ATM Card AMC (Annual Maintenance Charge)

Annual Maintenance Charge (AMC) is a yearly fee charged by banks on debit cards as an ATM service fee. The fee is fixed by the bank, and the cardholder must pay it every year

The AMC applicable on a debit card may differ from one card issuer to another and is determined by the type of ATM card used. A predetermined amount is automatically deducted from the account of the cardholder on the bank's behalf. This fee is waived by a majority of banks during the first year after the card is issued and the charges begin in the second year.

AMC for a Debit Card

The AMC will be determined based on the type of ATM card you have. Banks like HDFC Bank, Axis Bank, SBI, and Punjab National Bank typically levy an AMC of Rs.100 to Rs.150 for classic cards.

An AMC of Rs.60 is levied in rural and suburban regions by Indian Bank while in metropolitan and urban areas, they charge Rs.120. ICICI Bank does not levy an AMC on debit cards except for coral debit cards that come with an AMC equal to Rs.499 (initial fee).

How to Avoid AMC for a Debit Card?

If you want to avoid paying the annual maintenance charge for your debit card, here are a few things to keep in mind:

- Do extensive research and choose a debit card with no AMC. For example, ICICI Bank does not impose any AMC for its debit cards.

- Always prefer using ATMs from your respective bank. Only if you do not find an ATM of your bank nearby should you use ATMs from other banks. Certain banks allow you to locate the nearest ATM via their mobile apps.

- Ensure that you have cash on hand if unexpected expenses cause you to run out of funds.

- Do not wait until you are out of cash before using the ATM. You must plan ahead of time to avoid being forced to use an ATM from a different bank. When withdrawing money, make sure you take out more than you need.

Process to Check AMC for Different Bank ATM Cards

You can check the AMC of an ATM card by visiting the official website of the respective bank. Alternatively, you can reach out to the bank executive to get a better understanding of the charges. The annual maintenance charge levied by popular banks in India are listed below:

ICICI Bank: With the exception of coral debit cards, which have an AMC of Rs.499, ICICI Bank does not charge an AMC for debit cards. In addition, the bank charges Rs.25 for ICICI debit card PIN regeneration.

HDFC Bank: Customers of HDFC Bank can avail ATM cards for free. You will have to pay an AMC ranging from Rs.200 to Rs.750 based on the card variant on redeeming or reissuing a hdfc debit card.

State Bank of India: SBI offers a facility for depositing cash to the account linked with a debit card for free. Customers can therefore deposit money into their bank accounts free of cost through their SBI debit cards.

According to the official website of SBI, a fee of Rs.22 plus GST is levied on depositing cash to third-party bank accounts through ATMs. SBI charges an AMC of Rs.125 plus GST on classic debit cards.

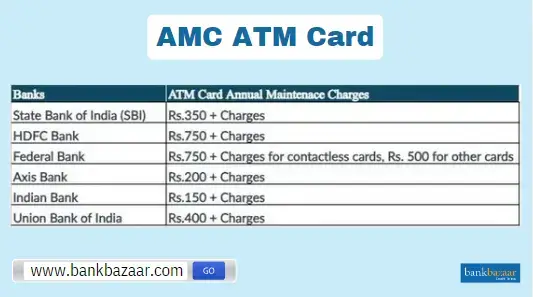

ATM AMC Charges for Top Banks

The following is the list of ATM AMC charges for some of the top Indian banks:

Banks | ATM Card Annual Maintenace Charges |

State Bank of India | Up to Rs.350 plus taxes will be levied from second year, which depends on the card type |

HDFC Bank | Up to Rs.750 plus taxes |

Federal Bank | Up to Rs.750 for contactless cards and Rs.500 for other cards |

Axis Bank | Rs.200 plus taxes for Visa Classic or Platinum card |

Indian Bank | up to Rs.150 plus taxes that will be levied from the second year onwards |

Union Bank of India | up to Rs.400 plus taxes |

How to Pay ATM Card AMC?

Usually, ATM card AMCs are automatically deducted from your bank account in accordance with your bank's guidelines. If your bank does not automatically deduct the charge, you can still pay the amount using other payment cards, UPI, and internet banking.

You must adhere to AMC policies as a responsible debit card holder to avail various debit card services in a hassle-free manner. You can get in touch with your bank's customer service for more information.

Consequences of Not Paying ATM Card AMC

Your bank will send you a reminder regarding ATM pending AMC. If you fail to pay the outstanding annual maintenance fees, you may encounter the following consequences:

- Service Disruption: If you don't give AMCs on time, you might experience problems with debit card service. The provider will give you an alert via email before they terminate the service.

- Limited Access and Card Deactivation: If you haven't paid the yearly maintenance fees, you might not be able to use the ATM card for all of its services. In addition to restricted access, your card could be deactivated.

- Fines and Late Charges: Besides the initial annual maintenance charge, banks may impose late charges, which increases your overall payment amount.

Therefore, you must review the terms and conditions and AMC for any debit card before applying.

FAQs on ATM Card AMC

- What is the AMC for a debit card?

Annual Maintenance Charge (AMC) is a yearly fee imposed by banks on debit cards as an ATM service fee.

- What is the AMC for an SBI debit card?

For classic debit cards, an AMC of Rs. 125 + 18% of GST (22.50) = 147.50 is levied by SBI. The AMC depends on the debit card variant. You can visit SBI’s official website for more information.

- How do I check ATM card AMC for various banks?

You can easily check the ATM card AMC of various banks on their official websites. To find out more information, you can also get in touch with the closest branch of your chosen bank.

- Can ATM fees be refunded?

Yes, depending on the bank policies, in some case the bank may refund the ATM fees deducted from your account.

- Are AMC charges compulsory?

No, ATM AMC is not always compulsory, as depneding on the bank policies, some bank does not levy any ATM AMC charges on certain types of ATM cards.

- What is the maximum number of days a bank needs to deposit money into the account for false charges?

As per the direction of the Reserve Bank of India (RBI), the money deducted on false charges is credited by the bank in 10 to 15 days.

- What is the AMC for Indian Overseas Bank debit cards?

For RuPay classic and platinum debit cards, Indian Overseas Bank (IOB) charges Rs.250. IOB levies an AMC of Rs.800 on RuPay select cards. For more information about the AMC for various card variants, visit the official website of IOB.

- Is the AMC directly deducted from the bank account?

Yes, the AMC is automatically deducted from the bank account.

- Does the bank charge a fee for using other banks' ATMs?

In the case of ATMs of other banks, the number of free monthly transactions is limited to five. If you use a non-bank ATM for up to five transactions, each additional transaction will cost Rs.20 as a transaction charge.

News about Annual Maintenance Charges

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.