UAN Login - How to Change Mobile Number in Uan Portal?

The Employees' Provident Fund Organisation (EPFO) has a web portal that makes it easier to access information about your account using just your Universal Account Number (UAN). You can check your EPF account balance, track the status of your claims, get updates on contributions made, and transfer funds from a previous member ID to the current one.

You can merge multiple PF accounts online using your UAN login, making it easier to manage your account and access all information in one place.

Steps for EPFO Mobile Number Registration Online

Before know how to update your mobile number in UAN, you should know the registration process of your mobile number on the EPFO Member Portal. Log into the EPFO member portal to activate your UAN once it’s generated.

Given below are the steps to activate the UAN:

- Visit the EPFO Member Portal.

- Choose the ‘Activate UAN’ available on the right side of the screen under the ‘Important Links’.

- Next, enter your name, UAN number, date of birth, mobile number, and email ID.

- After entering all the details, you need to click on the 'Get Authorization Pin’ option.

- You will receive a One Time Password (OTP) on your registered mobile number.

- Enter the OTP in order to activate the UAN.

For more information, Check out related articles: UAN Registration & Activation, PF Balance Check, EPF Claim Status & EPF Passbook

Steps to UAN Login

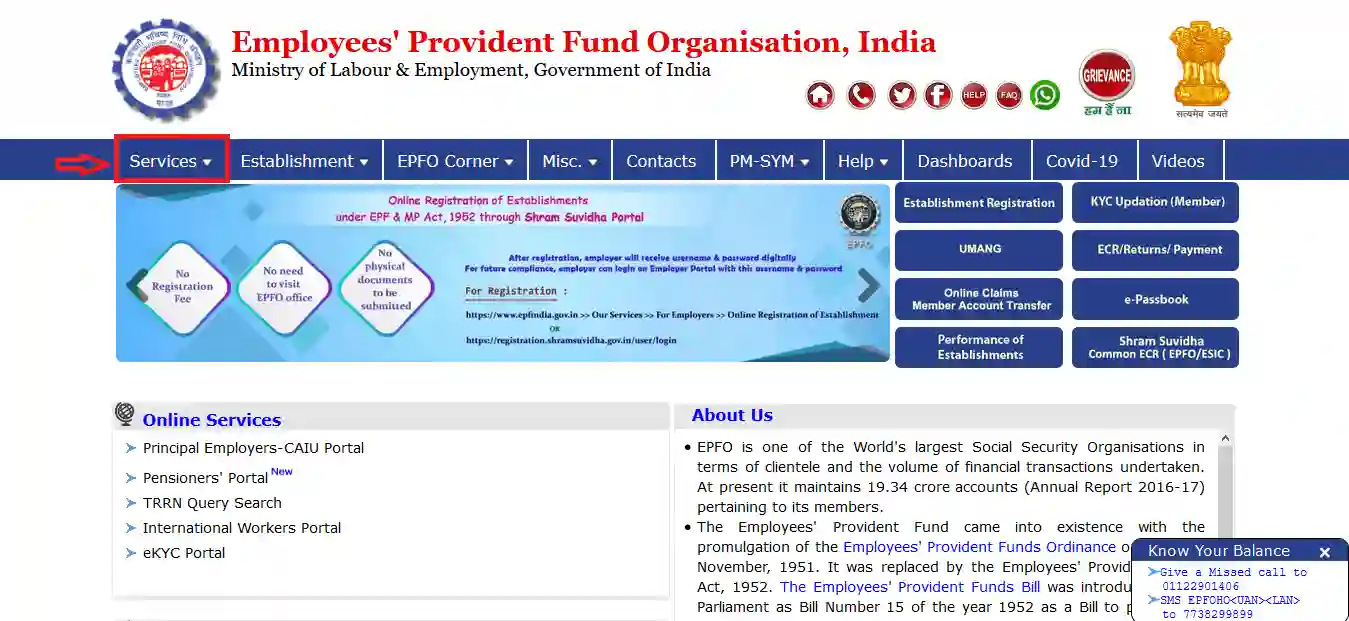

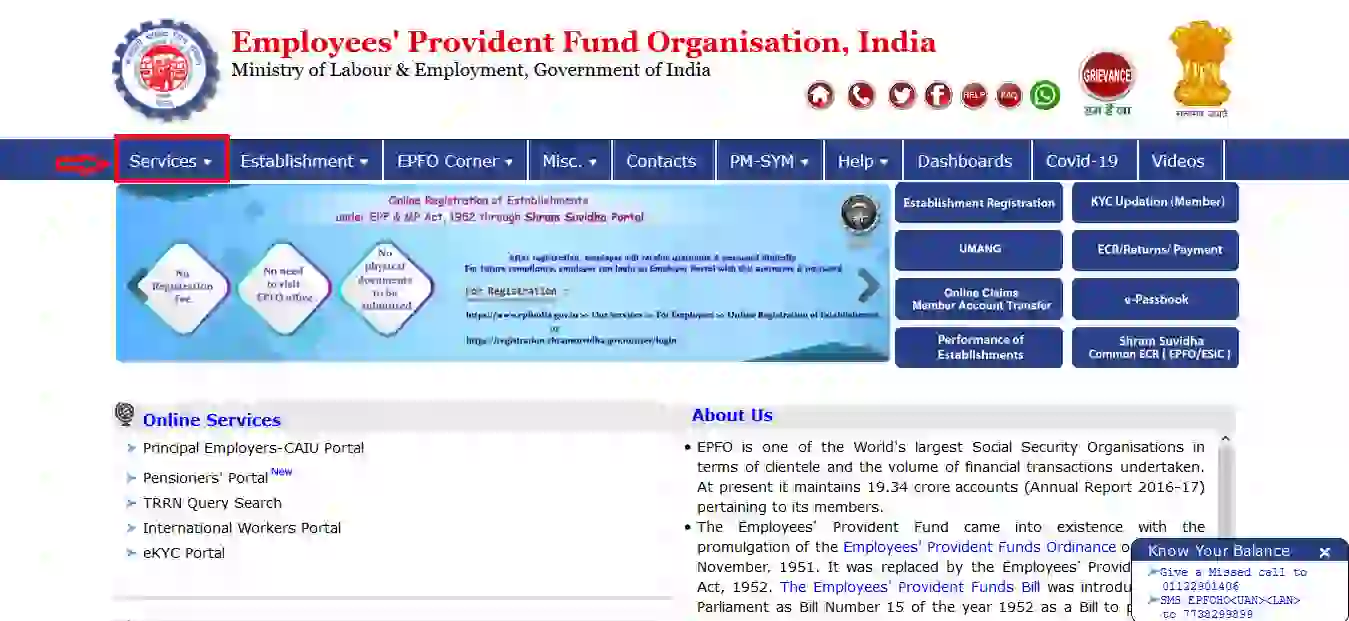

Step 1: Go to the EPFO website(https://www.epfindia.gov.in/site_en/index.php)

Step 2: Click on ‘For Employees’.You can find the option under ‘Services.’

