GHMC Property Tax in Hyderabad

Property taxes are paid to the Greater Hyderabad Municipal Corporation in Hyderabad (GHMC) is refered as GHMC Property Tax. Residents can pay GHMC property taxes online using the GHMC site.

Table of Contents

- What is GHMC Property Tax?

- How to Pay GHMC Property Tax Online

- GHMC Property Tax Rates

- How to Calculate GHMC Property Tax Payment

- Deductions in GHMC Property Tax Based on Building Age

- Due Dates to Pay GHMC Property Tax

- Greater Hyderabad Municipal Corporation Zones and Circles

- Hyderabad Property Tax Exemptions

Hyderabad property tax payers have the option of making payments offline or online. Individuals who have not made their GHMC property tax payments on time are subject to a 2% penalty.

What is GHMC Property Tax?

Tax Levied on Any Property Tax Owner by Hyderabad Municipal Corporation in Greater Hyderabad is known as GHMC Property Tax. The rate of tax is calculated based on the area and the type of occupancy.

How to Pay GHMC Property Tax Online

Follow simple steps to pay GHMC Property Tax:

Step 1: Visit the official website of GHMC at https://www.ghmc.gov.in/

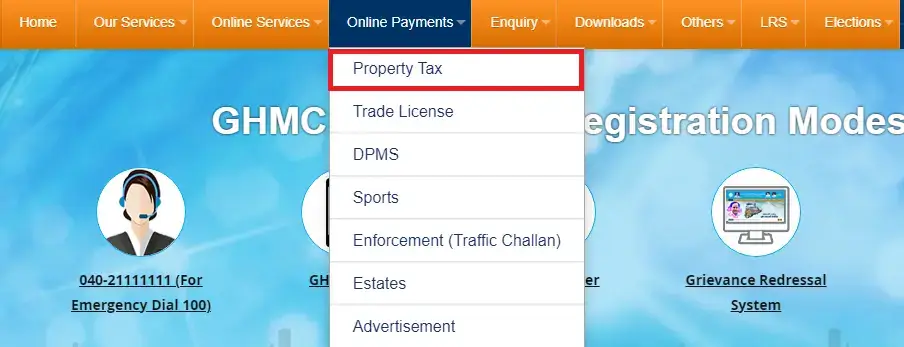

Step 2: Click on 'Online Payments' and select 'Property Tax' from Menu

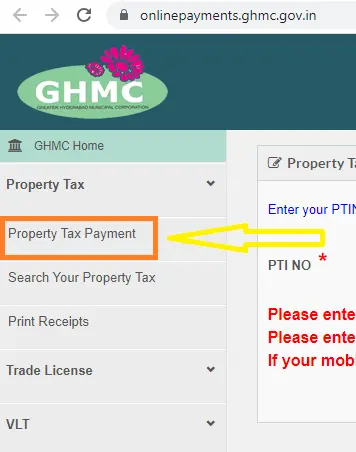

Step 3: Now, Select 'Property Tax Payment' under 'Property Tax' option.

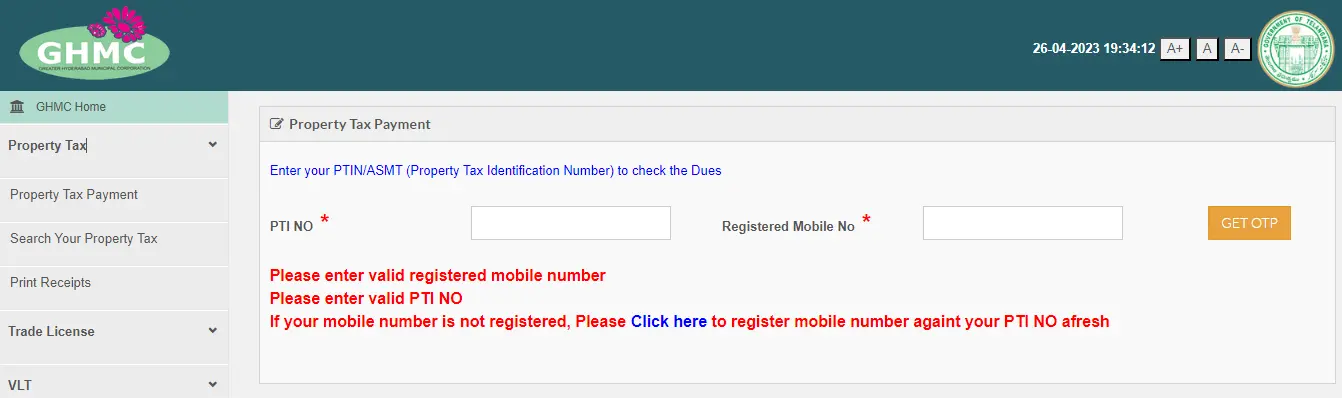

Step 4: Enter your PTI number and 'Registered Mobile Numer'. Now, Click 'Get OTP'.

