VPF - Voluntary Provident Fund 2026

What is Voluntary Provident Fund (VPF)?

The Voluntary Provident Fund (VPF) allows employees to make additional contributions to their EPF account beyond the mandatory amount. Participation is optional, but it offers a safe, government-backed investment with an 8.25% interest rate. Employees can contribute up to 100% of their basic salary and dearness allowance, boosting their retirement savings.

Overview of Voluntary Provident Fund (VPF)

- Risks of investing are minimal

- Easy to transfer the amount in case of a job change

- Easy to open a VPF account

Tenure | Up to retirement or resignation |

Interest rate | 8.25% |

Investment Amount | Depends on the employee |

Maturity Amount | Depends on the investment amount |

Under the VPF scheme, employees can voluntarily contribute to their provident fund account. The scheme is also called the Voluntary Retirement Fund scheme.

The scheme does not include the mandatory 12% that the employee makes towards the Employees' Provident Fund (EPF).

Employees can contribute up to 100% of their basic salary and dearness allowance towards the scheme. The VPF interest rate is similar to the EPF scheme. It is not mandatory for employers or employees to contribute to the VPF.

However, the scheme has a lock-in period of 5 years. The rate of interest of VPF is decided by the Government of India on a yearly basis.

VPF Eligibility

Since the VPF scheme is an extension of the EPF, only salaried employees who receive payments monthly in their salary accounts can invest in it.

Documents Required to Open a VPF account

The below-mentioned documents must be submitted in order for employees to open a VPF account:

- The company registration certificate with the Ministry of Finance (MoF) must be submitted.

- Form 24 and Form 49 must be submitted.

- In case the organisation is an 'Sdn Bhd', the memorandum and articles of association must be submitted.

- The company profile in details must be given.

- The business registration certificate must be submitted.

Employees can check with their employer if any further documents need to be submitted to open a VPF account.

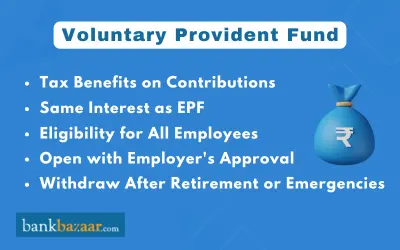

Benefits of VPF

The VPF account comes under the Exempt-Exempt-Exempt (EEE) category. Therefore, employees can enjoy tax benefits and earn a large amount of money in the long-run by investing in the VPF. The main benefits of a VPF account are mentioned below:

- Safe option to invest: There are no dangers associated with investing in the scheme because it is run by the Indian government. It is quite safe to invest in a VPF account as opposed to other long-term investment options provided by commercial companies.

- High rate of interest: Under the VPF scheme, the rate of interest is 8.25% p.a. The interest that is generated from the contributions is also exempt from tax.

- Application process is easy: Opening a VPF account is a fairly easy process. Workers can request to start a VPF account by submitting the registration form to their employer's finance staff. The VPF account will function similarly to the current EPF account.

- Transfer process is simple: In case employees change their jobs, it is very simple for them to transfer the VPF account of the old company to the new one.

Tax Benefits Under VPF

When it comes to various investment options in India, the VPF account is considered among the best. Under Section 80C of the Income Tax Act, 1961, employees are eligible for tax benefits of up to Rs.1.5 lakh. The interest that is generated from these contributions is also exempt from tax. However, in case the rate of interest is more than 9.50% p.a., the amount will be taxable.

Interest Rate of VPF

The rate of interest is set by the Indian Government and is revised on a yearly basis. The rate of interest for FY 2025-2026 is 8.25% p.a. which was the rate of interest previously. Investments towards a VPF account is viable because of its high rate of interest and tax benefits. Given below is the comparison of the PPF and VPF interest rates:

Financial Year | PPF rate of interest p.a.(%) | VPF rate of interest p.a.(%) |

2025 - 2026 | 7.10 | 8.25 |

2024 - 2025 | 7.10 | 8.25 |

2023-2024 | 7.10 | 8.25 |

2021-2022 | 7.10 | 8.10 |

2019-2020 | 7.10 | 8.5 |

2018-2019 | 7.6 to 8 | 8.65 |

2017-2018 | 7.6 to 8 | 8.55 |

2016-2017 | 8 to 8.1 | 8.8 |

2015-2016 | 8.7 | 8.8 |

2014-2015 | 8.7 | 8.75 |

2013-2014 | 8.7 | 8.75 |

Rules and Regulations of VPF

The rules and regulations of VPF account are mentioned below:

- When compared to an EPF account, employees are allowed to contribute 100% of their basic salary and dearness allowance towards a VPF account.