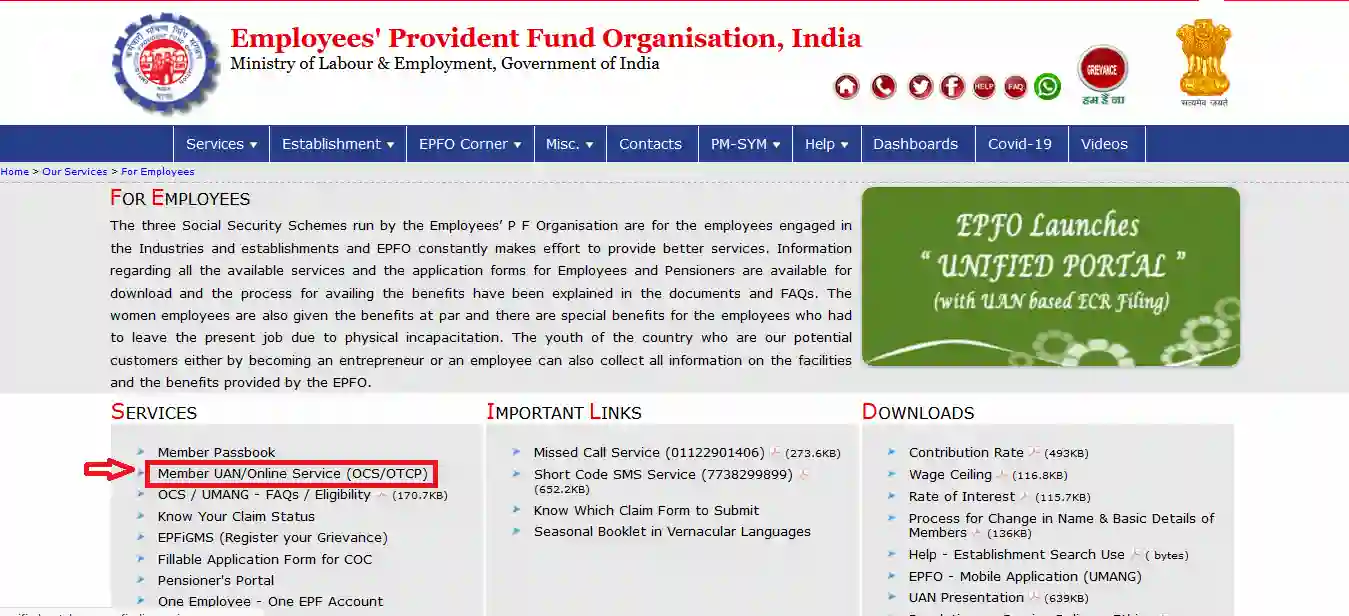

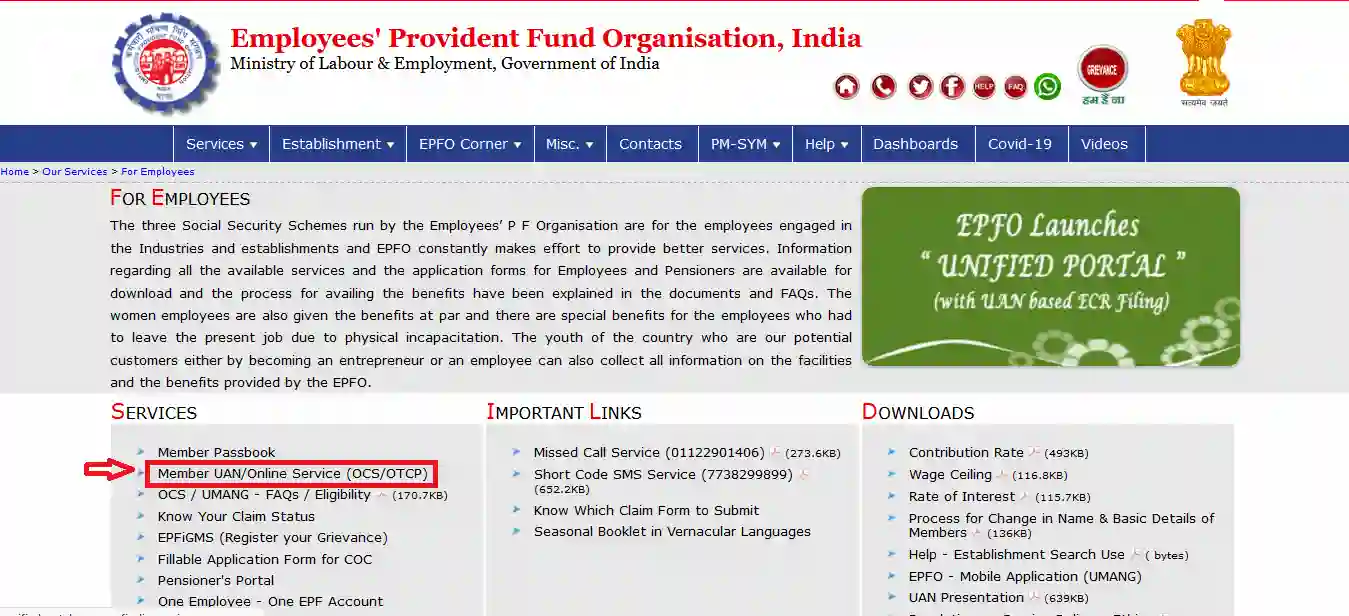

Step 3: On the next page, click on ‘Member UAN/Online Service (OCS/OTCP)’.

