How to Transfer EPF Online

A transfer of EPF account means moving your existing Provident Fund balance from your old employer to your new one. You don’t need to open a new PF account when changing jobs. Your UAN remains the same throughout your career. To transfer, you need to fill and submit Form 13 with your current employer.

Eligibility criteria to transfer EPF

You need to meet the below mentioned conditions in order to transfer EPF from the old account to the new one:

- The EPF account holder should have an activated UAN on the EPF portal.

- The mobile number used by the EPF account holder for activation should also be functional.

- The EPF account should be linked with Aadhaar card.

- The Date of Exit and Date of Joining should be mentioned on the EPF portal.

- The employee should link his/her bank account on the EPF portal and the same should be verified by the employer.

- Account transfer is allowed only once by EPFO for every member ID

Steps to transfer PF online

There is a possibility that an employee might find better job offers and shift companies in his/her pursuit for career growth. While changing jobs is easy, transferring the EPF can be a hard task, involving time and effort on the member's part.

To minimise the effort involved, the government has introduced online EPF transfer. Individuals who wish to transfer their EPF need to follow these basic steps.

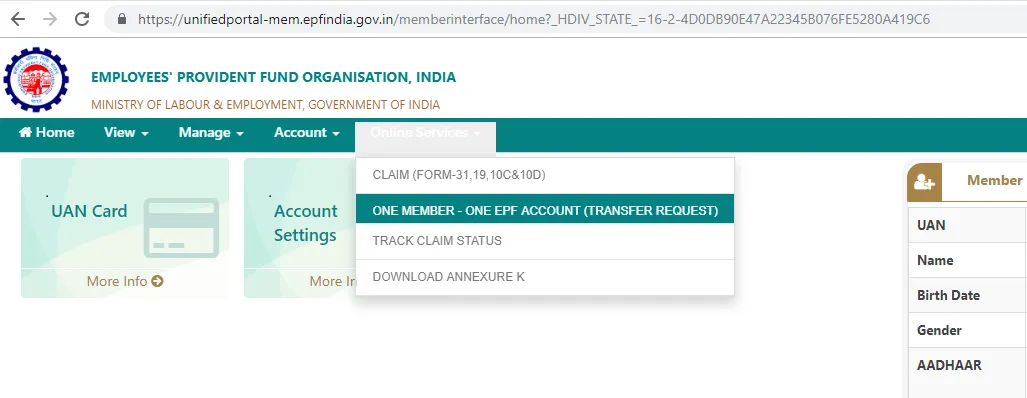

- Employees can log in to the unified portal of the Employees Provident Fund Organisation (https://unifiedportal-mem.epfindia.gov.in/memberinterface/) using their UAN and Password. Here is a screenshot of the portal.

- Upon successfully logging in, go to 'Online Services' and click on 'One Member - One EPF Account (Transfer Request)'.

- Check eligibility - Is he or she eligible to apply online? In certain cases, a physical copy of Form 13 should be submitted to the previous or current employer if he or she is not eligible to avail of online services.

