LIC Money Back Plan 20 Years

LIC's New Money Back Plan-20 years is a Non-linked, Participating, Limited Premium, Individual Life Assurance plan that provides an appealing blend of death protection throughout the plan's term and periodic survival payouts at specified intervals.

This distinctive combination ensures financial support for the policyholder's family in the event of the policyholder's death before maturity while also providing a lump sum amount upon maturity for those who survive. Additionally, the plan addresses liquidity needs through its loan facility.

Highlights of LIC’s New Moneyback Plan 20 Years

The following are the key highlights of the LIC’s New Moneyback Plan 20 years:

- Moneyback plan with the benefit of maturity benefit.

- Participating traditional plan.

- The nominee will receive the entire sum assured along with bonus, if the life insured dies within the policy tenure.

- If the policy continues for 20 years, the premium needs to be paid for 15 years only.

- A sum assured of 20% will be paid a survival benefit if the life assured is alive at the end of the 5th, 10th, and 15th year.

- The remaining 40% of the basic sum assured along with the accrued bonuses will be paid, if the life insured survives till the end of the policy tenure.

Specifications | Minimum | Maximum |

Entry Age (Last Birthday) | 13 years | 50 years |

Maturity Age (Last Birthday) | NA | 70 years |

Policy Term | 20 years | |

Premium Paying Term (PPT) | 15 years | |

Premium Paying Frequency | Annual, Half-yearly, Quarterly, and Monthly | |

Sum Assured | Rs. 1 lakh | No Limit |

Benefits of LIC Moneyback Plan for 20 Years

The following are the benefits of the LIC Money Back Plan 20 years:

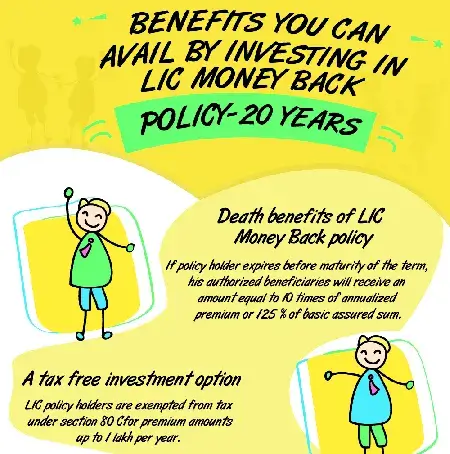

- Death Benefit: If the policyholder dies during the policy term, the nominee will get ten times of annualized premium or 125% of the Basic Sum Assured, vested simple reversionary bonuses and a final additional bonus. Also, the periodical survival benefits which have been paid will not be deducted. This death benefit shall not be less than 105% of the total premiums paid as OF date of death.

- Survival Benefits: If the policyholder survives the policy term, the nominee will receive 20% of the Basic Sum Assured at the end of each of the 5th, 10th & 15th policy years and 40% of the Sum Assured in addition to accrued bonuses.

- Maturity Benefit: If the Life Assured survives till maturity, 40% of the Basic Sum Assured in addition to simple reversionary bonuses and a final additional bonus will be paid.

- Participation in Profits: The policy shall participate in the profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation, provided the policy is in full force.

Additional Benefits of LIC Moneyback Plan for 20 Years

The following are some of the additional benefits of the LIC Moneyback Plan 20 years:

- Rider Benefit: The plan comes with the additional benefit of rider options that offer enhanced coverage and protection against certain circumstances, such as accidents, illness, and others. Here is the list of rider options available under this plan offered by the Life Insurance Corporation of India:

o LIC's Accidental Death and Disability Benefit Rider: The rider can be opted after payment of an additional premium provided the policy is in force on the day of the accident. In case of accidental death, the accident benefit is sum sssured and the death benefit will be paid. In case of accidental permanent disability, a sum equal to the Accident Benefit Sum Assured will be paid over a period of 10 years. Consequently, future premiums for Accident Benefit Sum Assured will be waived.

o LIC Accident Benefit Rider: To opt for this rider option, the outstanding premium paying term of the base plan should be at least five years. The policyholders can opt for this at any time during the premium paying term under the in-force policy term, but the benefit cover will be provided only during the premium paying term. The sum assured will be payable in lumpsum in case the rider opt for accidental death.

o LIC’s New Term Assurance Rider: This rider option can only be opted for during the inception of the policy and the benefit can be availed by the policyholders during the policy term. The Rider Sum Assured will be paid on the death of the Life Assured during the policy term, if the rider amount opted for is equal to the Term Assurance.

o LIC’s New Critical Illness Benefit Rider: This rider is like the LIC’s New Term Assurance Rider plan, which can also be opted at the inception and policyholders can avail themselves of the benefits during the policy term. The Critical Illness Sum Assured shall be payable if the rider has opted for any of the 15 illnesses covered under this plan which is diagnosed on the first checkup.

