Which ITR Should you File? Types of ITR Forms for FY 2025-26

The Income Tax Return (ITR) is a required process for taxpayers to report their earnings and tax payments to the IRS (Indian Revenue Service), and it must be submitted by the specified deadline Filing your Income Tax Return (ITR) can be daunting since there are several ITR forms available.

Each ITR form is designed to accommodate different types of income and taxpayer categories. It is essential to select the correct one to ensure compliance and avoid the complications of refiling. Understanding which ITR form is applicable to your specific situation is crucial for accurate and timely tax filing.

Importance of filing an ITR

Filing Income Tax Returns (ITR) is essential for individuals and businesses for the following:

- If individuals seek to obtain a refund from the Income Tax Department.

- If individuals intend to apply for a loan or a visa.

- If individuals have multiple income sources, such as capital gains or house property.

- If individuals have earned income from foreign assets in the financial year.

- For companies or firms, regardless of profit or loss.

Why Should an Individual File ITR?

In India, it is mandatory for individuals to file ITR in case they fall under the below mentioned categories

In case the gross income of the individual is more than the details mentioned in the table below:

Particulars | Income |

Individuals below the age of 60 years | Rs.2.5 lakh |

Individuals between 60 years and 80 years (Senior Citizens) | Rs.3 lakh |

Individuals above the age of 80 years (Super Senior Citizens) | Rs.5 lakh |

- In case individuals wish to receive a refund from the Income Tax Department.

- In case individuals wish to apply for a loan or a visa.

- In case individuals have more than one source of income (capital gains, house property, etc.)

- In case individuals have earned an income from foreign assets during the financial year.

- Irrespective of profit or loss, if the taxpayer is a company or a firm.

IRT should be filed by an individual even if their income is below the basic exemption limit but satisfies any one of the below conditions:

- Aggregate amount deposit in more than one current bank is more than Rs.1 crore

- Aggregate expenses incurred on foreign travel for self, or any person is more than Rs.1 lakh

- Aggregate expenses incurred on electricity consumption is more than Rs.1 lakh

- TDS or TCS exceeds Rs.25,000 or Rs.50,000 (for senior citizen) in the previous years

- Total sales, turnover, or gross receipt exceeds Rs.60 lakh for previous year for businessman

- Gross receipt exceeds Rs.10 lakh for professionals

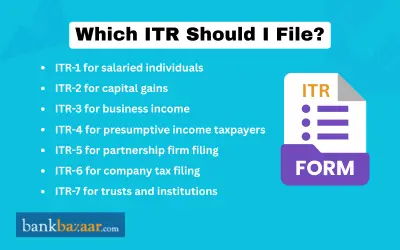

Which ITR Form to File When Filing Income Tax Return?

Depending on the type of income, the category the taxpayer falls under, and the income the taxpayer makes, the relevant form must be chosen.

Find the Eligibility to File ITR Form:

Forms | ITR-1 | ITR-2 | ITR-3 | ITR-4 | ITR-5 | ITR-6 | ITR-7 |

Eligible for | Individual (residents), HUF | Individual, HUF | Individual, HUF, or partner in a firm | Individual, Firm, HUF | Partnership Firm, or LLP | Company | Trust |

Salary | Yes | Yes | Yes | Yes | No | No | No |

House property | Yes (one) | Yes | Yes | Yes (one) | Yes | Yes | Yes |

Capital Gain | No | Yes | Yes | No | Yes | Yes | Yes |

Business income | No | No | Yes | Presumptive | Yes | Yes | Yes |

Other sources | YesYes | Yes | Yes | Yes | Yes | Yes | Yes |

Exempt income | Yes (Agricultural income less than Rs.5000) | Yes | Yes | Yes (Agricultural income less than Rs.5000) | Yes | Yes | Yes |

Lottery Income | No | Yes | Yes | No | Yes | Yes | Yes |

Foreign Income/ Asset | No | Yes | Yes | No | Yes | Yes | Yes |

Carry Forward Loss | No | Yes | Yes | No | Yes | Yes | Yes |

Types of ITR Forms and Explanation

ITR 1 or SAHAJ

ITR-1 can be filed by residents of India with total income up to Rs.50 lakh earning from home, job, or any other outlets. Salaried taxpayer can be file ITR-1 by using Form 16, which cannot be done by NRIs (Non-Resident Indian).

Who can File ITR1

- Income is generated from a pension or salary.

- Income is generated from single house property.

- Total income of up to Rs.50 lakh in a financial year.

- Income that has been generated from other sources such as winning horse races, lottery, etc.

