Oriental Bike Insurance Policy Online

The Oriental Insurance Company Ltd Incorporated in 1947, Oriental Insurance Company offers a variety of general insurance products in India.

Headquartered in New Delhi, the insurance company has 31 regional offices and over 1800 operating offices spread across the country.

Oriental Insurance Two-Wheeler Overview

Add-On Covers |

|

Incurred Claim Ratio | 68.19% |

Inclusions |

|

Exclusions |

|

Cashless Network Garages | A number of cashless garages are available making it easier to make claims. |

Third-Party Cover | Any legal liability due to death or property damage to any third party will be covered. |

Bonus / Discounts |

|

Personal Accident Coverage | Protects the owner or driver of the vehicle. This coverage can also be availed for other passengers. |

Policy Term | Ranging between 1 year and 3 years |

Motor Package Insurance Policy for Two-Wheelers by Oriental

Oriental Insurance Company offers Liability Only Two-Wheeler Insurance Policy and Two-Wheeler Package Policy for two-wheelers in India. While the Liability Only Policy covers the insured against loss or damage caused to a third party due to the insured vehicle, the package policy covers own damage as well.

Oriental Insurance Two-Wheeler Insurance Benefits

Oriental Bike Insurance offers insurance offers both liability-only plan and a comprehensive insurance plan. Both the plans have their benefits. Pick the one you want after knowing the advantages based on your insurance needs. Oriental Bike Insurance offers insurance offers both liability-only plan and a comprehensive insurance plan. Both the plans have their benefits. Pick the one you want after knowing the advantages based on your insurance needs.

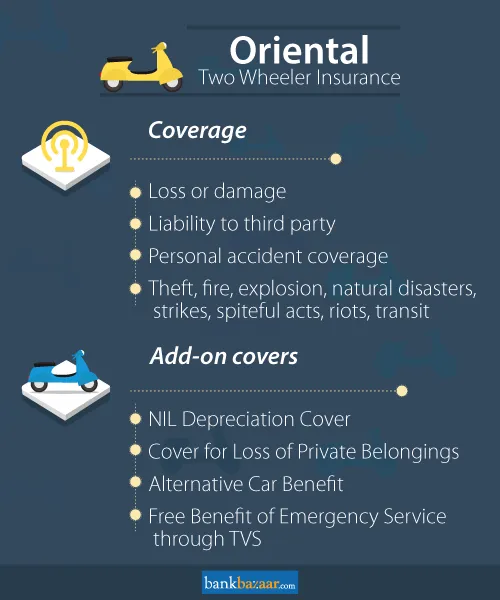

Coverage Under Oriental Bike Insurance Package Policy

- Loss or damage caused to the vehicle

- Personal accident cover for the driver/owner of the vehicle.

- Loss or damage caused to the vehicle due to burglary, theft, housebreaking, and more.

- Loss or damage to the vehicle due to fire, explosion, lightening, and self-ignition.

- Loss or damage caused to the vehicle due to a natural disaster such as landslide, rockslide, earthquake, etc.

- Man-made malicious acts, strikes, riots, terrorism.

- Loss or damage to the vehicle while in transit.

Factors Affecting Premium Calculation

The premium for a two-wheeler insurance policy is determined based on multiple factors. Some of which are listed below:

- Insured Declared Value of the vehicle

- Vehicle registration zone

- Cubic capacity of the vehicle

- Age of the vehicle

- Add-on covers opted for

- Electrical and electronic items installed to the vehicle

Exclusions Under The Policy

- Damage or loss caused to the vehicle by a person driving the vehicle without a valid driving license

- Damage or loss caused to the vehicle by a person driving under the influence any intoxicating substance

- Mechanical or Electrical breakdown

- Consequential loss

- Depreciation in the value of the vehicle

- Loss or damage to the vehicle due to war/mutiny/nuclear risk

- Damage or loss of consumable items unless the vehicle is damaged at the same time. The liability of the insurer is limited to 50% in such cases.

- Damage caused outside the geographic area outside India.

- Claims made for an insured vehicle being used against the limitations specified in the policy.

- Loss or damage to the vehicle accessories unless the vehicle is stolen at the same time.

Know more about Bike Insurance Related Articles

- Paperwork Required When You Buy a Used Motorcycle

- How to Calculate Two Wheeler Insurance Premium in India

- Third Party Two Wheeler Insurance In India

- Vehicle Registration Details in India

- 6 Benefits of Two Wheeler Insurance Renewal

- Steps Involved in Two Wheeler Ownership Transfer

- Zero Depreciation Cover for Bike Insurance

- Tips to Reduce Bike Insurance Premiums

- How to Cancel Two Wheeler Insurance Policy?

