Employee Name Change in EPF Account - Online & Offline Process 2026

Any wrong data, including wrong name in your EPF account may cause trouble during the time of withdrawal of your deposit.

So, if you find out that your name is misspelled in your EPF account, make the correction immediately. You can choose either online or offline method to make this correction.

Online Method of Changing Employee Name in EPF Account

The Online method of changing your name in your EPF account eliminates the need of submitting documents and waiting for three months for the change to be accepted.

Follow the simple steps mentioned below to change your name in your EPF account online:

Step 1: Open the UAN portal

Step 2: Log in to your EPF account with your user ID and password.

Step 3: Next click on the 'Modify' section and then click on 'Modify Basic Details'

Step 4: Next, a page will appear with the available details and the option to request change.

Step 5: Fill up your name as per Aadhaar card on the 'Request Change' option.

Step 6: Click on the 'Update' button.

Step 7: After clicking 'Update', you'll get the notification 'Pending approval by Employer.'

Step 8: Contact your employer to approve the request

Step 9: After employer's approval, EPF office will make the changes to your name within 30 days.

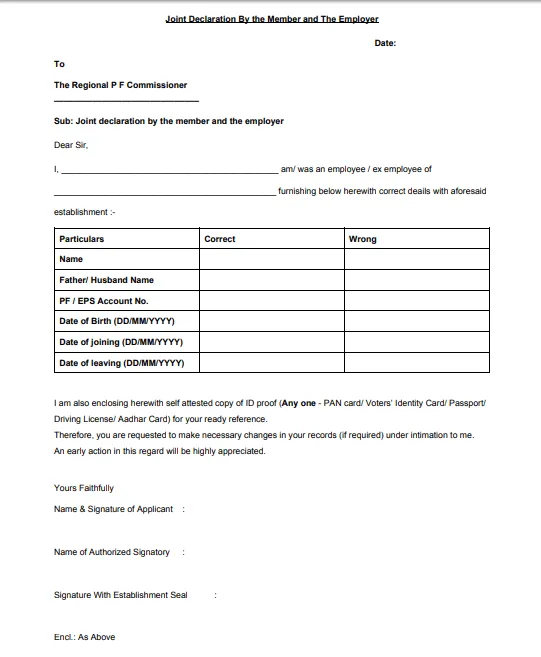

About EPF Name Correction Form

The EPF Name Correction forms a simple document. It is more of a letter than a document. It is addressed to the Regional EPFO Commissioner and must follow this format:

- Address the letter to the Regional PF Commissioner.

- State the subject of the letter as "Joint declaration by the member and the employer."

- State that you are or were an employee of the establishment that got your details wrong and that the letter is being written to request for corrections to be made to your details.

- In a table with three columns, enter the detail that needs to be changed, the correct entry and the wrong entry that has been made. This form can be used for the correction of the following errors:

- Errors in name

- Errors in the name of the father or the husband

- Errors in PF or EPS account numbers

- Errors in date of birth

- Errors in date of joining an organization and

- Errors in date of leaving an organization

- All the columns will be mentioned in the form and you will have to fill the ones where the information recorded needs to be corrected.

- Once the form is filled, you can mention the documents that you are going to provide as proof of the changes you are requesting for.

- As far as attesting the form is concerned:

- You will need to affix your name to the form and sign it.

- You will also have to enter the name of the authorized signatory from your previous organization.

- The authorized signatory will also have to sign the application form and affix the company seal on the form.

Documents Required to access EPF Account

There is a list of documents that the government has declared to be acceptable for these changes and that list includes documents like:

- PAN card

- Driver's license

- Passport

- Voters ID card

- ESIC ID card

- Aadhaar card

- Bank or post office passbooks

- Certificates related to schools and education

- Copy of a phone or electricity or a water bill that has your name on it

- Certificates of birth or death that have been issued by the registrar

- A certificate that is created based on the records of government service (state or central)

- In a table with three columns, enter the detail that needs to be changed, the correct entry and the wrong entry that has been made. This form can be used for the correction of the following errors:

Issues to Deal with in Case of Incorrect EPF Details

Incorrect information in your EPF account can create issues at the time of withdrawal. You may feel that as long as you fill your EPF withdrawal form, there will not be any problems with your withdrawal. However, that is not the case.

The documents that you submit to your employer at the time of EPF registration are also very crucial. It is very important to ensure that details recorded at registration are correct or it could add to the reasons for rejection of online claim form. For the approval of a claim, the details given on the form should match the establishment records. Given below are some of the errors that could lead to a claim rejection of EPF:

- Any misspelt or wrong entry of data in the EPF's record during enrollment can result in the rejection of a claim from EPF.