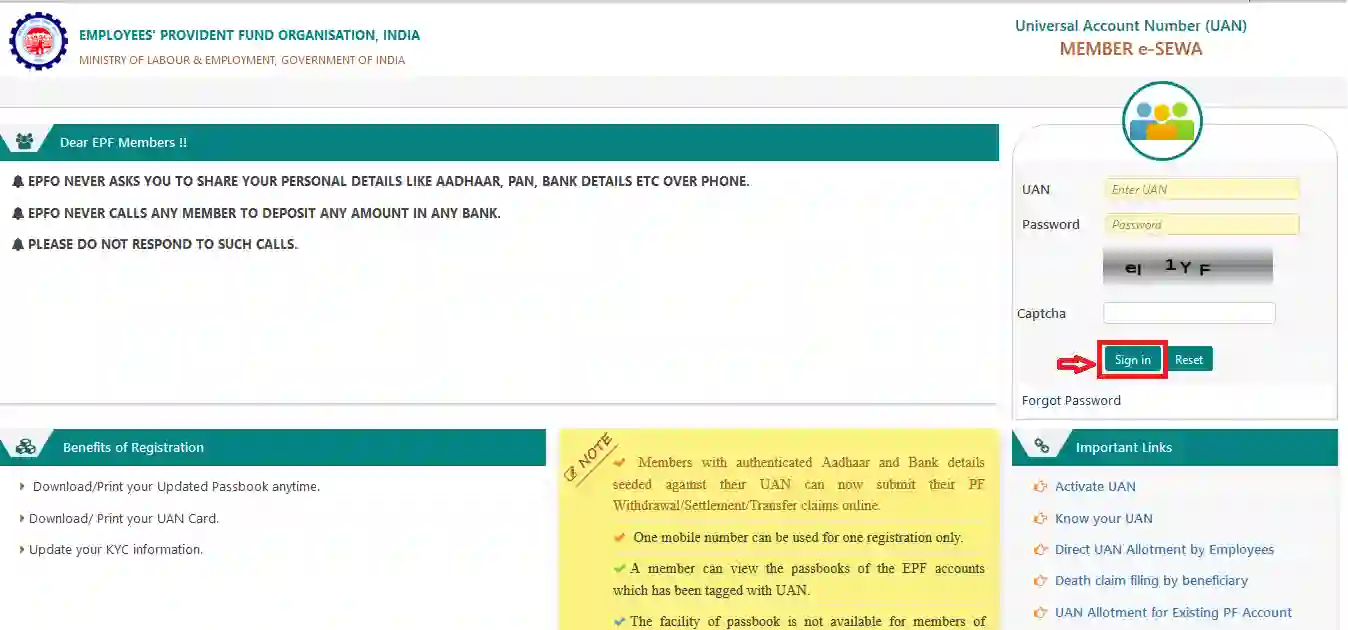

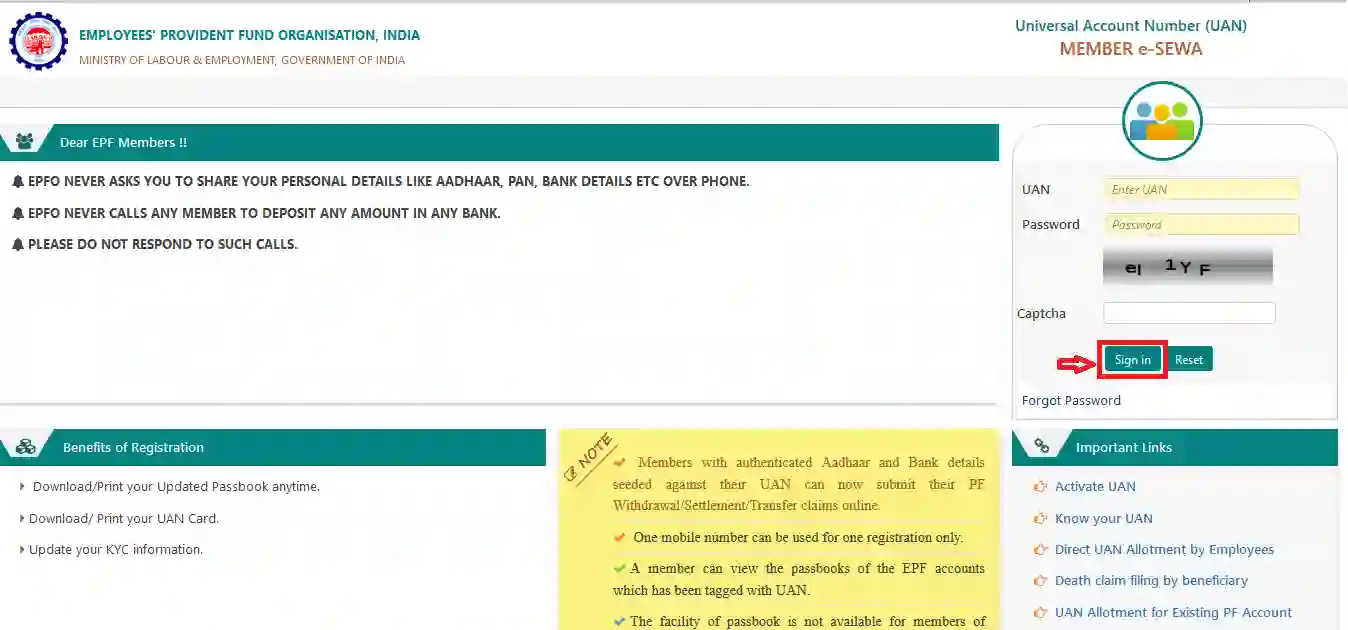

Step 4: Next, enter the UAN, password, and captcha details. Click on ‘Sign in’.

Step 5: The next page will be the main page of your EPFO portal.

Steps to Change Mobile Number on UAN Portal

Given below are the steps to change mobile number on UAN Portal:

Step 1: Visit the official website of the EPFO.

Step 2: Next, under the ‘Services’ tab, you must click on ‘For Employees’.

Step 3: On the next page, click on the ‘Member UAN/Online Service (OCS/OTCP)’.

Step 4: On the next page, enter the UAN, password, and captcha details. Click on ‘Sign In’.

