Reliance Two-Wheeler Insurance

Reliance General Insurance Company provides various insurance solutions, including health, home, travel, marine, and motor insurance. The company has 139 offices and over 26,587 intermediaries spread across India. As one of the leading general insurance companies in India, it has a huge customer base consisting of corporates, SMEs, and individuals.

Reliance General Insurance Company offers various insurance policies across various sectors like health, marine, home, travel and vehicle insurance. The company has a vast network with 139 offices and 26,587 intermediaries spread across India.

Whether you commute by a two-wheeler daily, Reliance offers several policies to safeguard you against accidents, theft, third-party liabilities, and natural calamities. Reliance two-wheeler insurance policies offer affordable premiums for various time periods along with 10,000+ cashless garages offering seamless experience, online renewals and 24/7 customer support across India.

Reliance General Insurance Two-Wheeler Insurance Overview

Claim Settlement Ratio | 98% |

Cashless Network Garages | 10,000+ |

Add-on Covers | 4 |

Claim Process | Easy and hassle-free video claims |

No Claim Bonus | Discount of up to 50% |

Third-Party Damage Cover | Up to Rs.1 lakh for property damage, permanent total disability cover |

Personal Accident Cover | Rs.15 lakh |

Own Damage Cover | Available |

Reliance General Two-Wheeler Insurance

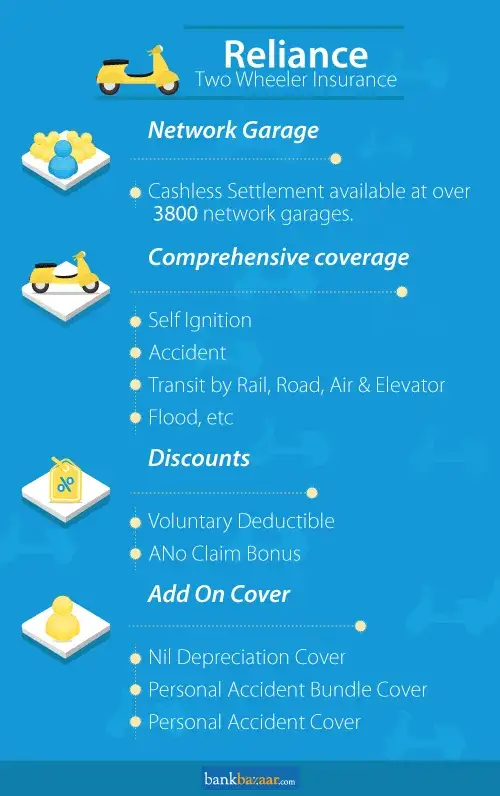

The Reliance General Bike Insurance Policy has been designed to provide two-wheeler owners with the much-needed protection against hazards that result in financial losses. The policy offers coverage against a wide variety of natural and man-made disasters, and other incidents that are beyond human control. Here are the key features of the policy:

- Minimal Paperwork: You can create an instant quote very quickly as the process is very simple and demands very little paperwork.

- Affordable Premiums: You can get insurance for your motorcycle for as low as Rs. 3 per day.

- Hassle-free Claims: Enjoy a seamless, stress-free and convenient process during settlement during emergencies.

- Cashless Networking: Gain access to more than 10,000 authorized garages across India for repair services.

- Personalised Coverage: Get enhanced protection by choosing from a variety of customized add-on covers.

- Long-Term Validity: You can opt for a single policy valid for up to 3 years and save on annual renewal hassles.

Types of Insurance Policies Offered by Reliance General Insurance Company

Reliance General Insurance Company offers a third-party liability motor insurance policy which protects the insured against financial and legal liabilities arising out of loss or damage caused to a third person or their property in an accident involving their vehicle. It also offers a comprehensive bike insurance policy which covers the insured against a wide range of incidents that result in loss or damage to the vehicle or personal loss due to an accident. The table below depicts the difference between both the policies:

THIRD PARTY LIABILITY | COMPREHENSIVE COVERAGE |

Covers third party liabilities only | Covers own damage as well as third party liability |

Lesser premium, cheaper than comprehensive insurance policy | Higher premium |

Minimum level of insurance as mandated by law | Not compulsory by law but most recommended |

Covers damages resulting due to vehicular collision | Covers damages to the vehicle caused due to theft and natural disasters as well as vehicular collision |

Two-Wheeler Insurance Policies Offered by Reliance General Insurance Company

Reliance General Insurance Company offers several life insurance policies for standalone coverage, long term plans, comprehensive and bundled bike insurance life policies to meet the diverse needs of various individuals. Given below are the various insurance policies and their features offered by the insurer.

