How to Check ITR-V Receipt Status?

Once the CPC Bangalore receives an ITR-V, it sends a confirmation e-mail to the taxpayer. The ITR-V receipt status can then be checked by visiting the official website of the Income Tax Department of India using the PAN number and assessment year.

Every Indian citizen who pays income tax have to file his/her income tax return (ITR) at the end of the financial year. ITR can be filed online on the e-filing website of the Income Tax Department of India.

How to Check the Status of ITR-V?

Once the Income Tax Return (ITR) is filed, it is important to validate the same by verifying the ITR-V receipt online or by sending to the Central Processing Centre (CPC) of the taxpayer. An individual can easily check the status of his/her ITR-V by following the steps mentioned below:

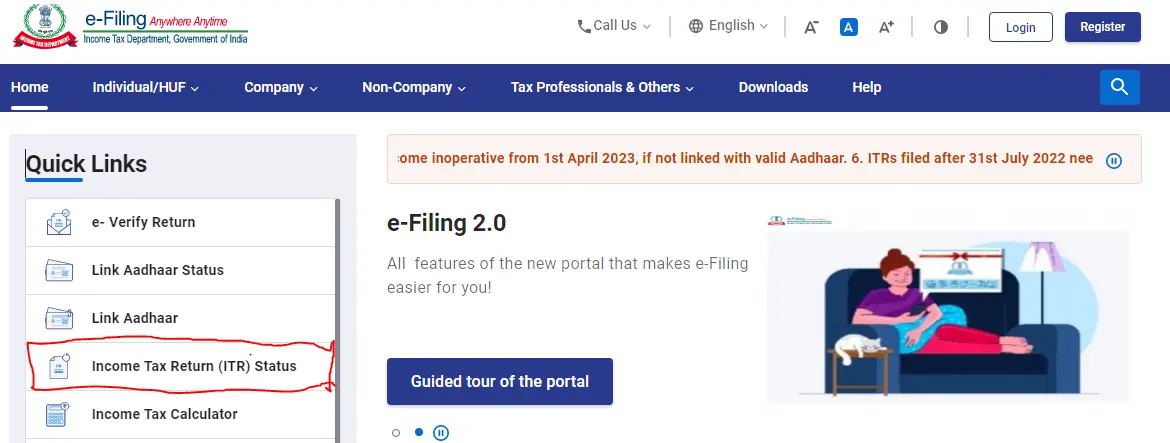

Step - 1: Visit the official income tax filing portal at https://www.incometaxindiaefiling.gov.in/home

Step - 2: From the menu on the left side of the home screen, click on the 'ITR Status' option.

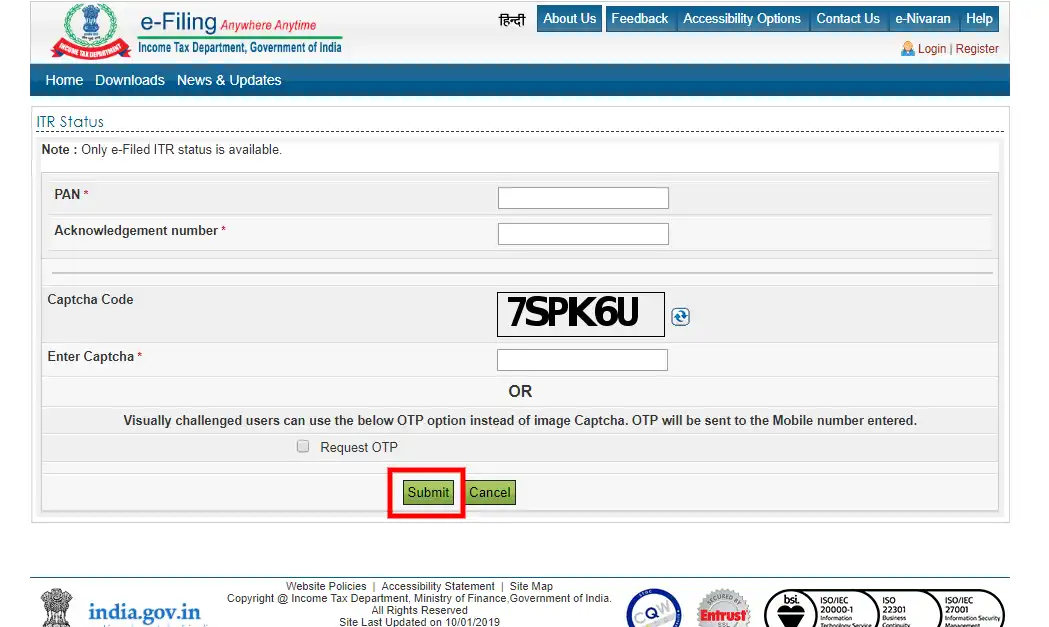

Step - 3: The user will be redirected to a new webpage.

Step - 4: On this new page, the user will be required to fill in his/her Permanent Account Number (PAN) and the Acknowledgement Number which is generated at the end of the ITR filing process.

Step 5: These two fields will be followed by a Captcha code which is required to be filled in the assigned field.

Step - 6: Once the steps mentioned above are completed, the user will be required to click on the 'Submit' button.

Process to Check ITR-V Receipt Status?

Once people send their ITR-V, they can easily find out if CPC Bangalore has received it or not. On receiving, CPC Bangalore will confirm that it has received the ITR-V through an email. People can easily check their ITR-V receipt status online on the website of the Income Tax Departmentof India. If the status says not received for 10 days, then they can contact on the helpline number for information.

Follow the steps mentioned below to check the receipt status:

- On the website, click on 'ITR-V Receipt Status'.

- You will be directed to another page where you have to provide certain information such as PAN and Assessment Year. You also have choose how you wish to know the status:

- by PAN and Assessment Year, or,

- eFiling Acknowledgement Number.

- Enter the captcha code.

- Click on 'Submit'.

You can also check the ITR-V receipt status on some third-party websites.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.