Who Cannot File ITR1

Individuals who fall under the below-mentioned categories cannot opt for ITR-1:

- In case the total income that has been generated is more than Rs.50 lakh.

- In case the individual is the director of a company.

- During the financial year, if any investments were present in unlisted equity shares.

- In case income is generated from more than one house property.

- In case individuals have capital gains that are taxable.

- In case you are a Non-Resident Indian (NRI) and Resident Not Ordinary Resident (RNOR).

- In case income that is generated from agriculture is more than Rs.5,000.

- In case income is generated from profession or business.

- In case any income is generated from a property that is located outside India.

- In case an individual has foreign assets or foreign income.

ITR 2

ITR-2 form must be used by individuals and Hindu Undivided Families (HUFs) earning from sources other than occupation or enterprises. Earning from home, capital gains, jobs, or any other sources, and have made profits or damages from stock purchases and sales can file ITR-2.

Who can File ITR2

Here are the following individuals who are eligible for ITR-2 who fall under the below-mentioned categories:

- The Income of the individual must be more than Rs.50 lakh.

- In case any investments were present in equity shares that were unlisted during the financial year.

- In case the individual is the Director of a company.

- Income has been generated from capital gains.

- Income can be generated via a pension or from salary.

- Income that is generated from house property.

- Income that is generated from winning a lottery or horse races.

- Income is generated from foreign income and foreign assets.

Who Cannot File ITR2

Individuals who make an income from profession and business can opt for the form.

ITR 3

This form must be chosen by individuals and HUFs who make an income from a profession or from a proprietorship business. ITR-3 can be filed by the salaried individual who has income from the intraday stock exchange or futures.

This also helps maintaining record of revenue earned from company or trade (including presumptive income), jobs, capital gains, real estate, and other sources. The below mentioned individuals can opt for the ITR-3 form:

- Individuals who are generating an income from a profession or business.

- In case any investments were present in equity shares that were unlisted at any time during the financial year.

- In case the individual is a partner in a firm.

- In case the individual is a Director of a company.

- If income is generated from a pension or salary, house property, or any other source of income.

- Turnover of the business exceeds Rs.2 crore.

ITR 4 or Sugam

In case HUFs, Partnership Firms, and individuals who are Indian residents generate an income from a profession or business, they must opt for ITR-4. However, Limited Liability Partnerships (LLPs) cannot opt for this form.

Individuals who have also chosen the presumptive income scheme according to Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act 1961, should also opt for this form.

Who cannot opt for this form?

The below-mentioned individuals and HUFs are not allowed to opt for ITR-4:

- In case the total income earned in a FY exceeds Rs 50 lakh

- In case any losses have been brought forward from previous years.

- In case the individual has a signing authority at a place that is not located in India.

- In case any investments are present in equity shares that are unlisted at any time during the financial year.

- In case individuals have foreign assets or have generated a foreign income.

- In case the income has been generated from more than one house property.

- In case the individual is a Director of a company.

- In case the individual is a non-resident or an RNOR.

ITR 5

Investment funds, Business trusts, Estate of insolvent, Estate of deceased, Artificial Juridical Person (AJP), Body of Individuals (BOIs), Associations of Persons (AOPs), LLPs, and firms must opt for ITR-5 form.

ITR 6

ITR-6, For any companies that are not claiming exemptions under Section 11, this form must be chosen. Companies that are filing returns under this section can only do it electronically.

ITR 7

ITR-7, Individuals and companies that have furnished returns under Section 139(4A), Section 139(4B), Section 139(4C), Section 139(4D), Section 139(4E), or Section 139(4F) must opt for this form. Given below are the details of the returns that must be filed under each section:

- Section 139(4A): The returns must be filed by individuals who receive an income from a property that belongs to a trust or other legal obligations and the income that is generated is solely used for religious or charitable purposes.

- Section 139(4B): Returns must be filed under this section by a political party if the total income that has been generated is more than the maximum amount.

- Section 139(4C): Returns must be filed under this section by the below-mentioned entities:

- Scientific Research association

- Institutions or association that come under Section 10(23A)

- Medical institutions, hospitals, universities, funds, and other educational institutions.

- News agencies

- Institutions that come under Section 10(23B)

Types of Forms to File ITR (Income Tax Return)

The following are the types of forms to file the respective ITRs:

Form 16

Form 16 is a crucial document provided by the employer to employees. It serves as a comprehensive summary of an individual's income and taxes deducted at source (TDS) during a financial year.

Here are the details about Form 16:

- Provided the employer

- Exemption along with the gross pay are mentioned

- Employee’s net taxable income is also provided in Form 16

- Salary TDS and all other revenue or loss reported tax-saving deductions mentioned in the form

Form 26AS

Form 26AS serves as a comprehensive document summarizing an individual's tax-related information as recorded by the Income Tax Department.

