurance policy?

Registered online users can log in to the website using their policy details to check the status.

- How does the company settle claims for SBI General Two-wheeler Insurance?

You need to inform the company via the toll-free number or by sending an i-claim to the company's email. Once the documentation is successfully completed, the claim is settled within 30 days.

- What is the process for policy cancellation of SBI General Two-wheeler Insurance?

If the vehicle is liability-covered, you can request policy cancellation. Simply visit the nearest branch to cancel the policy.

- Can I renew a policy with a different insurer with SBI General Bike Insurance Policy?

Yes, you may enter the details of your existing policy and renew the policy with SBI General Insurance.

- What is the process for renewing SBI Two-wheeler Insurance?

You can renew your SBI two-wheeler Insurance policy conveniently through the website. Firstly, log in to the e-portal using your policy details. Then, select the desired policy and choose the preferred payment mode, which can be either Net Banking, Debit Card, or Credit Card. After completing the payment process, you can either print or save the cyber receipt for your records. Alternatively, renewal can also be done by visiting the nearest branch and making payment via cheque or debit card.

- I have misplaced the SBI insurance policy for my vehicle. How do I get a duplicate copy?

By paying a nominal fee of Rs.50, you can get a duplicate copy from any of the nearest SBI General offices.

- How can I make a premium payment?

What payment methods are available? SBI General Insurance Company Ltd. provides policyholders with six convenient modes of premium payment. These include making payments in cash at the branch or opting for online payment. For online transactions, policyholders have the flexibility to use various methods such as credit cards, debit cards, or net banking for seamless transactions.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.