Reliance Two-Wheeler Policy Standalone Own Damage

- This policy covers damage to your own vehicle only.

- It covers damage to vehicles due to accidents, natural or man-made disasters or theft.

- A third-party liability policy is a mandatory requirement to purchase this policy.

Reliance Two-Wheeler Policy-Bundled

- This policy is designed for newly purchased two-wheelers.

- It provides third-party liability coverage of 5 years and own-damage coverage of 1 year.

- This policy also includes a personal accident cover for the owner-driver.

Third-Party Long-Term (2 & 3-year) Policy

- This policy covers third-party liabilities. Any injuries to others or damage to their property is covered under this policy.

- It includes a Personal Accident (PA) cover for the owner-driver.

- This policy is only valid for a time period of 2 or 3 years.

Reliance Two-Wheeler Package Policy

- This insurance policy is a standard comprehensive plan offered by the insurer.

- This policy covers any damage to the vehicle in case of theft or accidents.

- Third party liability is also covered under this policy.

- It also provides a personal accident cover for the owner-driver.

Long-Term Two-Wheeler Package Policy

- With a validity of 2 to 3 years, the long-term two-wheeler package policy is a comprehensive insurance plan.

- This policy eliminates the need for annual renewals.

- It also covers own damage and provides a third-party liability and a personal accident cover.

Long-Term Two-Wheeler Package Policy

- With a validity of 2 to 3 years, the long-term two-wheeler package policy is a comprehensive insurance plan.

- This policy eliminates the need for annual renewals.

- It also covers own damage and provides a third-party liability and a personal accident cover.

"A" Policy for Act Liability Insurance (5 Years):

- This insurance policy is commonly known as a standard third-party policy.

- The main feature of this insurance policy is that it provides a third-party liability coverage for 5 years.

- This policy also includes a personal accident cover for the owner-driver.

Reliance Two-Wheeler Package Policy (5 Years)

- This is another comprehensive insurance plan that offers extensive coverage for a time period of 5-years.

- This plan includes damage to the vehicle in case of theft or accidents.

- This plan provides a third-party liability and a personal accident cover for the owner - driver.

Benefits of Reliance Two-Wheeler Insurance

A comprehensive insurance policy can provide valuable financial support if you face an unexpected incident on the road. Reliance Two-Wheeler Insurance offers both comprehensive coverage and the mandatory third-party liability cover to suit different needs. Additionally, the overall cost of insurance can reduce over time if you do not raise any claims, thanks to the No Claim Bonus benefit. Mentioned below are some key advantages, including the No Claim Bonus, that you can enjoy by choosing Reliance Two-Wheeler Insurance.

Add-On Covers Available

Zero Depreciation Cover: The add-on cover removes the effects of depreciation on the Insured Declared Value (IDV) of the vehicle.

Medical Cover: This add-on cover ensures that a policyholder gets sufficient medical assistance at the time of an accident. It covers the medical costs for treatment in case of an accident.

Cashless Hospitalisation: The add-on cover assures medical treatment at network hospitals without the need of advance cash payments at the hospital.