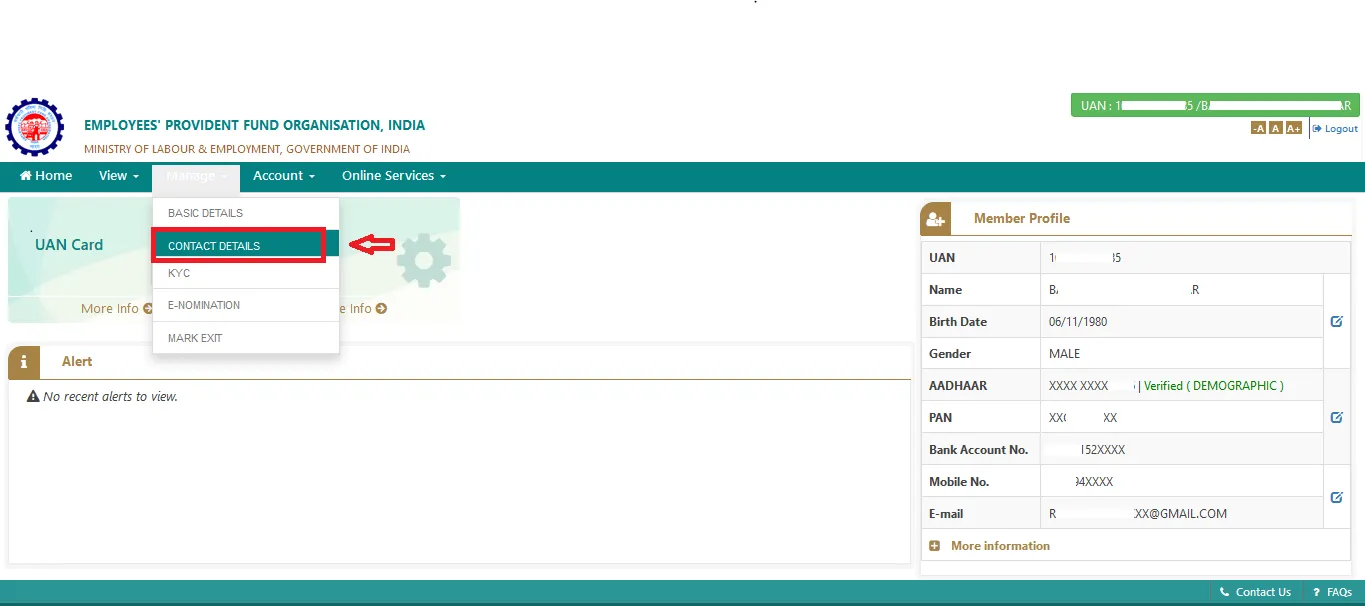

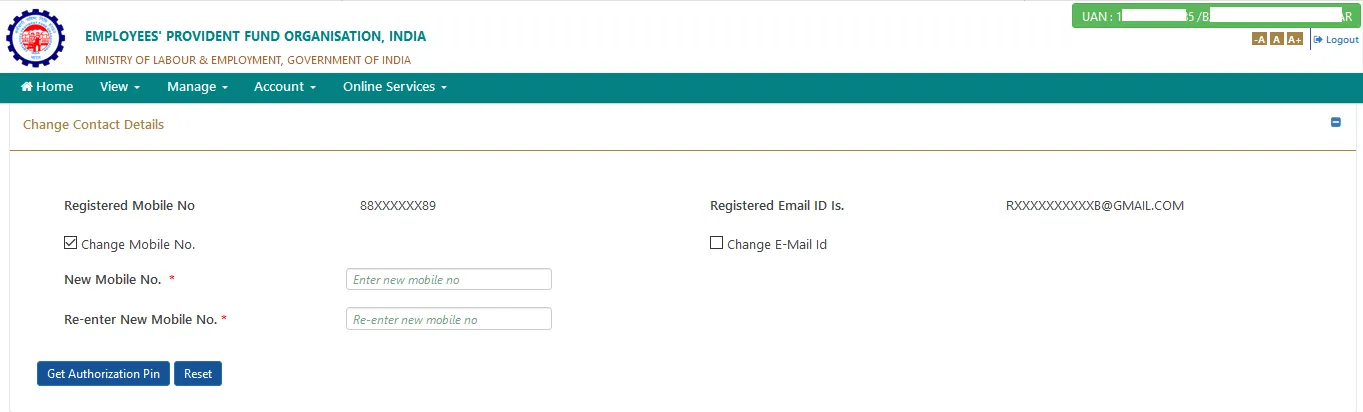

Step 5: Click on ‘Contact Details’ which can be found under the ‘Manage’ tab.

Step 6: On the next page, click on the ‘Change Mobile No.’ option.

Step 7: Enter the new mobile number twice in the respective boxes and click on ‘Get Authorization Pin’.

Step 8:The system will send an OTP to the new mobile number. Enter the OTP and click on ‘Submit’.

Step 9:After completing the above step, the system will update the new number on the EPFO portal.

