What is CVV & How to Know CVV Number on Debit Card?

The CVV, or Card Verification Value, is a 3- or 4-digit number printed on your debit card that helps ensure secure online and card-not-present transactions. It acts as an extra layer of protection, verifying that the person making the payment physically holds the card.

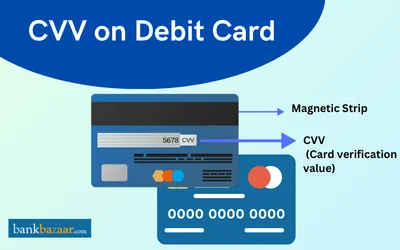

Card Verification Value (CVV) is printed by the companies that manufacture bank cards on the backside of credit or debit card. This unique number serves as both the card verification code and the card security code.

What is CVV Number?

During an online transaction, there is a field asking for the CVV after the card number is entered. This is printed on the backside of credit cards and debit cards, acting as an extra level of security for online transactions and card swipe transactions at point-of-sale machines.

- When a person uses their card online, the CVV confirms that the card is actually in their possession.

- The CVV code needs to be kept private and shouldn't be disclosed to any individual.

- The Payment Card Industry Data Security Standards prohibit merchandise portals from storing CVVs.

- While merchants might possess card details, they do not possess the CVV information, which makes card misuse impossible.

- CVV is an external validation feature that ensures banks that the card is being used by the rightful cardholder.

- The banks that issue credit and debit cards generate the CVV numbers.

What is Disclosed by CVV?

A CVV code reveals the following:

✅The bank account numbers

✅Expiry date

✅Service code

✅Unique code Only the bank that issued the card is aware of this code. The card is verified and authenticated by being converted to a three- or four-digit decimal code.

One of the various types of authentications that banks employ is CVV. It protects the card owner's interest by acting as a deterrent to hackers who might have obtained the card number.

What are the Components of CVV?

There are two types of CVVs:

CVV1: When you swipe your card to pay, the POS (Point of Sale) terminal automatically reads an encrypted code that is hidden on the magnetic strip of your card. You may have observed that certain retailers accept payments without requesting your PIN.

CVV2: When making an online purchase, you must enter this three-digit code, which is printed behind the card. All other card information can be stored by the payment gateway except the CVV number.

Regardless of how often you use the same merchant's service, you must enter this number every time you make a purchase.

How to Find CVV on Debit Cards?

The CVV number is mentioned on debit cards as well as credit cards. The person to whom the card is issued is given a unique decimal representation code.

Card Security Code (CSC) or Card Verification Code (CVC) is the name given to the CVV number. MasterCard, Discover, VISA, and RuPay provide this three-digit number. Four-digit numbers are assigned to American Express cards.

Finding the CVV number on a credit or debit card is a simple process. can be found on the back of MasterCard, Discover, VISA, and RuPay cards, either inside or close to the signature strip. The four-digit CVV is located on the front of American Express cards, over the Amex logo.

How Does CVV Work?

- Once the card details and expiration date have been entered into the online merchant site's payment gateway, the CVV should be entered. Payments will not be processed without CVVs.

- Banks keep this basic security layer to mitigate fraud. Hackers can obtain card details that online merchants potentially record. However, Industry Data Security Standards forbid storing CVV numbers.

- Thus, this number cannot be guessed without having access to the card. When making an offline payment or swiping a card, it is not possible to copy the CVV number.

- The POS devices will reject the card if the information on the magnetic chip has changed. Despite the high level of security offered by CVV, credit cards are not impervious to phishing attempts and other types of online fraud.

- Because credit card details can be used by hackers to conduct unauthorised transactions, they are more at risk. When using credit cards, never proceed with a transaction if they lack several layers of verification.

Furthermore, make sure to apply for credit cards with reputable lenders.

How Does CVV Prevent Fraud?

When you visit a specific merchant's payment gateway, you benefit from the customisation that the merchant provides if you are one of their regular customers. Your card number is already saved, and you just have to enter the CVV number.

