Bank of Baroda Credit Card Application Status

By applying for a Bank of Baroda credit card, you can track the status of your card application from the website of the bank. If you have applied for the card from BankBazaar, the website also gives you the means to track the application status of your card.

You can track the credit card application status through offline methods as well such as contacting the customer care of the bank or visiting the nearest branch of Bank of Baroda.

When checking your application status, you may receive one of the following updates:

- In Progress

- Dispatched

- Approved

- Rejected

How to Check BOB Credit Card Application Status Online?

If you have internet access, knowing the status of your credit card application is just a few clicks away. Mentioned below is a step-to-step guide to check the status online.

Step 1: Visit BOB official website dedicated for cards

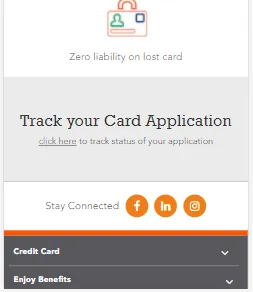

Step 2: In the home page, if you scroll down you find 'Track your Card Application'. Then click on the link under that section

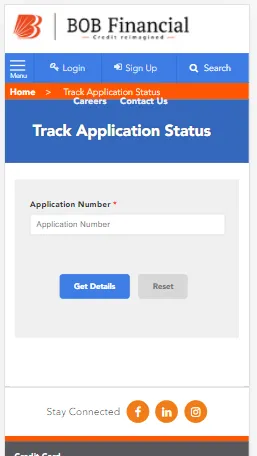

Step 3: You will be redirected to 'Track Application Status' page, which prompts for details such as your application number.

Step 4: Enter the details and click on 'Get Details'

In case you are not eligible for the credit card as per the bank's norms, your application will get rejected and you will see the same status. Once your credit card application is rejected, you need to wait 3-6 months to re-apply again. It's always better to call customer care and check the reason for rejection so that you can be a little cautious while applying it next time.

You will receive the 'no records found' option, if the details you entered are incorrect or when the bank hasn’t received your application yet. Re-enter your details with the correct information and also make sure to check the status a week after submitting your application allowing the bank to update the details.

Other Banks Credit Card Status

- Credit Card Status

- SBI Credit Card Status

- HDFC Credit Card Status

- Axis Bank Credit Card Status

- IndusInd Credit Card Status

- Yes Bank Credit Card Status

- RBL Credit Card Status

- Standard Chartered Bank Credit Card Status

- Kotak Credit Card Status

- Canara Bank Credit Card Status

- PNB Credit Card Status

- HSBC Credit Card Status

- CBI Credit Card Status

How to Check the Status of BOB Credit Card Application Offline?

If you don't have internet access, you can use the offline channels to check the status of your credit card application.

Customer Care

- If you're unable to check your Bank of Baroda credit card application status online, you can reach out to their 24×7 helpline at 1800 2665 100 or 1800 2667 100.

- Have your application reference number ready, as the customer care representative will need it to provide you with the status of your application.

- It's recommended to call from your registered mobile number, which you provided in your Bank of Baroda credit card application.

Branch Visit

- Visit the nearest Bank of Baroda branch and speak with a bank official to inquire about your credit card application status.

- You will need to provide your application number and a valid photo ID to the bank official, who will then assist you with your request and inform you of your application status.

Factors to Consider when Applying for Bank of Baroda Credit Card after Rejection

When reapplying for a Bank of Baroda credit card after a rejection, consider the following factors:

- Credit Score

- Your credit or CIBIL score is crucial in determining your eligibility for a credit card.

- It provides insight into your creditworthiness.

- Bank of Baroda will check your credit score with the credit bureau.

- Any errors in your credit report can impact your score negatively; correct any inaccuracies before reapplying.

- Maintaining a good credit history and score improves your chances of approval.

- Eligibility

- Ensure that you meet all the eligibility criteria for a Bank of Baroda credit card.

- Applicants should be between 18 years old and 65 years old.

- Spending Patterns

- Credit cards are tailored to suit different spending habits, such as travel or shopping, offering rewards like miles or cashback.

- Identify the type of credit card that best matches your spending patterns.

- Income Status

- Owning a credit card can increase expenses, so it's important to manage it responsibly.

- Assess whether you genuinely need a new credit card, as having multiple cards can be risky.

FAQs on Bank of Baroda Credit Card Status

- I have applied for a Bank of Baroda Credit Card. When will it be dispatched?

In order for you to receive your credit card, the bank has to first process your application. Once this is done, and once the bank feels that you have met the required eligibility criteria they will process your application. Ideally, it takes up to 21 days from the date of application to get your credit card delivered to your address.

- I want to check my credit card application status, when can I do so?