Steps to Update Mobile Number in case Individuals have Forgotten Password

The following are the steps to update mobile number if you have forgotten your password:

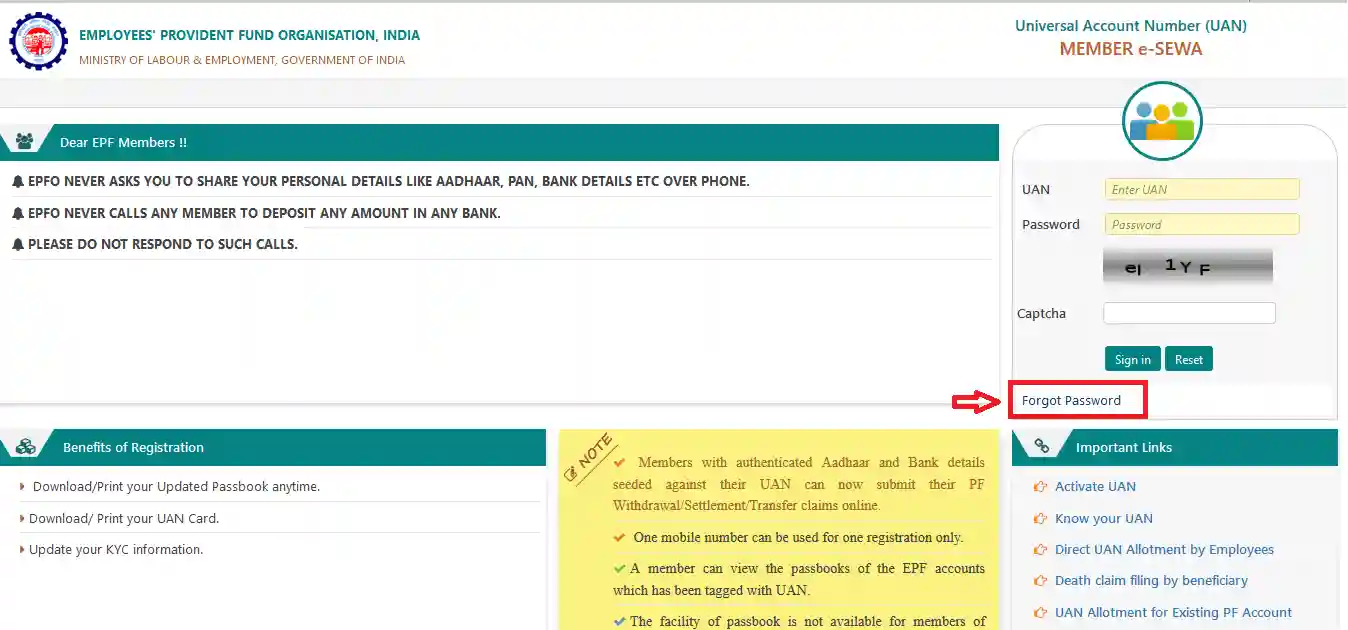

Step 1: Visit the page: https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

Step 2: Once on the page, click on ‘Forgot Password’.

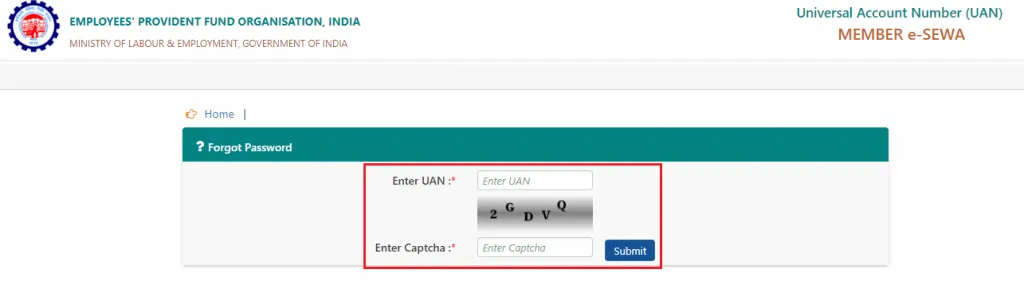

Step 3: On the next page, enter the UAN and captcha details.

Step 4: Enter the above details and click on ‘Submit’.