- Simple Reversionary Bonus: It is declared per thousand Sum Assured at the end of each year, following which, they form part of the guaranteed benefits. Simple Reversionary Bonus, therefore, accrues during the premium paying term but is paid at the end of the term or death in addition to the final additional bonus. Simple Reversionary Bonuses are declared as per the performance of the Life Insurance Corporation.

- Final Addition Bonus: Paid if the policy has run for a minimum period. A Final Additional Bonus may be declared when a claim is made either as a result of death or maturity, provided the policy has been in effect for a minimum term.

How Does the Money Back Policy Work

Let's explore the mechanics of a Money Back Policy using an example. The following scenario will demonstrate the advantages of a money-back policy.

Mr Sharma decides to purchase a Money Back Policy, opting for a sum assured of Rs. 10 lakh. This policy spans a duration of 25 years, during which he diligently pays the premiums. The plan offers survival benefits, which amount to 20% of the basic sum assured after every five years of the policy's duration. Additionally, upon maturity, Mr Sharma will receive 20% of the sum assured, along with any accumulated bonuses.

Consequently, Mr Sharma receives Rs. 2 lakh at intervals of every five years, specifically on the 5th, 10th, 15th, and 20th years of the policy. Upon reaching the 20th year, Mr Sharma will receive a total of Rs. 8 lakh, comprising the Rs. 2 lakh received periodically, as well as the bonus upon maturity. At this point, the policy will cease. In the unfortunate event of Mr Sharma's demise during the 18th year of the policy, his family will be entitled to receive Rs. 10 lakh, inclusive of any accrued bonuses.

LIC Money Back Policy 20 Years - Key Details

The following are the details of the LIC Money Back Plan 20 years:

Features | Details |

Grace Period |

|

Free-look Period | Within 15 days from the date of receiving the policy bond |

Settlement option: | A. Maturity Benefits:

B. Death Benefits:

|

Surrender | Anytime, provided two full year’s premiums have been paid |

Policy Loan |

|

Rebate | Mode Rebate:

High Sum Assured Rebate:

|

Documents Required for LIC Money Back Plan

- The policyholder needs to complete an 'Application form or proposal form' accurately, providing details of their medical history.

- Address proof and other Know Your Customer (KYC) documents are also necessary.

In certain cases, depending on the sum assured and the policyholder's age, LIC may require a medical examination.

Eligibility Conditions

The following are the conditions that should be fulfilled by the policyholder of the LIC Money Back Plan 20 years:

- Minimum Basic Sum Assured: Rs.1 lakh

- Maximum Basic Sum Assured: No Set Limit

- Minimum Age: 13 years

- Maximum Age: 50 years

- Maximum Maturity Age for Life Assured: 70 years

- Term: 20 years

- Premium paying term: 15 years

Note: The basic sum assured should be in multiples of Rs.5,000.

Accidental Death and Disability Benefit Rider

The following are the details of the accidental death and disability benefit rider:

- Minimum Accident Benefit Sum Assured: Rs.1 lakh

- Maximum Accident Benefit Sum Assured: Amount equal to the Sum Assured under the Basic Plan (maximum of Rs.50 lakh) Accident Benefit Sum Assured.

- Minimum Age: 18 years

- Maximum Age: Can be opted at any time.

- Maximum cover: 70 years

In case of accidental permanent disability due to an accident within 180 days of the date of the accident, an amount which is equal to the Accident Benefit Sum Assured will be paid out in equal monthly instalments. This will be spread over ten years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured which is equal to Accident Benefit Sum Assured under the policy, shall be waived.

Payment of Premiums

Premiums under the policy can be paid on a yearly, half-yearly, quarterly or monthly basis or via salary deductions. A grace period of one month will be given (for yearly, half-yearly, and quarterly modes) and 15 days for monthly modes.

The table below shows the premiums of the basic sum assured

Age | Rs. 5 lakh Sum Assured | Rs. 10 lakh Sum Assured |

30 Years | Rs. 37,259 | Rs. 74,518 |

40 Years | Rs. 39,146 | Rs. 78,291 |

50 Years | Rs. 43,604 | Rs. 87,209 |

What’s Covered Under LIC Money Back Policy

- Once the policy has acquired a surrender value after three policy years, a loan option becomes available.

- The policy can be converted to a paid-up policy after paying premiums for a minimum of 3 years. However, the paid-up sum assured will decrease proportionally.

