Claim Settlement Ratio for Life Insurance

What is a Claim Settlement Ratio in Life Insurance?

Life Insurance isn't just about paying premiums; it's about ensuring your loved ones receive financial protection when it matters most. A key indicator of an insurer’s reliability is the Claim Settlement Ratio (CSR), a metric that highlights how often claims are honoured.

Why CSR Matters?

Life Insurance aims to secure your family’s financial future in the event of the policyholder’s untimely demise. Thus, knowing how effectively an insurer settles claims is essential. While not the only criterion, a high CSR reflects trustworthiness and commitment to fulfilling obligations.

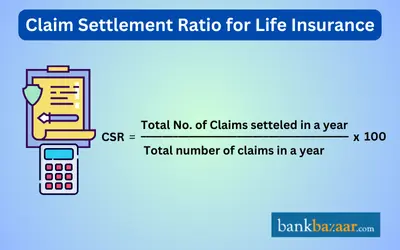

How is the Claim Settlement Ratio Calculated?

The Claim Settlement Ratio is calculated using the following formula:

CSR = (Number of Claims Settled/Number of Claims Received)×100

Latest Claim Settlement Ratio (CSR) Data: FY 2023–24

As per the IRDAI Handbook on Indian Insurance Statistics (FY 2023–24), the latest data offers valuable insights into how efficiently life insurance companies in India settle individual death claims. The performance has been particularly noteworthy in terms of claims settled within 30 days, which is a critical benchmark of customer service and operational effectiveness.

Insurer | CSR (Within 30 Days) | No. of Policies Settled | CSR by Amount Paid |

HDFC Life | 99.97% | 19,333 | 99.98% |

Axis Max Life | 99.79% | 19,569 | 99.97% |

LIC | 96.42% | 799,612 | Data Not Specified |

Kotak Mahindra Bank | 100% | Data Not Specified | Data Not Specified |

Ageas Federal Life | 100% | Data Not Specified | Data Not Specified |

Future Generali Life | 100% | Data Not Specified | Data Not Specified |

Aviva Life | 100% | Data Not Specified | Data Not Specified |

- Overall Industry CSR (30 Days): 96.82%

- Private Insurers’ Average CSR (30 Days): 99%

The above data can be interpreted in the following ways:

- High Efficiency Among Private Insurers: Private companies, such as HDFC Life and Axis Max Life, consistently deliver over 99% CSR, particularly within the 30‑day settlement window, underscoring operational excellence.

- Public Sector Entity (LIC): While LIC handles a significantly larger volume, its CSR of 96.42% (number of policies) remains respectable.

- Full Compliance by Select Insurers: Companies like Kotak Mahindra, Ageas Federal, Future Generali, and Aviva achieved perfect CSR, demonstrating seamless processes.

- Financial Efficiency (Benefit Amount): HDFC Life and Axis Max Life lead here, paying almost the entire claim amount within 30 days.

Best Practices to Avoid Claim Denial

- Disclose all relevant details accurately, such as medical history and lifestyle factors, at application stage.

- Complete the application yourself; do not rely solely on the agent’s inputs.

- Utilise the free‑look period wisely, review policy terms and return it if unsatisfactory.

- Inform your nominees and ensure they understand the claim‑filing procedure.

Types of Life Insurance Claims

Life insurance claims are of two types. They are mentioned briefly below -

1. Maturity claims - Payment for maturity claims is made when the life insurance policy matures. This essentially indicates that a specific amount will be paid to the life guaranteed if the policy period finishes and they outlive the whole policy term. In order to receive a maturity claim, the life assured must fill out a fully completed and signed discharge application. The amount that the maturity claims brought in is free of tax as per the ITA, 1961.

2. Death Claims - In this, in the event of the policyholder's passing, the claimant may ask for death benefits. This only indicates that, in the event of the policyholder's passing, a sum insured amount is paid to the nominee. Notifying the insurance company of the death is necessary. According to ITA, 1961 § 10(10D), the amount received as the death claim benefit is free of taxes.

Why is Claim Settlement Ratio Considered Important?

- The Claim Settlement Ratio (CSR) is a crucial metric that reflects how reliably an insurer honours its promise of financial protection. It indicates the percentage of claims settled by an insurance company against the total claims received in a financial year.

