EPF Form 5

What is EPF Form 5?

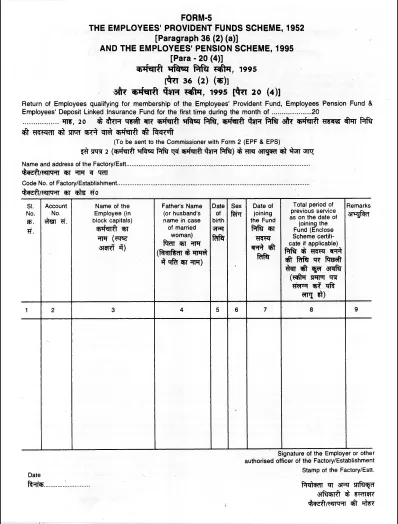

EPF Form 5 is a document used by employers in India to report the monthly contributions to the Employees' Provident Fund (EPF) for their employees. It includes details of the employees' wages and the contributions made by both the employer and the employee. The form is submitted to the Employees' Provident Fund Organization (EPFO) for proper record-keeping and compliance with EPF regulations.

Overview of Form 5

EPF Form 5 has high importance for companies that are registered under the Employees Provident Fund (EPF) Scheme.

Form 5 offers details on the new employees who are eligible to join the Provident Fund Scheme in one particular month.

EPF Form 5 is required for companies that are members of the Employees Provident Fund Scheme. It's essentially a monthly report that provides information on new employees in a company.

Better job opportunities open the door for new and fresher brains to join the workforce, and Form 5 is designed to get to know them.

All new employees are expected to enroll in the EPFO scheme that their company has in place, and form 5 is a report that lists all new employees who enroll in the Provident Fund Scheme in a given month.

This monthly report aids employers in keeping track of new hires and their corresponding provident fund obligations.

Form 5 is mentioned in para 36(2) (a) of the Employees’ Provident Funds Scheme of 1952.

Components of Form 5

The basic elements of Form 5 are mentioned below.

- Name of organisation/company

- Address of organisation

- Code Number of organisation

- Account number of employee

- Name of employee

- Father’s/Husband’s name

- Date of birth of employee

- Date of joining

- Term/period of previous service/work (as on joining date)

The form should be signed and stamped by the employer along with the date of filing said form.

Importance of Form 5

EPF Form 5 is extremely important for new joinees who haven’t had previous experience with the employees’ provident fund. It is through this form that such new members can avail the benefits offered under the provisions of EPF, without which their social welfare and security would be incomplete.

It also helps employers keep track of new employees and ensure that everyone is covered under EPF rules.

Due Date

EPF Form 5 needs to be updated every month, with all new joinees expected to fill up the relevant data. This form should be submitted to the Commissioner’s office before the 25th of the next month.

For example, Mr. Rao, the boss of Integral Communications hires a new employee in the month of October. He is expected to furnish Form 5 to the authorities before 25th November, as per the provisions of the Act.

FAQs on EPF Form 5

- I joined a new company. Do I need to fill and submit Form 5?

No. It is your employer's responsibility to fill and submit Form 5.

- Who fills the EPF form 5?

It's usually the employers who fill up the EPF form 5 for the new employees who joined the organisation.

- An employee joined my company on 24 January. When should I fill and submit Form 5 for him?

You must fill and submit Form 5 of your new employee by 25 February. It is mandatory for the employer to submit the details of all new employees to the EPFO before the 25th of the next month.

- No new employee joined my company in the previous month. Do I need to submit Form 5?

You need to fill and submit Form 5 even if a new employee did not join your company. Note that in the employee details field, you must mention 'Nil' and then submit it to the EPF Commissioner's office.

- I have a startup with very few employees. Should I submit Form 5?

As an employer, you will be covered under the EPFO if the number of employees working in your company is more than 20. You will have to fill and submit Form 5 for all your employees.

- where should employers submit the EPF form 5?

Employers need to submit the EPF form 5 at the Regional EPF commissioner by the 25th day of the month of the employee's recruitment.

- Do the employers need to submit EPF form 5 for every new employee?

Yes, the employer needs to submit EPF form 5 for every new employee.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.