The following are the details of Form 26AS:

- Consists of details of the TDS on the selling of immovable property, wages, and debt

- Includes details of listed financial transactions, advance tax paid by an individual, and self-assessment tax

Form 15G and Form 15H

Form 15G and Form 15H are declarations used by individuals to prevent tax deduction at source (TDS) on certain incomes.

Here are the details of Form 15G and Form 15H:

- Used if you earn income without TDS (Tax Deducted at Source)

- Individual with gross taxable income below basic exemption and are below 60 years of age will file Form 15G

- While those above 60 years of age or are senior citizens and have income with zero tax owed on net salary will file Form 15H

How can I download the ITR Form utility online?

The following are the steps to download the ITR form utility online:

- Visit the official website of the Income Tax department of India

- Click on ‘Downloads’

- Select the specific assessment year

- Click on ‘Common Offline Utility (ITR 1 to ITR 4)’ option

- To download the excel file for desired ITR, click on ‘Utility Excel Based’

Where can Individuals Download the Various Forms?

Individuals will be able to download the various ITR forms on the official website of at https://www.incometaxindia.gov.in/pages/downloads/income-tax-return.aspx). The forms will be available in PDF format and the instructions to fill the form will also be available on the same website.

Depending on the type of income that individuals make, they can either opt for ITR-1, ITR-2, ITR-3, ITR-4, and ITR-7. The Income Tax Returns can be a file on the official website of the Income Tax Department (https://www.incometaxindiaefiling.gov.in/home) and the process to file the returns is simple.

FAQs on Which ITR to File

- Which ITR for which income?

ITR 1 is for Income from Salary/Pension and other sources.

- How to decide which ITR form to fill in?

Depending upon the class, type of income, and overall income, the ITR forms are selected for filing income tax return for a particular financial year.

- In which month do ITR forms become available?

There is no fixed date for the release of ITR forms. The forms are released every year by the end of the respective financial year.

- Where do you declare profession tax on the ITR-1 form?

In deductions u/s 16 in ITR 1, the profession tax should be declared on the ITR-1 form.

- Which ITR form to fill for self-employed?

For self-employed individuals, one must fill in either ITR-3 or ITR-4 form.

- Which ITR form to fill in for NRI?

Non-Resident Indians must fill in ITR-2 or ITR-3 to file their ITR returns for the respective financial year.

- Which ITR do I have to fill for two incomes, such as commissions -194H and Salary?

If income is from salary or other sources of income, then ITR-1 is applicable. While ITR-3 would be used if commission is business income of the individual.

- How many types of ITR are there?

There are 7 types of Income tax return forms in India.

- Who can file ITR 3?

Any individual taxpayer or a HUF can file ITR 3 if they get profits and gains from business or profession.

- How to get tax or TDS refund under Section 87A of the internal revenue code?

You can get the highest refund of Rs.12,500 if the net revenue after deduction is less than Rs.5 lakh.

- Can I edit ITR forms once submitted?

Revised return can be filled in and submitted in the e-filling portal in case there is any wrong statement or mistakes committed while filling ITR forms.

- Which ITR form to fill for zero return?

Depending on the source of income, type of taxpayer, and various other factors, the type of ITR forms to be filed is determined. If a HUF individual needs to file nil return, then either ITR-2, iTR-3, or ITR-4 can be filed depending on the source of income, and other factors.

- May I file an ITR if I have a loss from a job, a home, or the selling of stock?

Yes, you can file an ITR if you have faced loss from job, selling stock, or from home loan due to change in interest rate. The ITR enables the taxpayers to exclude their deficit and move it to the subsequent years.

- What amount of penalty is charged in case TDS return is not filled within due date?

A penalty amount ranging between Rs.10,000 to Rs.1 lakh can be charged in case TDS return is not filled within the stipulated time.

- Do I need to pay additional TDS while filing ITR in case my salary is subject to TDS?

TDS is proportionate to the payment, which is not flexible, while the income is charged as per slab rate. The remaining tax to be paid in case TDS is less than anticipated, while a refund will be received in case the TDS amount is more than expected. Evaluate the tax due or the rebate to be claimed by calculating the total annual revenue before filling ITR.

- How to find out whether my IT return has been processed or not?

To check the status of your IT return, visit the official website, Click Income Tax Return (ITR) Status and enter the acknowledgement number. Enter the valid registered mobile number and click on ‘Continue’. Enter the OTP receive on the mobile number and click on ‘Submit’ to complete the process and view the status of your IT return, whether it has been processed or not.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.