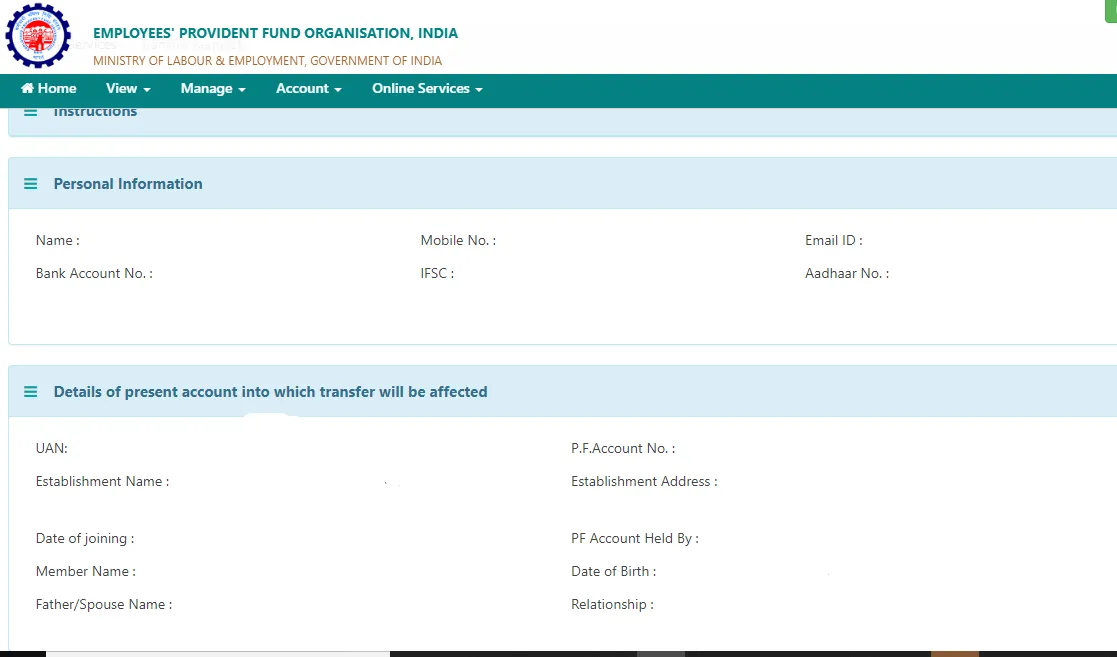

- Carefully go through the personal information and the present PF account details to which the fund will be transferred.