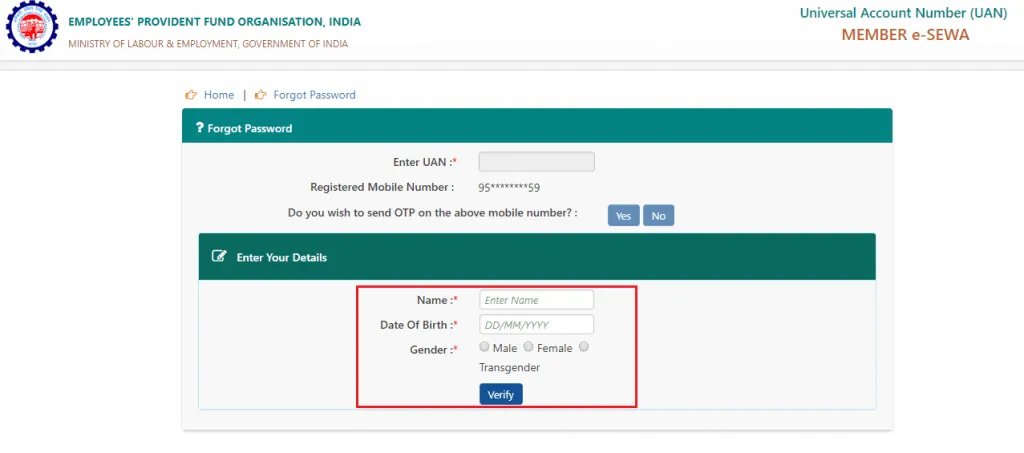

Step 5: On the next page, there will be a request to send an OTP to the old mobile number. Click on the ‘No’ option next to ‘Do you wish to send the OTP to the above mobile number?’

Step 6: Next, enter your name, date of birth, and gender

Step 7: Once the above details have been entered, click on ‘Verify’.

Step 8: Next, select the method by which they would like to verify your details. You will be able to verify details either by using the Permanent Account Number (PAN) or Aadhaar number.

Step 9: Once the relevant details are entered, click on ‘Verify’.

Step 10: Once the details that are provided by you are validated, enter the new mobile number in the box provided and click on ‘Get OTP’.

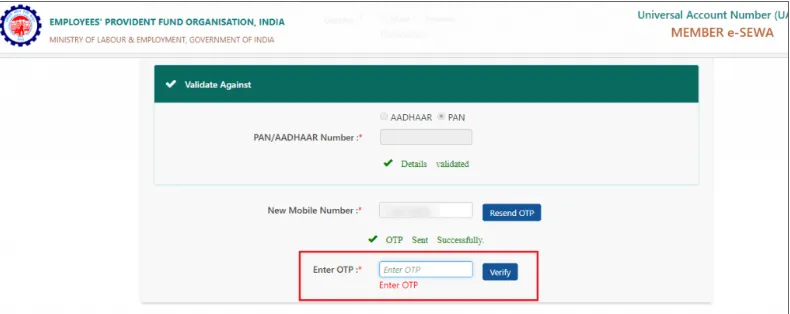

Step 11: The system sends an OTP to the new mobile number.. Enter the OTP and click on ‘Verify’.

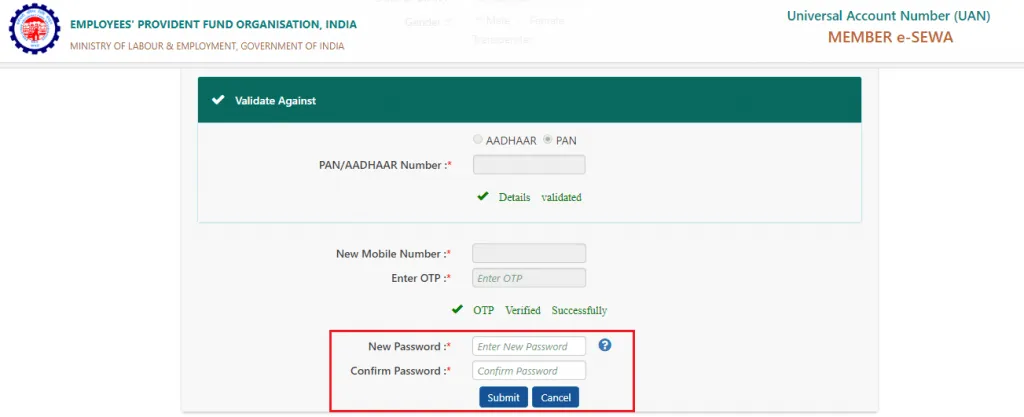

Step 12: Once the above step is complete, you have the option to change the password. Enter the password twice in the provided boxes. After entering the new password, click on ‘Submit’

Step 13: Once the above step is complete, the mobile number and the password will be updated on the EPFO portal.

Advantages of Updating Mobile Number on EPFO portal

The following are the advantages of updating mobile number on the EPFO Portal:

- You can check your EPF balance by sending an SMS from your registered mobile number.

- You can check the claim status using your registered mobile number.

- The system sends updates about EPF contributions via SMS to your registered mobile number.

- Once the EPF withdrawal process begins, the system sends an SMS notification to your registered mobile number.

- To transfer EPF amount from the previous member ID to the current one.

- The system completes the validation process once you enter the OTP sent to your registered mobile number.

Merging Multiple PF Accounts using UAN

Now, instead of closing a PF account every time a subscriber changes his/her job, he/she can merge multiple PF accounts using their UAN and manage all accounts as one. For those who wish to merge multiple PF accounts using their UAN, they can follow the steps mentioned below. Subscribers will have to ensure that they have the below-listed conditions in place before getting to the process of merging their accounts.