Personal Accident Cover: This add-on cover covers the rider of the vehicle against an accident anywhere in the globe. The cover also ensures financial compensation in case of accidental death or permanent total disability. Below are the details of benefits under the personal accident add-on cover:

Table of Benefits | Coverage | Amount of Compensation (percentage of Capital Sum Insured) | Capital Sum Insured (In Rupees) |

A | Death or permanent disability | 100% | 500,000 |

B | Loss of eyesight of both the eyes or physical separation of two limbs | 100% | 500,000 |

C | Loss of eyesight of one eye or physical separation of one limb | 100% | 500,000 |

D | Physical separation or loss of one limb or loss of sight of one eye | 50% | 500,000 |

Coverage Offered Under Reliance Two-Wheeler Insurance Policy

The two-wheeler insurance policy offered by Reliance General Insurance Company covers the insured against losses or damages caused to the vehicle due to any of the following incidents:

Natural Calamities: The policy covers the insured against damages or losses caused to the vehicle due to natural calamities such as fire, frost, flood, tempest, earthquake, explosion, cyclone, lightning, landslide, rockslide, hailstorm, hurricane, and more.

Man-Made Calamities: Man-made calamities include theft, vandalism, terrorism, self-ignition, riots & strikes, malicious acts, and more.

Other incidents: Loss or damage to the vehicle due to other incidents such as accident, loss or damage in transit, self-ignition, and others too are covered under the policy.

Exclusions Under Reliance Two-Wheeler Insurance

The following instances are not covered under the two-wheeler insurance policy offered by Reliance General Insurance Company.

- Depreciation in the value of the vehicle

- Breakdown of electrical/mechanical nature

- Use of vehicle against its limitations

- Damage caused to the vehicle by a person driving the vehicle under the influence of any intoxicating substance

- Damage caused to the vehicle be a person driving the vehicle without a valid driving license

- Consequential loss

- Compulsory deductibles at the time of insurance claim

- Damage caused to tyres and tubes (unless the vehicle is also damaged at the same time)

- Loss or damage to the vehicle accessories

No Claim Bonus for Reliance Bike Insurance

The No Claim Bonus is provided by the insurer to its customers if there are no claims made on the two-wheeler insurance policy during the preceding years. The same can be transferred to the new vehicle. The NCB is accumulated on an annual basis as shown in the table below.

Number of claim-free years | Discount |

1 year | 20% |

2 consecutive claim-free years | 20% |

3 consecutive claim-free years | 35% |

4 consecutive claim-free years | 45% |

5 consecutive claim-free years | 50% |

Depreciation Rates

Certain depreciation rates are applicable to the cost of replacement parts, Depreciation rates for various parts of a bike are mentioned below:

Bike Part | Depreciation Rate |

Glass parts | NIL |

Fibreglass parts | 30% |

Rubber, plastic, and nylon parts | 50% |

Tyres, tubes, airbags, and batteries | 50% |

Paint materials | 50% |

Other parts/ Wooden components | As mentioned in policy documents |

How to Buy/Renew Reliance Two-Wheeler Insurance Policy Online?

You can buy or renew your two-wheeler insurance policy with minimum documentation through the official website of Reliance general Insurance.

The steps to purchase Reliance Two-Wheeler Insurance online are as follows:

Steps to Purchase Reliance Two-Wheeler Insurance Online

Step 1 - Visit the official website of Reliance Two-Wheeler Insurance.

Step 2 - Enter the requested details such as your name, mobile number, registration number, bike make and model, etc.

Step 3 - Choose the optional add-on covers you wish to avail.

Step 4 -Select the duration of your policy and pay the premium.

Step 5 - After the payment is made, a soft copy of your bike insurance policy will be sent to your email address. It can also be downloaded from the Reliance Two-Wheeler Insurance website.

Renew your Reliance Two-Wheeler Insurance Online

Step 1 - Visit the official website of Reliance Two-Wheeler Insurance.

Step 2 - Enter the requested details about your policy.

Step 3 - Click the 'Proceed to Renew' option.

Step 4 - Choose the optional add-on covers you wish to avail.

Step 5 - Select the duration of your policy and pay the premium.

Step 6 - After the payment is made, a soft copy of your bike insurance policy will be sent to your email address. You can also log in to your account to download it.

Registration of Claims

In any incident resulting in damage or loss to the vehicle, you may register your insurance claim by calling on the below-mentioned toll-free number: 1800 3009

Reliance General Two-Wheeler Insurance Claim Settlement Process

1. Register your bike insurance claim by calling on 1800 3009 (toll-free number)

2. Take your two-wheeler to any of the nearest authorised network garage for repair.

3. Submit the required documents to the surveyor.

4. The insurer confirms the liability.

5. The repairs can be done at the authorised cashless garages of the company.

6. In absence of cashless facility, the insured needs to make payment for the repairs. The bills of the same can be submitted to the insurer for final settlement.