- It is not compulsory for employees to contribute to a VPF account.

- The Indian Government decides the rate of interest of a VPF account at the start of the financial year. The rate could increase or decrease when compared to previous years.

- The full amount available at maturity can be withdrawn at the time of resignation or retirement. Individuals can also transfer their VPF amount from the previous employer to the current one. In case the account holder passes away, the legal heir or the nominee will receive the total amount that has been accumulated.

- Only individuals who work for companies that come under the Employees' Provident Fund Organisation (EPFO) and have an EPF account are eligible to open a VPF account. Individuals who work for unorganised sectors are not allowed to open a VPF account.

- Individuals can open a VPF account at any given time during the financial year. Investments made into the account cannot be stopped for 5 years.

- Partial withdrawals in the form of loans can be made against the VPF account. In case the amount is withdrawn before the maturity period, the withdrawn sum is taxable.

Process to Withdraw Money from VPF Account

In case of financial requirements due to medical emergencies, withdrawing money from a VPF account could come in handy. Employees must fill up Form-31 and give a request letter in writing for VPF withdrawal. Employees will be able to get the Form-31 from their employer's Human Resource (HR) team or on the government's portal. All required documents, including the details of the employee such as PF number, postal address, and bank details must be submitted. A cancelled cheque must also be submitted. All documents that are submitted must be self-attested.

In case of unforeseen financial emergencies, employees can withdraw from the VPF account. Some of the reasons where the VPF can be broken are mentioned below:

- In case medical bills of the account holder or his/her children need to be paid.

- For the marriage or higher-education of the account holder.

- To buy new land or a house or for the construction of the house.

FAQs on VPF - Voluntary Provident Fund

- What is the interest rate on VPF?

The current interest rate on VPF is 8.25%.

- What is the maximum and minimum amount that can be invested in VPF?

Regarding investments, the VPF Limit has no upper or lower bound. Your individual monthly donations determine the same. Up to 100% of your monthly income (dearness allowance + pay) may be designated for a VPF contribution. Keep in mind that your employer is under no need to make contributions to your VPF account. As a result, the amount of money in your voluntarily provided fund account is directly influenced by the interest you earn on your monthly contributions during the investment.

- What is the difference between VPF and EPF?

EPF's extension is called VPF. A person must contribute 12% of their basic salary and Dearness Allowance to an EPF account. In a VPF, the maximum allowed voluntary contribution is 100%.

- How much amount can I withdraw as a loan against my VPF account?

Both partial and full withdrawals of the funds accumulated in the VPF account are possible. People who are moving occupations are typically more likely to utilise their earnings from their voluntary retirement accounts. Note that the accumulated funds may be liable to taxes if this activity is done before the account in question has existed for five years.

- Who are the ideal candidates for a VPF account?

Anyone who is looking to invest in a long-term financial instrument is an ideal candidate. VPF accounts are best suited for people who are nearing retirement and/or are looking out for a robust, safe and scalable pension fund option.

- If I find a new job, will my VPF account be affected?

Your Aadhar Card is linked to your VPF account. Thus, moving your account from one employer to another is a simple process.

- Can I stop contributing to my VPF account monthly in the middle of the year?

No, you will be unable to withdraw from the scheme in the middle of the year after your VPF account is created.

Annie Jangam is a financial writer with a unique background in biotechnology and eight years of genomics research experience, culminating in 6 international publications. Her three-year experience in SEO-based content writing spans diverse topics. She combines her analytical skills with a talent for clear communication to simplify complex financial concepts. She delivers informative, engaging content with scientific precision and creative flair in the fintech industry. She covers various financial products such as banking, insurance, credit cards, tax, commodities, and more. Her research background demonstrates her dedication, attention to detail, and problem-solving skills, making her a valuable asset in the data-centric world of fintech. |

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.