- The security code that keeps hackers out of your account is the CVV. Hackers can use the magnetic strip to duplicate the credit card and gain access to the CVV code in order to misuse the card.

- However, physical card fraud has been successfully eliminated by chip-enabled card technology. Two layers of protection are included with cards: the encoded magnetic strip for offline transactions, and the CVV.

- This CVV is encrypted with magnetic decimal codes so it is not visible while the other can be seen. When performing transactions online, you must provide this CVV.

- Credit card numbers and expiry dates can be obtained by online hackers, but CVVs cannot be tracked. Thus, keep in mind that you are enhancing transaction security whenever you pay for an online transaction that needs your CVV to be filled out.

- In case you lose your credit card in public, someone could misuse it. However, temporary numbers expire as soon as the cardholder receives them via email or text message under the new dynamic CVV technology.

If the card gets stolen, the person cannot proceed with transactions without verification. All of these methods reduce risk and protect the cardholder's interest. The cardholder will be protected from fraudsters by exercising caution and vigilance.

How to Protect CVV?

- Make sure you have an antivirus program installed if you are conducting transactions from your computer.

- When entering credit card information, use trustworthy websites.

- Ignore unsolicited requests for personal information.

- Pay close attention to your account activity.

- Make sure you use a secure Wi-Fi network when conducting transactions.

Dos and Don’ts When Using CVV

- After receiving your card from the bank, sign the back of the card.

- Never give out your CVV number or credit/debit card numbers to anybody, not even bank employees.

- Your One Time Password (OTP) should never be sent to or shared over the phone with anyone else.

- Remember the card PIN and never write it down.

- When entering your PIN, cover the POS PIN pad.

- Avoid conducting financial transactions on public networks, such as free Wi-Fi and internet cafes.

- Avoid using ATMs that are unattended, remote, or poorly lit.

- Keep changing your PINs whenever it's convenient for you.

- Register for email and SMS alerts for any access or debit to your account.

- Refrain from tearing up and discarding the ATM transaction slips.

- The slip's printed information may be misused. Make sure you shred the transaction slips into tiny pieces and discard them.

- To detect dubious transactions, regularly check the transactions listed on your bank statement.

- If you lost a debit or credit card, report it as soon as possible.

- Steer clear of unsolicited texts, calls, or emails that request private financial information such as ATM pins, credit card/debit card numbers, CVVs, expiry dates, or passwords.

FAQs on CVV in Debit Card

- Can I share my CVV number?

No, you can share your CVV number only when making a payment through reputable merchant gateways.

- How do I find the CVV number on my debit card?

Debit cards usually have the CVV codes printed on the back, to the right of the white signature strip.

- Can I find my CVV number online?

No, you cannot CVV numbers online. A CVV number is printed on the back of a debit/credit card. Your CVV cannot be stored by any online gateway.

- Is CVV required for online payments?

Yes, online financial transactions are not allowed without a CVV. Transactions carried out without a CVV are unsafe and unapproved, and they should be avoided.

- Are the PIN and CVV numbers on a debit card the same?

No, the PIN will be sent to your registered mobile number via SMS, just like an OTP, while the CVV number is printed on the back of the card.

- Is my CVV number required for offline transactions?

No, CVV is not required for offline transactions. The POS machine reads your card details automatically, and you only need to enter your OTP or PIN to complete the payment.

- Can the CVV number have four digits?

The CVV number is typically a three-digit number that appears on the back of your debit card. Each debit or credit card has a different number. In certain rare situations, it might also be four digits.

- Can I generate the CVV number for my debit card?

No, the card issuer assigns and generates the CVV number. Your debit or credit card number, the card's expiration date, the service code, and other information are used to generate it.

- What is the purpose of the CVV number?

The CVV number is used to confirm that the transaction is being conducted by the cardholder. Online transactions cannot be completed without entering the CVV number. It serves as an extra security measure and provides protection against fraud.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.