Federal Bank FD Schemes 2026 - Interest Rates, Tenure & Benefits

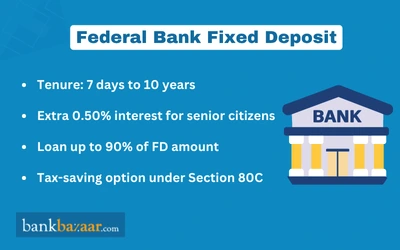

Federal Bank's fixed deposit schemes offers attractive returns on deposits with competitive interest rates while ensuring the highest safety of your funds with easy liquidity as well.

There are convenient investment tenures that range from 7 days to 5 years and above. Senior citizens are given an additional rate of interest of 0.50% across all tenures.

Types of Federal Bank Fixed Deposits

The following are the different types of Federal Bank fixed deposits:

- Resident Term Deposit

- Tax Saving Deposit

- NRE Fixed Deposit

- NRO Fixed Deposit

Features of the Federal Bank Resident Term Deposit Scheme

These are the salient features of the resident term deposit scheme:

- Convenient range of deposit tenures from 7 days to 5 years and above.

- Nominal minimum deposit making it possible for all to start savings.

- No maximum amount for deposits.

- Monthly, quarterly, half-yearly, and annual interest payout.

- Automatic credit of amount to Federal Bank savings account on maturity.

- Automatic renewal facility available.

- Nomination facility available.

- Loan of up to 90% of deposit amount can be availed.

Features of Federal Bank Tax Savings Fixed Deposit Scheme

The key features of the Federal Bank Tax Savings Fixed Deposit scheme are given below:

- Nominal minimum amount of Rs.100 making it possible for all to start saving.

- Tax benefits under Section 80C of the Income Tax Act.

- Can be held in a joint account.

- Lock-in period of 5 years with no premature withdrawal.

- Maximum Rs.1.5 lakh can be invested in a single financial year.

Top Bank FD

- SBI Bank FD

- HDFC Bank FD

- Axis Bank FD

- Post Office FD

- Senior Citizen FD

- Canara Bank FD Rates

- Kotak Bank FD

- Yes Bank FD

- Standard Chartered Bank FD

- Bank of Baroda FD

- PNB FD

- IDFC Bank FD

- IDBI Bank FD

- Indian Bank FD

- Union Bank FD

- Bank of India FD

- Central Bank of India FD

- IOB Bank FD

- Shriram City FD

- LIC Housing FD

- Mahindra Finance FD

- Bandhan Bank FD

- KTDFC FD

- J & K Bank FD

- Bank of Maharashtra FD

Features of Federal Bank NRE Fixed Deposit Scheme

The main features of the Federal Bank NRE Fixed Deposit scheme are as follows:

- Advance can be availed of up to 90% of the deposit amount.

- Premature withdrawal is allowed.

- Deposit and interest can be repatriated.

- Interest is exempt from income tax.

- Wealth tax not applicable for amount outstanding.

- Easy transfer to any convertible currency.

- Tenures range from 1 year to 10 years.

- Interest paid on a half-yearly basis.

Features of Federal Bank NRO Fixed Deposit Scheme

The following are the attractive features of the Federal Bank NRO Fixed Deposit scheme:

- Advance of up to 90% of deposit amount can be availed.

- Balance in the account can be repatriated.

- Interest accrued net of TDS can be repatriated or credited to NRE account.

- Premature withdrawal is allowed.

Federal Bank Term Deposit Interest Rates

Federal Bank offers attractive interest rates on tenures starting from 7 days onwards. Senior citizens are offered 0.50% additional rate of interest. Effective from 17 December 2020, the Federal bank fd interest rates for deposits below Rs.2 crore range from 2.50% p.a. to 5.50% p.a. for tenures ranging from 7 days to 5 years and above.

Who is Eligible to Open an Account Under the Federal Fixed Deposit Scheme?

The following entities are eligible to open a fixed deposit account with Federal Bank:

- Individuals

- Guardians on behalf of minor individuals

- Sole proprietors

- Firms

- Joint stock companies

- Hindu Undivided Families (HUF)

- Clubs

- Associations

FAQs on Federal Bank FD

- What is the minimum and maximum amount required to open a fixed deposit account with Federal Bank?

The minimum amount required to open an account under the Federal Fixed Deposit Scheme is Rs.1,000. There is no maximum cap on the amount a depositor can invest in a fixed deposit account with Federal Bank.

- Is TDS applicable on Federal Bank fixed deposits?

Yes, TDS is applicable on the interest accrued on Federal Bank fixed deposit accounts as per your income tax bracket.

- How can I open a fixed deposit account with Federal Bank?

You can open a fixed deposit account with Federal Bank either by using the internet banking facility or by visiting your nearest branch.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.