Delivery of the vehicle.

Documents Required to File an Insurance Claim

1. For Damages Due to Accident:

- Duly-filled claim form

- Insurance certificate

- Copy of vehicle Registration Certificate (RC)

- Copy of Driving License

- Police FIR (for third-party property damage/body injury/death)

- Repair bills and payment receipts

- Any other document as required by the insurer

2. Theft Cases:

- Insurance Certificate/Policy Document

- Vehicle RC (original)

- Theft endorsement from the concerned RTO

- Tax payment receipt

- Details of existing insurance

- Policy number

- Details of the insurer

- Validity of insurance

- Sets of keys/service book/warranty cards

- Police FIR and FIR

- Copy of letter intimating the RTO about the theft

- Any other document as required by the insurer

Reliance Bike Insurance Contact Details

For any queries or concerns related to two-wheeler insurance or any other general insurance solution offered by Reliance General Insurance Company, you may reach out to the customer care team using the following contact information Email Address: rgicl.services@relianceada.com Toll-free Number: 18003009

Reliance Bike Insurance Branches in Major Cities

You may also visit your nearest Reliance General Insurance branch office to buy or renew your two-wheeler insurance policy or to get assistance with any other related issue. Here is the list of branch offices in important Indian cities:

New Delhi

Branch | Address And Contact Number |

Connaught Place | Flat No-10-15, 14th Floor, Vijaya Building, 17, Barakhamba Road, Connaught Place, New Delhi-110001 Phone Number: 011-39975617 |

Okhla | Plot No - D160/2, 2nd and 3rd floor, Okhla Industrial Area Phase 1, New Delhi Phone Number: 011-30913560 |

Laxmi Nagar | Flat no. 408-412A, 4th Floor, Plot No.21, Metroplex East, (Old Radhu Cinema), Distt. Centre, Laxmi Nagar, Delhi-110092. Phone Number: 011-39827100 |

Janakpuri West | C-1 IIIrd Floor, New Krishna Park , Beside Janakpuri West Metro Station, New Delhi - 110018 Phone Number: 011-30292925 |

Okhla Industrial Area | Plot No - D160/2, 2nd and 3rd floor, Okhla Industrial Area Phase 1 Phone Number: 011-30913560 |

Pune

Branch | Address And Contact Number |

Ramabai Ambedkar Road | Heritage House, Ground floor, 6 Ramabai Ambedkar Road, Pune Phone Number: 020-30565149 |

Ahmedabad

Branch | Address And Contact Number |

Ellisbridge | 3rd Floor, Zodiac Avenue, Opp. Mayor's Bunglow, Near. Law Garden, Ellisbridge, Ahmedabad Phone Number: 079-30266966 |

Maninagar | 4th Floor, Poonam Plaza, Above ICICI Bank, Main Rambaug Road, Maninagar, Ahmedabad, Phone Number: 079-39832184 |

Chennai

Branch | Address And Contact Number |

T Nagar | Old No 15, New No 29, 3rd Floor, North Usman Road, T Nagar, Chennai Phone Number: 044-30062371 |

Anna Nagar | H Block, 4th street, Door No 12, H 2035, 15th Main Road, Anna Nagar (West), Chennai Phone Number: 044-30925816 |

Hyderabad

Branch | Address And Contact Number |

Abids Road | 4-1-327 TO 337,IV Floor, Sagar Plaza, Abids Road, Hyderabad Phone Number: 040-39838550 |

Musheerabad | 1st Floor, Vijetha Sanjeevani, H.NO.6-4-8, Opp. Gandhi Hospital, Musheerabad, Hyderabad Phone Number: 040-69000322 |

Bangalore

Branch | Address And Contact Number |

Rajajinagar | UNNATI ARCADE, 5/111 & 6/112, 1st floor, 1st Block, Dr. Rajkumar Road (1st main road), Rajajinagar, Bangalore - 560010 Phone Number: 080-41900202 |