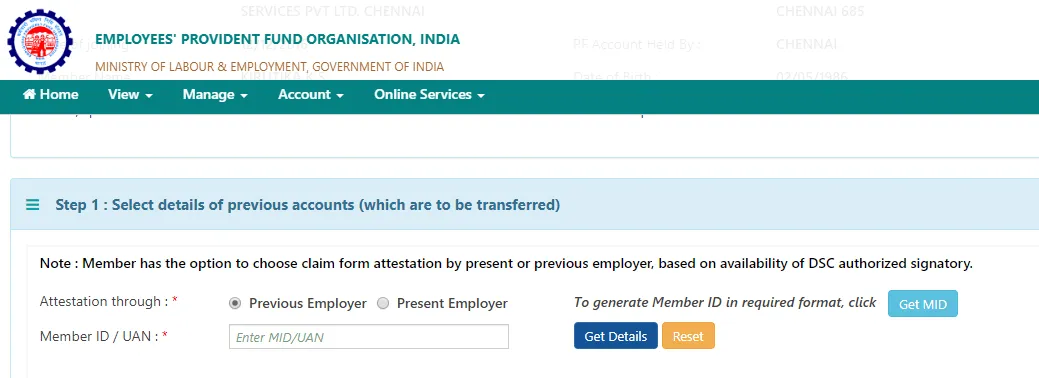

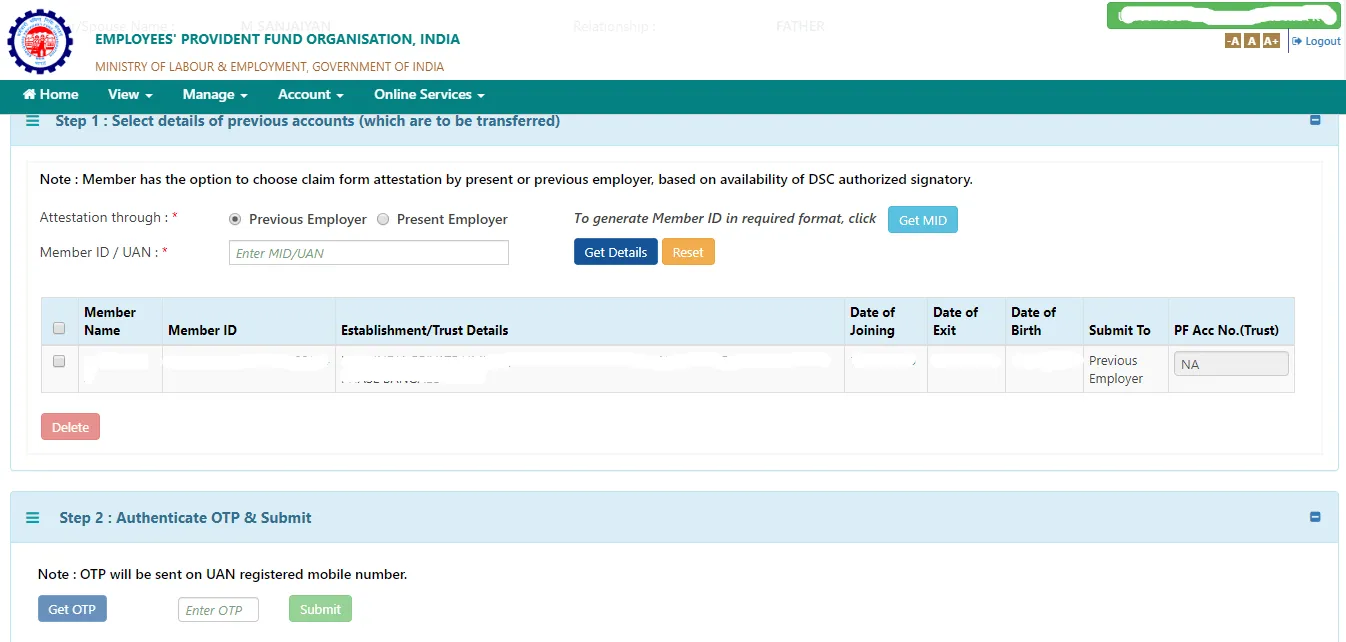

- Click on 'Get Details' to get the account information of the previous employment. Select 'Previous Employer' and enter the previous employment's member ID or UAN to get the details.

- Once the previous employment details are displayed and verified, click on 'Get OTP', which will be sent to the registered mobile number. Enter the OTP in the provided box and click on 'Submit'.

- Fill up the online Form 13 (https://www.spmcil.com/UploadDocument/Form%2013-Transfer%20of%20EPF%20Account.ef23ef33-f252-4e0e-907c-133b2ed861e0.pdf) with details that include PF numbers from both previous and current organisations.

- A tracking ID will be generated. This can be used to keep a track of the process.

- One needs to take the printout of the form and sign it. This form needs to be submitted to the employer within 10 days of obtaining it.

- The previous and present employers will verify the details mentioned in the form.

- Approval of both the employers is needed before funds are credited to the account number.

- The employer is expected to verify authenticity and signature of the employee.

Documents required to complete EPF transfer:

The following documents are required to complete EPF transfer:

- Valid identity proof (Aadhaar card, PAN card or driving licence)

- UAN

- Account number

- Current employer’s details

- Salary bank account details

- Revised Form 13

- Current and old PF account details

- Establishment number

Forms Needed for EPF Transfer

The following are the list of forms required to transfer the PF online:

- Form 13

- PF Transfer form

How can I check PF transfer status online?

There are multiple ways to check PF transfer status online. They are as follows:

- Through EPF official website

Step 1: Visit https://www.epfindia.gov.in/site_en/For_Employees.php

Step 2: Click on ‘Know your claim status’ below the ‘Services’ section

Step 3: Enter UAN and Captcha

Step 4: Click on ‘Login’

Step 5: Select ‘Member ID’ for account

Step 6: Click on ‘View your Claim Status’

Step 7: PF transfer status will be displayed on the next page

Things to Consider While Transferring PF Online

You need to ensure the following things while transferring PF online:

- UAN is active on the EPFO portal.

- The mobile number which is registered is active.

- Bank account is linked with the UAN.

- Know Your Customer (KYC) is verified.

- Both previous and current employers have registered authorised digital signatures

- PF numbers of former and current employments is saved in the EPFO database.

Use of UAN for Online Transfer of PF

Various employers provide different member IDs to their employees. Universal Account Number, also known as UAN helps to link multiple PF account IDs which belong to one individual.

An individual gets the following benefits from the UAN:

- Update PF passbook

- Updating the UAN card

- Transferring the account after switching to another employer automatically

- Receiving SMS alerts regarding the monthly credits in the PF account

- Linking former member ID with the present member ID

How to Check the Status of PF Transfer?

The following are the three ways to check the status of PF transfer:

Track Status through Member Claim Status Link:

You need to follow the given steps to track status through member claim status link:

- Visit the EPFO member portal https://www.epfindia.gov.in/site_en/For_Employees.php.

- You will be redirected to the employee’s page on the EPFO portal.

- Click on ‘Know Your Claim Status’ under the ‘Services’ section.

- A new page will open where you have to enter your UAN number and captcha code.

- Next, click on ‘Login' button.

- Select the Member ID for the account for which you want to track the claim status.

- Next, click on ‘View your Claim Status’.

- You will be able to see your PF transfer status.

Track Status through EPFO Portal

Given below are the steps to track status through EPFO portal:

- Go to the EPFO portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- You will be redirected to a new page where you need to enter UAN, password, and captcha.

- Click on ‘Login’.

- Under ‘Online Services', choose ‘Track Claim Status’.

- A new tab will appear, where you need to click on the ‘Transfer Claim Status’.

- You will be able to view your claim status.