Know your UAN status

- Log into the portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Choose ‘Know your UAN Status’ button.

- Enter your Member ID, PF number, Aadhaar, or PAN.

- Enter the state you stay in and your office address.

- Enter details like name, date of birth, and your contact information.

- Enter the captcha code.

- Select ‘Get Authorization Pin’.

- You will get a one time password.

- Enter the OTP.

- Choose ‘Validate OTP and get UAN’.

- The system sends your UAN number and status to your mobile number.

Advantages of UAN Login Portal

The UAN Member Portal serves as a crucial online platform designed to facilitate various services and transactions related to the Employees' Provident Fund (EPF) for all employees. Activation of the Universal Account Number (UAN) is a prerequisite for accessing these services, ensuring a streamlined and digital approach to managing EPF-related activities. Within this portal, individuals can access and review various details, including their KYC (Know Your Customer) information, service records, and UAN card. This centralization of information enhances the ease of managing multiple PF accounts.

Moreover, the portal streamlines the processes of transferring and withdrawing provident fund amounts. To initiate EPF account transfers or withdraw funds, it is essential to associate the Universal Account Number (UAN) with the Aadhaar card, PAN card, and primary bank account. This linking process can be effortlessly completed via the UAN Member e-Sewa portal, or the login portal designed for EPF employees. EPF members can leverage the EPF member e-Sewa portal for convenient and efficient transactions related to their provident fund. This digital platform simplifies administrative tasks, making it more user-friendly for EPF participants to navigate and manage their financial records. Overall, the UAN and associated portals contribute to a more transparent and accessible Provident Fund system for employees in India.

How to Activate your UAN

Activating the Universal Account Number (UAN) for the first time is a straightforward process that enables individuals to access online services related to the Employees' Provident Fund (EPF). Here is a step by step guide on how to activate UAN:

Step 1: Visit the EPFO Member Portal. Go to the official EPFO Member Portal, where various services related to the EPF are provided. Look for the option labeled ‘Activate UAN.’

Step 2: Fill in the required details, including your UAN, member ID, mobile number, Aadhaar number, name, and date of birth. Ensure that the information entered is accurate and matches the records maintained by the EPFO.

Step 3: Once the necessary information is provided, click on the ‘Get Authorization PIN’ button. A Personal Identification Number (PIN) will be sent to the mobile number registered with the EPFO.

Step 4: Retrieve the PIN from your registered mobile number and enter it on the portal to verify your request. This step ensures the authenticity of the activation process.

Step 5: Create Username and Password: After successful verification, proceed to create a username and password for your UAN portal account. These credentials will be used to log in to the portal for future access.

How to login via the e-Sewa Portal

By following the steps given below, employees can easily navigate the UAN Member e-Sewa:

Step 1: Open your web browser and visit the official website of the Employees' Provident Fund Organisation (EPFO).

Step 2: On the EPFO website, look for the 'Services' section. From the dropdown menu, select 'For Employees.' This section is specifically designed to cater to the needs of employees accessing their Provident Fund-related services.

Step 3: Go to 'Member UAN/Online Services'. Within the 'For Employees' section, find the option for 'Member UAN/Online Services.' Click on this option to proceed with the UAN Member e-Sewa Portal login.

Step 4: You will be redirected to a page where you need to enter the necessary details. Provide your Universal Account Number (UAN), password, and the captcha code displayed on the screen. Ensure that the information entered is accurate and matches your records.

Step 5: After entering the required details, click on the 'Sign In' button to initiate the login process. This action will authenticate your credentials and grant access to the EPF member portal. Step 6: Upon successful login, you will be directed to your personalized dashboard within the UAN Member e-Sewa Portal. Here, you can access various features and services related to your EPF account.

Step 7: Once logged in, you can view essential information such as your UAN card, profile details, and service history. This provides a comprehensive overview of your EPF account and associated records.

UAN Login Portal Services

View | Manage | Online Services |

Profile:View and edit personal information such as UAN, Name, Date of Birth, Gender, Contact details, Marital Status, etc. Only mobile number and email ID can be edited by the user., Service History:View details of organizations worked with, including Member ID, Establishment Name, Dates of Joining and Ending EPF, Dates of Joining and Ending EPS, and Dates of Joining and Ending FPS.UAN Card:View and download UAN Card from the portal, useful for offline withdrawal or transfer.EPF Passbook:Passbook option available under 'View' menu. | Basic Details:Modify basic details like name, date of birth, gender, and employer using Aadhaar-based authentication., Contact Details:Manage contact details such as mobile number and email ID. Changes require an authorization pin sent to the new number or email.KYC:Update KYC details including Bank Account, PAN, Aadhaar, Passport. Details are verified by authorities before updating against the UAN.E-Nomination:Add a nominee to the EPF account using the E-nomination option.Mark Exit: Self-update date of exit online if the employer hasn't marked exit. | Change/Reset Password:Manage EPF account by changing or resetting the password using Aadhaar-based OTP authentication., Online Services: Claim (Form 31, 19, 10C), Use new composite claim forms for full or partial PF withdrawal. Aadhaar must be linked to UAN for claiming through these forms.Transfer Request:Request the transfer of PF amount from the previous account to the current one. Ensure KYC details are correct, bank account details are updated, and KYC is seeded against UAN.Track EPF Claim Status:Track the status of EPF claims on the UAN Login Portal without entering any acknowledgment or PF account number. |

How to manage UAN Passbook

The UAN passbook provides a detailed record of contributions, withdrawals, and other financial transactions associated with the EPF account, enhancing transparency and accountability for employees. Individuals can efficiently access and manage their EPF passbook through the official EPFO website by following the instructions given below:

- Step 1: Visit the EPFO Website www.epfindia.gov.in .