- Nominee details are very important and should be updated when the member gets married as it may lead to hassles during an EPF claim.

- Date of joining is also another data that if wrongly recorded could lead to a lot of issues in the EPF processes. The date is crucial as it is used to calculate EPS pension. It is also important for the calculation of the number of years of EPF contribution as based on that it is decided if EPF withdrawal will be tax-free or not.

Procedure to Change Credentials Online

The Employees' Provident Fund Organization (EPFO) allows its members to make changes in the credentials in EPF's records online. Although the website is still in a transition phase, most of the services are being moved online. In order to make changes online, EPFO has introduced the EPFO UAN portal. To access your EPF account through this website, you are required to have a UAN number, mobile number, and password. UAN is a 12-digit unique number allotted to employees contributing to EPF. The UAN remains the same throughout the career of an employee.

- If you want to change your mobile number, you should visit the EPFO UAN portal and click on 'Profile'. Under that tab, you will have the option to change your mobile number. However, it is mandatory to keep your old mobile number active while you make the change.

- In case you have forgotten your login password and do not have an active mobile number, you are then required to make an online request through the EPF UAN Helpdesk portal.

- The UAN Helpdesk portal enables you to correct and resolve multiple issues in your EPF account. All you have to do is log on to the EPFO UAN portal and click on the 'Member' tab. Upon clicking on the tab, you are redirected to a page which allows you to make changes in the given list.

Procedures to Change Credentials Offline

EPFO allows you to make changes in your EPF account online through the UAN portal. Changes such as name, date of birth, date of joining, etc. can be made in the following ways:

- Name correction: If your name has been recorded incorrectly in EPFO's records, you will have to submit a joint application through your employer. You are also required to submit supporting documents for name change. The following documents are accepted in order to make the change:

- Passport

- Driving License

- PAN Card

- Aadhaar Card

- Voter Identity Card

- ESIC Identity Card

- Ration Card

- Bank Passbook copy

- A certificate issued by Registrar of Birth or Death

- Any education certificate

- Certificate as proof of service in the Central or State Government organization

- Letter from a recognized public authority or public servant as a proof of identity and residence of the employee

- Copy of telephone bill or water or electricity bill

The following steps need to be taken if you want to change your name in the EPF account:

- Fill in the requisite form with all the required details.

- Sign the duly filled form.

- Obtain signature and seal from your employer in the form.

- Attach a self-attested copy of any of the documents mentioned above.

- Submit the form along with the documents to your employer.

- The application is then sent to the concerned EPFO Field Office by your employer.

- Change of Father's or Spouse's name: The same procedure given above can be followed. You are required to send a joint request on behalf of you and the employer to the concerned EPFO department.

- Date of birth correction: Following the same procedure above, you can also change your date of birth. The form has an option to make this change. However, you would have to provide the date of birth proof with the application. Above mentioned documents are allowed to be submitted as the date of birth proof.

- Correction of date of joining/leaving: Same procedure as above.

- Change of address: The EPFO portal does not allow change of address through the portal as of now. The change can be made at the time of PF transfer or PF withdrawal. The only thing that you need to provide is your address proof.

EPF Name Change Rules

As your name has been provided by your employer to the EPFO, change in your name in the account cannot be done independently. It requires you to give a joint application from you and your employer, to correct your name in the EPF account.

Only the specified documents listed above are allowed as identity proof in order to make the change.

Name Correction due to Marriage

Sometimes, after your marriage, you add a surname or title, and in these cases, you are required to fill in a prescribed form and submit it to the EPFO. If you change your surname in your bank records or official records, it is mandatory that you make the exact change in the EPF database.

FAQs on Employee Name Change in EPF Account

- Is it mandatory to change the name on the EPF account after marriage?

If the name change has been made on the Aadhaar card, PAN card, and bank account, then it is mandatory to make the name change on the EPFO portal as well. However, if the name change has not been done on the KYC documents, then it is not mandatory.

- Will the employer also need to authorise the employee's change of name?

Yes, the employer and the employee will need to submit a joint declaration for a name change. The employer will need to approve the name change in case the employee makes the changes online as well.

- What are the requirements for name and date of birth change on the EPF Name Correction Form?

- Individuals must have a UAN.

- Activation of UAN must have been completed.

- Individuals must have access to the EPFO portal.

- Members should have an Aadhaar card.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.