Given below are the steps track Claim Status from the website :

- Visit https://www.epfindia.gov.in/site_en/For_Employees.php.

- Click on ‘Click here for Knowing your Claim Status’ link.

- Choose the state where your PF office is situated.

- Choose the regional office from the drop down list

- Once you have entered all your information, the system will automatically enter the region as well as the office code

- Next, enter the ‘Establishment Code’.

- Enter your seven digit account number.

- Finally, click on ‘Submit’ button to know the status.

Why Transfer from EPF to NPS Transfer

NPS and EPS are government retirement savings schemes having the provision of pension after retirement. Having said that, the following are the reasons why an individual wishes to transfer their EPF account to NPS:

- Employees who are working in the public sector organization need to create an account with NPS like private organizations. If an individual transfers their job to a government organization from a private organization need to withdraw their EPF amount.

- NPS is transparent investment option as compared to EPF because it provides you a complete insight of where all your money has been invested.

- As we all know EPF does not involve any risk element and provides fixed returns, NPS provides comparatively better returns along with the moderate risk level.

- Investments that are made in NPS helps you in making changes in the portfolio and manage your retirement corpus.

- NPS also provides better tax benefits as compared to EPF.

Advantages of Transferring PF Online

If you are still working and want to continue the same, it is not recommended to withdraw your PF corpus. PF is a fixed investment made for a long term backed by the Government of India with moderate risk involved. Thus, it is advisable to withdraw PF amount only if there is an emergency. You can also transfer your EPF amount rather than withdrawing it.

Given below are the benefits of transferring PF online:

- TDS is chargeable on PF withdrawal in case the account is less than five years old. If an individual transfers their PF account and maintains it for at least five years, you will be eligible for tax free withdrawal benefit.

- Employees, on the other hand, who have an active EPF account for over ten years are eligible to get pension after they cross 58 years of age which will not be possible in case an individual closes the account every time they switch their jobs.

- EPFO provides compound interest on the savings amount which means if you close your current PF account and open the new one, the interest amount will be reduced.

Importance of Linking UAN with Aadhar

Given below are the reasons why you need to link UAN with Aadhar:

- As Aadhar card comprises all the personal details of an individual, it is one of the most important documents needed to do personal verification.

- If you link your UAN with Aadhar, it will ensure that the information that you have provided is error free and consistent.

- It is mandatory to link your UAN with Aadhar to ensure safety so that you can easily make withdrawals as well as payments in your EPF account.

- Furthermore, linking UAN with Aadhar also denotes that only the account holder has the access to his or her account.

FAQs on How to Transfer EPF Online

- How many online PF transfer requests can one make?

Only one PF transfer request can be made against the previous employment member ID.

- Can I withdraw EPF without the company’s approval?

You will not require your employer’s approval or authorisation of your employer while withdrawing your PF if you have submitted your Aadhaar number to the PF office.

- How many times can I withdraw EPF?

You can withdraw EPF up to three times. The maximum that you can withdraw is either the total employee’s share or six times your wage, whichever is lower.

- Can I withdraw EPF whenever I wish?

No, you cannot withdraw EPF anytime. You need to meet a certain set of criteria to be able to withdraw EPF.

- Can I withdraw my PF corpus while working?

No, you cannot withdraw your EPF while working. You can withdraw partial PF corpus only if you have been unemployed for at least two months.

- Is tax applicable on EPF withdrawal?

If you withdraw your PF corpus before five continuous years of employment, your EPF will be taxable.

- Can I make EPF withdrawals without PAN?

If you make EPF withdrawal without PAN details, you need to pay TDS at the maximum marginal rate of 34% but if you claim amount is less than Rs.50,000, TDS will not be deducted.

- When is EPF withdrawal taxable?

If the withdrawal is done before years continuous years employment, the EPF withdrawals will be taxable.

- What is the enquiry number of EPF withdrawal?

To resolve any issue regarding your EPF withdrawal, you can call 1800118005.

News on PF Transfer Online

EPFO subscribers need not to request for PF transfer on changing jobs

As per the new EPFO (Employees’ Provident Fund Organisation) rule, subscribers need not request for transfer of Provident Fund due to job change from 1 April 2024. The automatic transfer of an employee's PF balance will happen when the employer is switched. The automatic transfer will happen only when the Universal Account Number (UAN) is linked, and the Know Your Customer (KYC) requirements are fulfilled. After making the first contribution by the employer the automatic transfer is activated.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.