- Step 2: On the website, locate the 'Services' menu and select the 'For Employees' option. This section is tailored to meet the needs of employees seeking access to various EPF-related services.

- Step 3: Within the 'For Employees' section, find and click on the 'Member Passbook' option. This choice will lead you to the portal where you can view and manage your EPF passbook.

- Step 4: You will be prompted to enter your Universal Account Number (UAN) and password (the same credentials used for the e-Sewa Portal). Additionally, input the captcha code displayed on your screen for security purposes.

- Step 5: After entering the required details, click on the login or submit button. This action will authenticate your credentials and grant access to the EPF passbook portal.

- Step 6: Once successfully logged in, locate the "Passbook" tab within the portal. Click on this tab to proceed with viewing and downloading your EPF passbook.

- Step 7: On the passbook portal, you'll have the option to choose from various EPF accounts linked to your UAN. Select the specific member ID associated with the account you wish to view. You can then view and download your EPF passbook in PDF format.

How to mark Exit on EPFO Portal

Marking an exit on the EPFO portal is a crucial step for individuals who have ceased their employment and wish to apply for an online transfer.

This delay allows for the completion of necessary financial transactions and documentation associated with your employment.

- Step 1: Log in to the EPFO Member Portal. Access the EPFO member portal using your Universal Account Number (UAN) and password. This requires prior activation of your UAN and linking it to a verified Aadhaar number, along with having your mobile number linked to Aadhaar for OTP verification.

- Step 2: Once logged in, go to the "Manage" tab on the portal. From the options presented, choose ‘Mark Exit.’

- Step 3: In the ‘Select Employment’ dropdown, choose the PF account number associated with the employment from which you are marking the exit.

- Step 4: Enter Date of Exit and Reason for Exit. Enter the relevant details, including the date of your exit from employment and the reason for the exit.

- Step 5: Click on ‘Request OTP’ to receive a one-time password on your Aadhaar-linked mobile number. Enter the OTP when prompted for verification.

- Step 6: After entering the OTP, select the checkbox indicating your consent, click on ‘Update,’ and then confirm by clicking ‘OK.’ You should receive a notification confirming the successful update of your date of exit.

How to contact the UAN Customer care

If a member of EPF encounters difficulty logging into the Member Portal, they can use the provided contact methods to reach out to the UAN Customer Care team for assistance.

Contact Method | Information |

Toll-Free Help Desk | |

Email ID | |

EPF i Grievance Management System | Raise an issue on the EPFO website |

EPFO Regional/Sub Regional Office | View the directory online- https://www.epfindia.gov.in/site_en/Contact_us.php |

Help Desk Service Hours | 9:15 AM to 5:45 PM |

FAQs on UAN Login

- Can I get UAN from mobile number?

Yes, you can get UAN from mobile number, if you have registered your number on UAN portal. To avail UAN details, you need to give a missed call on 011-22901406.

- Will the UAN be mentioned on the salary slip?

Yes, most companies include the UAN on the salary slip.

- Which details are mentioned on UAN card?

Details like Unique Account Number of the employee, employee’s name, QR code, date stamp, etc are mentioned on UAN card.

- Which documents are required for UAN activation?

Documents like Aadhaar card, Permanent Account Number (PAN) card, bank account details, etc. are required for UAN activation.

- Will I have to activate my UAN again if I change my job?

No, you do not have to activate UAN again if you change your job.

- How will UAN help in the PF Withdrawal Process?

The UAN has all your KYC documents (PAN card, Aadhaar Card, etc.) seeded in its system. In the future, you will not need the attestation of your ex-employer (always a hassle for many) to transfer funds or make withdrawals. All that the PF account holder needs to show to make a PF transfer or a withdrawal is his/her Aadhaar card.

- Can I get free SMS alert for any update in my UAN?

Yes, you will get free SMS related to your UAN.

- Can I update my mobile number in EPFO account offline?

No, you cannot update your mobile number in EPFO account offline.

- What has to be done if I change my job?

With the introduction of the UAN, the processes with regard to PF accounts have become far more relaxed. Now, all you have to do is to declare your UAN with your present employer. The UAN will link all your accounts and it will be maintained as a single UAN account.

- When changing jobs will my PF Account automatically merge or do I continue with my old PF Account?

Yes, PF accounts will be automatically transferred in the case of job change.

- Is it possible to upload the Know Your Customer (KYC) Documents using the EPFO'S Member Portal?

Yes, you can, but your employer has to digitally attest your documents using his/her digital signature. Once that is done, your documents which will be seeded in the EPFO member portal will be valid. Till the process of attestation is done, your KYC will show as 'Pending'.

News about UAN Login

EPFO Reports Surge in New Members, Youth Dominates Organised Workforce

The Employees Provident Fund Organisation (EPFO) saw a significant increase of 15.5 lakh net members in February, with nearly 7.8 lakh being new members, according to data released on 20 April 2024. A noteworthy aspect of the data is the predominance of the 18-25 age group, comprising 56.4% of the total new members added in February. This suggests that a majority of individuals entering the organised workforce are youth, primarily first-time job seekers, as stated in an official statement. The payroll data also revealed that approximately 11.8 lakh members exited and subsequently rejoined EPFO, indicating job switches among employees covered under EPFO. Rather than opting for a final settlement, these members chose to transfer their accumulations, thus ensuring long-term financial stability and extending their social security protection.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.