After applying for a credit card, you need to wait for at least a week before trying to check your credit card application. This is because banks take a long time to verify whether you have presented all the documentation before moving on to the next step. When they do this, they will also update the same on their online database which in turn will be made available to you at a much later date.

- The bank says my application has been rejected. What should I do?

Banks don't reject your application without any reason. So, you need to check your application carefully and understand why it could have happened. For starters, if you have applied for a higher limit credit card with a low salary, your card will be rejected. So, you need to do your research and find out if you meet the eligibility criteria before submitting an application.

- Will my credit score drop if I apply for a credit card?

When a person applies for a credit card, banks will generally make a hard enquiry on your credit account with the CIC. A hard enquiry is basically the bank asking the CIC about your score and giving the reason that you are looking for a line of credit. Each time you apply for a loan, it is called a hard enquiry. The higher the instance of this occurring, the more your credit score can take a hit. So, never apply for too many cards at the same time.

- How long should I wait to reapply for a credit card?

Ideally, you should wait for 3 to 6 months to apply for a credit card. Also, if your credit score is the reason behind your application getting rejected, you need to work on the same and prove to the bank that you have improved and can handle a credit card.

Types of Credit Card

- Top 10 Credit Cards in India

- Fuel Credit Cards

- Lifetime Free Credit Cards

- Kisan Credit Card

- Student Credit Cards in India

- Shopping Credit Cards

- Contactless Credit Cards

- Travel Credit Cards

- Co-Branded Credit Cards

- Lifestyle Credit Cards

- Rewards Credit Cards

- Business Credit Cards

- NRI Credit Cards

- Cashback Credit Cards

- Lounge Access Credit Cards

Credit Card by Banks

- Axis Bank Credit Card

- HDFC Bank Credit Card

- Kotak Bank Credit Card

- Federal Bank Credit Card

- SBI Credit Cards

- HSBC Credit Card

- IndusInd Bank Credit Card

- RBL Bank Credit Card

- Standard Chartered Credit Card

- YES Bank Credit Card

- Canara Bank Credit Card

- Punjab National Bank Credit Card

- Bank of Baroda Credit Card

- IDBI Credit Card

- Union Bank of India Credit Card

- Bank of India Credit Card

Articles on Credit Card

- How to Check Credit Card Status

- How to Manage Multiple Credit Cards

- Best Credit Card for Poor Credit

- How to get Credit Card without Job

- Credit Card Insurance Benefits

- How to Apply for Lost Credit Card

- Reasons for Credit Card Rejection

- Advantages & Disadvantages of Credit Card

- Difference between Credit Card & Debit Card

Credit Card Customer Care

- SBI Credit Card Customer Care

- HDFC Bank Credit Card Customer Care

- Axis Bank Credit Card Customer Care

- Federal Bank Credit Card Customer Care

- IndusInd Bank Credit Card Customer Care

- PNB Credit Card Customer Care

- RBL Bank Credit Card Customer Care

- Kotak Credit Card Customer Care

- Yes Bank Credit Card Customer Care

- Standard Chartered Credit Card Customer Care

- Canara Bank Credit Card Customer Care

- HSBC Credit Card Customer Care

- Indian Bank Credit Card Customer Care

- Bank of Baroda Credit Card Customer Care

- Bank of India Credit Card Customer Care

- Union Bank of India Credit Card Customer Care

Credit Card Bill Payment

- Credit Card Bill Payment

- SBI Credit Card Bill Payment

- HDFC Credit Card Bill Payment

- Federal Bank Credit Card Bill Payment

- Axis Bank Credit Card Bill Payment

- IndusInd Credit Card Bill Payment

- Kotak Credit Card Bill Payment

- Standard Chartered Credit Card Bill Payment

- RBL Bank Credit Card Bill Payment

- HSBC Credit Card Bill Payment

- PNB Credit Card Bill Payment

- Canara Bank Credit Card Bill Payment

- Bank of Baroda Credit Card Bill Payment

- Bank of India Credit Card Bill Payment

- Union Bank Credit Card Bill Payment

Credit Card Eligibility

- Credit Card Eligibility

- SBI Credit Card Eligibility

- HDFC Credit Card Eligibility

- Federal Bank Credit Card Eligibility

- Axis Bank Credit Card Eligibility

- Yes Bank Credit Card Eligibility

- IndusInd Bank Credit Card Eligibility

- HSBC Credit Card Eligibility

- Kotak Credit Card Eligibility

- Canara Bank Credit Card Eligibility

- Standard Chartered Credit Card Eligibility

- RBL Bank Credit Card Eligibility

- Bank of Baroda Credit Card Eligibility

- Union Bank Credit Card Eligibility

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.