Jayanagar | 2nd floor, SM Towers, 11th Main, 3rd Block, Jayanagar, Bangalore Phone Number: 080-30480894 |

BTM Layout | 2nd Floor, Balaji Enclave No 782,2nd Floor, Above Bata Showroom, 16th Main, 2nd Stage, BTM Layout, Bangalore Phone Number: 080-39860971 |

Kochi

Branch | Address And Contact Number |

Edappally P O | 2nd Floor, Kurikkal Arcade, NH-47, Near Changampuzha Park, Edappally P O, Ernakulam (Dist), Phone Number: 0484-3327842 |

Kolkata

Branch | Address And Contact Number |

J L Nehru Road | Himalaya House 8th floor,38 B J L Nehru Road, Kolkata Phone Number: 033-30274578 |

J L Nehru Road | Himalaya House 5th floor,38 B J L Nehru Road, Kolkata Phone Number: 033-30274578 |

Mumbai

Branch | Address And Contact Number |

Santacruz | Reliance Centre, South Wing, 4th Floor, Off. Western Express Highway, Santacruz (East), Mumbai Phone Number: 022-33031000 |

Borivali (West), | Tiara building, 4th Floor, Chandavarkar Lane, Borivali (West), Mumbai Phone Number: 022-30885709 |

Goregaon East | 4th Floor, Chintamani Avenue, Next to Virwani Industrial Estate, off western express Highway, Goregaon East, Mumbai-400063 Phone Number: 022-33123123 |

Dadar West | Apple Plaza, Unit no. 301, 302 and 303, Senapati Bapat Marg, Dadar West, Mumbai Phone Number: 022-33458000 |

Ghatkopar (E) | 210,Sai infotech, 2nd flr, R.B. Mehta Marg, Patel Chowk, Ghatkopar (E), Mumbai Phone Number: 022-39981325 |

Mumbai Fort | 21 Veena Chambers Ground Floor Dalal Street Mumbai Fort, Mumbai Phone Number: 0-7666828135 |

Vashi | 3rd Floor, Apeejay Express, Plot No. 87, Sector 17, Vashi, Navi Mumbai Phone Number: 022-39101041 |

FAQs on Reliance Two-Wheeler Insurance

- Is it possible to buy or renew Reliance Two-Wheeler Insurance Online?

Yes, you can buy a new insurance policy or renew your existing insurance policy on the official website of Reliance General Insurance. All you need to do is fill in some basic details about your vehicle, calculate the premium (using the premium calculator feature), and make the necessary payment. The whole process hardly takes a few minutes.

- What are the benefits of a zero-depreciation add-on cover?

The zero-depreciation cover assures 100% repayment on depreciated parts (except for tyres and tubes) at the time of claim. This will help you save significant costs on the repair and retrieval of the vehicle. However, this add-on cover is applicable only for two-wheeler models not older than two years

- What are the factors that affect the premium of a two-wheeler insurance policy?

Some of the main factors that determine the premium of a motor insurance policy are the vehicle’s make and model, cubic capacity, age, place of registration, and add-on covers.

- What are the available modes of payment if I buy a two-wheeler insurance online?

Reliance General Insurance allows you to make payments via debit cards, credit cards, and net banking.

- What to do if my two-wheeler is stolen?

In case of theft of the vehicle, the incident should be reported at the nearest police station and an FIR should be filed. A copy of the FIR will be needed to file an insurance claim.

- I am planning to buy Reliance two-wheeler insurance policy online. What details do I have to provide?

You will be required to provide details like registration number, chassis number, engine number, previous policy number, date & place of purchase, contact details and vehicle manufacturing date. Also, you need to have a copy of your vehicle’s RC book.

- What is No Claim Bonus (NCB)?

Policyholders get a discount on the premium if they have not claimed anything during the previous term, this discount is referred to as NCB. No Claim Bonus can also be accumulated on a monthly basis starting at 20% for the first two years of claim-free renewal and 25% for the next year and so on.

- How is the IDV calculated?

IDV or the Insured Declared Value is calculated by adjusting the manufacturer’s listed selling price against the depreciation percentage which is based on the age of the vehicle.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.