- Long Term Two Wheeler Insurance

- Documents Required To Purchase New Two Wheeler

- A Beginner's Guide to Two Wheeler Insurance

- RTO Rules For Vehicle Transfer

Available Discounts on Premium

A policyholder may avail certain discounts on their two-wheeler insurance policies in the following ways:

- Opting for a higher voluntary excess

- By installing an ARAI approved anti-theft device

- Availing No Claim Bonus (NCB)

- By becoming a member of a recognised automobile association.

Oriental Insurance Company Two Wheeler Insurance Customer Care Numbers

In case you have queries or concerns regarding the products offered by Oriental Insurance Company or need information on claims processing and settlement, you may get in touch with the customer care department at Oriental Insurance Company by calling on 1800118485 (toll-free number). You may also call on 011- 33208485 (Charges applicable).

Oriental Insurance Company Branch Offices

Customers may also get the needed information and buy insurance products by visiting the nearest Oriental Insurance Branch. The branch offices can be located through the official website of the insurer. Below mentioned is the address of the registered office of Oriental Insurance Company:

Check for - oriental two wheeler insurance customer care

Oriental Two Wheeler Insurance Registered Office Details

Oriental House, A-25/27, Asaf Ali Road,

New Delhi - 110002

Phone No.s: 011-43659595

CIN: U66010DL1947GOI007158

Two Wheeler Insurance in top cities

- Two Wheeler Insurance Bangalore

- Two Wheeler Insurance Chennai

- Two Wheeler Insurance in Hyderabad

- Two Wheeler Insurance Kolkata

- Two Wheeler Insurance Mumbai

- Two Wheeler Insurance Pune

- Two Wheeler Insurance Chandigarh

- Two Wheeler Insurance Indore

- Two Wheeler Insurance Ahmedabad

- Two Wheeler Insurance Coimbatore

- Two Wheeler Insurance in Goa

- Two Wheeler Insurance Jaipur

- Two Wheeler Insurance Noida

- Two Wheeler Insurance Gurgaon

Two Wheeler Insurance from Top Manufactures

- Royal Enfield Two Wheeler Insurance

- Honda Two Wheeler Insurance

- Mahindra Two Wheeler Insurance

- Hero MotoCorp Two Wheeler Insurance

- Harley Davidson Two Wheeler Insurance

- Kawasaki Two Wheeler Insurance

- Suzuki Two Wheeler Insurance

- Triumph Two Wheeler Insurance

- Bajaj Two Wheeler Insurance

- TVS Two Wheeler Insurance

- KTM Two Wheeler Insurance

- Hyosung Two Wheeler Insurance

- Yamaha Two Wheeler Insurance

- BMW Two Wheeler Insurance

- Piaggio Two Wheeler Insurance

FAQs on Oriental Two-Wheeler Insurance

- What are the kinds of motor insurance policies that I can buy from Oriental Insurance Company?

The insurance company offers two types of motor insurance policies as mentioned as - Liability Only Policy: This policy covers the insured against legal and financial liabilities arising out of damage or loss caused to a third party due to the insured vehicle. A third-party liability insurance policy is the minimum insurance required for motor vehicles as under the Motor Vehicles Act & Package Policy: The package policy offered by Oriental Insurance Company covers the insured in a variety of incidents causing loss or damage to the vehicle as well as liabilities arising out of accidental loss or damage caused to a third party.

- Can I buy Oriental motorcycle insurance policy online?

Yes, you may buy or renew a motorcycle insurance policy through the official website of Oriental Insurance. All you are required to do is fill up some basic details about your vehicle, enter some basic personal details, calculate the premium, and make the payment using any of the payment options available.

- What will be the premium for my motorcycle insurance policy?

The premium for a motorcycle insurance policy depends on multiple factors such as make and model of the vehicle, zone of registration, claims history, No Claim Bonus, age of the vehicle amongst other factors.

- Can I buy a new motor insurance policy if my existing policy has already expired?

A fresh insurance policy can be purchased if your existing policy has already expired. However, since there will be a break in the insurance, the insurance company may inspect the vehicle before issuing a fresh insurance policy.

- Can I get a duplicate insurance certificate if I have lost my policy document?

Yes, you can submit an application for a duplicate insurance certificate to the issuer who will issue a duplicate policy copy.

- What to do if my vehicle gets stolen?

In case of a theft, the first thing that a policyholder should do is report the incident at the nearest police station. The policyholder also needs to inform the insurer about the incident.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.