- A higher CSR implies greater dependability and trustworthiness in settling claims, especially during the most critical moments for policyholders or their beneficiaries.

- Since life insurance is often taken to secure the financial future of one’s family, it is vital to choose an insurer with a strong claim settlement record.

A few reasons why CSR matters:

- It serves as a transparent measure of the insurer’s performance.

- It reflects the insurer's internal processes and customer commitment.

- It helps customers compare insurers objectively, especially when other product features like premiums and benefits are similar.

- A consistently high CSR builds long-term trust in the brand.

While CSR is important, also ensure full and accurate disclosure of personal, medical, and lifestyle details during the policy application. Many claims are rejected due to non-disclosure.

The maturity claim process is applicable when the policyholder survives the term of the policy and is eligible to receive the sum assured plus any applicable bonuses.

- Notification to the Insurer: The policyholder must inform the insurance company about the policy’s maturity at least 15 to 30 days before the maturity date.

- Document Submission: The following documents are typically required:

- Original policy bond

- Maturity claim form or discharge voucher

- A valid ID and address proof

- Bank account details (cancelled cheque or passbook copy)

- Verification and Processing: Once submitted, the insurer verifies the details and processes the maturity payout, usually within seven to ten working days.

The process is generally straightforward if the policy is in force, and all dues are cleared. These documents are required for death claims, not maturity claims.

FAQs on Claim Settlement Ratio for Life Insurance

- What does the term claim settlement ratio mean?

The claim settlement ratio refers to the percentage of claims that the insurance company settles in a year compared to the total number of claims received. It serves as a measure of the company's trustworthiness. Typically, the higher the ratio, the more dependable the insurer is.

- Why is the claim settlement ratio significant?

A high claim settlement ratio (CSR) reflects an insurer’s reliability in honouring claims. It ensures your family receives the assured sum without delays or complications. Consistently strong CSR indicates financial stability and lowers the risk of claim rejection, making it a key factor when choosing a life insurance provider.

- What is the timeframe for reporting a claim?

Reporting a claim as soon as possible is advisable to expedite claim processing. For death claims, there is no specific time frame. Disability claims should be reported within 120 days from the date of the disability. In the case of critical illness or major surgery, the claim must be reported within 60 days of the diagnosis or surgery date.

- Who is entitled to receive the claim benefit?

At the time of submitting claim documents, you need to select the mode of receiving the claim amount. You can receive the claim amount in the mode you choose, and it is advisable to choose electronic funds transfer to enjoy swift and convenient services.

- How will I receive the claim amount?

At the time of submitting claim documents, you need to select the mode of receiving the claim amount. You can receive the claim amount in the mode you choose, and it is advisable to choose electronic funds transfer to enjoy swift and convenient services.

- Is a high claim settlement ratio beneficial?

The claim settlement ratio is the percentage of claims settled by an insurance company in a given year as a percentage of the total number of claims received. It is used to assess the company's credibility. In general, the higher the ratio, the more reliable the insurer.

- Why is a claim ratio considered important?

The claim resolution ratio demonstrates their willingness to pay the sum guaranteed to you or your nominee. If your provider has continuously maintained a high CSR over a long period of time, they are unlikely to renege on their compensation pledge.

Recent News on Claim Settlement Ratios in Life Insurance

Life Insurance Companies’ Claim Settlement Ratio Decreased in FY23

In the fiscal year 2022-23, the claim settlement ratio for life insurance experienced a marginal decline, dropping to 98.45% from 98.64% in the previous fiscal year, as per the annual report of the Insurance Regulatory and Development Authority of India (IRDAI).

Both the public and private sectors reflected this decrease, with Life Insurance Corporation (LIC) settling at 98.52% (down from 98.84%), and private insurers at 98.02% (a slight drop from 98.11%).

Conversely, the health insurance sector presented a different scenario. Although general and health insurance companies settled 85.66% of claims based on policy count, the payout amount was lower at 71.62%.

The claim settlement ratio, a crucial metric for policy buyers, signifies the percentage of claims paid by the insurer during a specific period. A higher settlement ratio is indicative of the company's commitment to fulfilling its promises, providing assurance to policyholders during times of need. It also reflects the efficacy of the insurer's underwriting processes, involving the assessment of applicants' risks based on their medical and financial information.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.