What’s Not Covered Under LIC Money Back Policy

If the Life Assured ends life, irrespective of whether sane or insane, in a year, from the date of risk commencement, LIC will not accept any claim except 80% of the premiums paid sans taxes, extra premiums and rider premiums. If the Life Assured ends life from the date of revival, 80% of the premiums paid till the date of death (excluding taxes, extra premiums and rider premiums) or the surrender value, will be payable.

Policy Details of LIC Money Back Policy 20 Years

- Grace Period: A 30-day grace period is provided for premium payments. If the policyholder fails to make the payment within this period, the policy will lapse.

- Policy Termination or Surrender Benefit: The policy lapses after the grace period ends but can be revived within two years from the first unpaid premium due date. Surrender benefits are available after paying premiums for three full years, as per the specified table.

- Free Look Period: If you are dissatisfied with the coverage or terms and conditions, you can cancel the policy within 15 days of receiving the policy documents, provided no claims have been made.

Informative Life Insurance Pages

GST of 18% is applicable on life insurance effective from the 1st of July, 2017

FAQs on LIC Money Back Plan 20 Years

- What is the core meaning of a money-back plan?

Money-back plan essentially means that the policyholder will receive payments at regular intervals from the insurance company. The period of time within which the policyholder receives the amount of money is usually 4-5 years. The concept of a money-back plan is very similar to that of an endowment plan. It provides 20% of the total sum assured after the initial four years have passed. Further, a 20% return is again offered after eight consecutive years. The 20% that remains out of the total is provided to the policyholder once the plan matures with an additional bonus amount.

- How does the money-back policy work?

This policy functions as a regular income plan for the policyholder and the survival benefit is paid after five years. The remaining amount is paid after maturity including the accumulated bonus. The Death benefit is paid to the nominee, in case the policyholder dies within the term of the policy and irrespective of the amount paid as a sum assured in regular intervals.

- Is there any limit to investing in the LIC’s New Moneyback Policy?

No, there is no limit to investing in the LIC’s New Moneyback policy. The plan has no upper limit for sum assured and customers can invest in any amount in multiples of Rs.5,000.

- Is the money back from LIC taxable?

The maturity benefit amount of the LIC’s New Moneyback policy is tax-free. The policy offers tax benefits under Section 10(10D) of the Income Tax Act of 1969.

- I purchased the policy last year. Can I avail myself of the loan under this policy?

No, you cannot avail yourself of the loan under this LIC’s New Moneyback policy even after one year from the purchase date. To become eligible to avail yourself of the loan facility under this policy, you need to pay two full years’ premiums.

- What documents do I need to apply for the LIC money-back policy?

Applicants need to submit a duly filled application or proposal form mentioning their medical history. The documents required apart from the application form are identification and age proof, residential proof, photograph along with a medical certificate, if necessary.

- How much is the return on LIC money-back policy?

Survival benefits on LIC Money-back policy will be paid after completing 5 years, 10 years, and 15 years of the policy term. The policyholder can earn 20% of the sum assured as returns and the remaining 40% as maturity benefit that is offered along with bonus and Final Additional Bonus.

- How can I withdraw my LIC policy money back?

You can withdraw your LIC Moneyback policy by visiting the nearest LIC branch and submitting a duly filled-in and signed surrender form. The surrender form will be processed by the insurer and after successful verification of documents the surrender value will be provided to the policyholder.

- What happens if a money back policy lapses?

In the event of a money back policy lapsing due to non-payment of premiums, the life insurer has the option to revive the policy within a two-year period from the last premium due. The revival process will be conducted with the terms and conditions in the policy document.

- What are the available premium payment modes for LIC Money Back Plan 20 Years?

LIC Money Back Plan 20 Years offers multiple premium payment modes, including yearly, half-yearly, quarterly, and monthly options.

- If I fail to pay the premium for my LIC Money Back 20 Years policy, what will happen?

The policy provides a grace period of 30 days. During this period, you can pay the outstanding premium from the due date of the first unpaid premium. Your policy will remain active, and you will continue to enjoy all the associated benefits. However, if the premium remains unpaid beyond the grace period, the policy will lapse.

- Will I receive anything if I surrender my policy?

If the policyholder has paid premiums for at least three years, they will be eligible for a surrender value upon surrendering the policy. The guaranteed surrender value is calculated as a percentage of the total sum of paid premiums, excluding any premiums paid for riders. The specific percentage will depend on the number of years elapsed before surrendering the policy.

- Can I take a loan in the LIC's New Money Back Plan 20 Years?

Once the New Money Back Plan 20 Years has been in force for a minimum of three years, the policyholder has the option to request a loan. The loan amount must be within the surrender value of the plan.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.