Step 5: Enter the OTP recieved on your mobile and Click on 'Submit'

Step 6: Now, Check the Details about your Arrears, Taxable Amount, Arrears Interest, Modifications, etc. are listed on the following page that loads. To make sure everything is correct, go through these.

Step 7: After Checking all the details, Enter the payment amount and click on 'Proceed to Online Payment'.

Step 8: Now, you will get a pop-up window. Select a payment method from debit card, net banking, or credit card, UPI, Googlepay, phonepay, wallet, e.t.c.

Step 9: Click on 'Pay Now'.

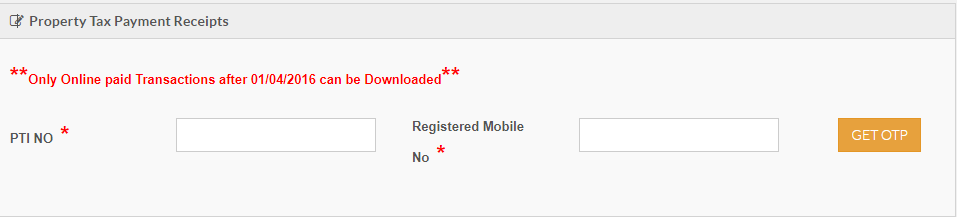

Step 10: Once youre done with the transaction, you can print out the receipt at https://onlinepayments.ghmc.gov.in/PTax/PT_Recipts_Main by entering PTI No and Mobile Number.

GHMC Property Tax Rates

Monthly Rental Value | General Tax | Other Tax (Conservancy Tax, Lighting Tax, Drainage Tax) | Total |

Up to Rs.50 | Exempt | Exempt | Exempt |

Rs.51 - Rs.100 | 2% | 15% | 17% |

Rs.101 - Rs.200 | 4% | 15% | 19% |

Rs.201 - Rs.300 | 7% | 15% | 22% |

Rs.300 and above | 15% | 15% | 30% |

How to Calculate GHMC Property Tax Payment

The house tax of residential and commercial properties in Hyderabad Corporation was calculated based on the following factors:

- Gross Annual Rental Value

- Type of Property

- The built-up Area of your Building

- Usage of the Property

- Location and

- Area

GHMC is divided into two types of properties, The first one is GHMC Residential Property Tax and second as GHMC Commercial Property Tax.

Steps to Calculate GHMC Residential Property Tax

To calculate your residential property tax, follow the following steps:

Step 1: Measure the size of your plinth (PA). The overall built-up area, which includes all covered spaces like balconies and garages, is known as the plinth area.

Step 2: If the property is self-occupied, find out what the going rate is for similar properties in your neighborhood. You must take into account the rent per square foot specified in the rental agreement if you have rented the property out. Your Monthly Rental Value (MRV) per square foot is this amount.

Step 3: Calculate your residential property tax with this formula:

Annual Property Tax for Residential Property = Gross Annual Rental Value (GARV) X (17% – 30%) depending on the monthly rental value in the below table - 10% depreciation + 8% library cess.

Steps to Calculate GHMC Commercial Property Tax

To calculate your Commercial property tax, follow the following steps:

Step 1: Measure your Plinth Area (PA).

Step 2: The notices sent out by the GHMC for the fixed monthly rent per square foot in various circles in various taxation zones include information about the MRV for commercial property. Proposed Division of Zones on the GHMC Website contains the MRV. (https://www.ghmc.gov.in/proposed_div_zones.aspx).

Step 3: Calculate the commercial property tax using this formula:

Annual Property Tax for Commercial Property = 3.5 x PA in sq.ft. x MRV in Rs./sq.ft.

Also note that:

- ATMs and cellular towers / hoardings are taxed as commercial property at the maximum with monthly rent of Rs.70 and Rs.50 per square foot, respectively.

- Educational institutions and hospitals are charged at the minimum with a monthly rent of Rs.8 and Rs.9.50 per square foot, respectively.

You can also register for self-assessment of property tax in Hyderabad by filling out the online form which requires the following details:

- Owner Details:

- First name.

- Last name.

- Phone number and e-mail ID.

- Circle.

- Property Details:

- Locality name.

- Street/Road name.

- Permission number and permission date for the building in question.

- PIN code and building type (apartment / independent).

- Door number.

- Plinth area and floor usage type.

Taxes can also be paid at e-Seva counters, Citizen Service Centres, State Bank of Hyderabad Branches, Cheques/DDs made in favour of the "Commissioner, GHMC" and to Bill Collectors.

Related Articles on Property Tax

Deductions in GHMC Property Tax Based on Building Age

Age of the Building | Deduction Allowed |

25 years or below | 10% |

25 years - 40 years | 20% |

Above 40 years | 30% |

Due Dates to Pay GHMC Property Tax

Given below is the due date for the payment of the GHMC Property Tax and the penalties you will incur if you delay the payment:

- The last date for the bi-annual payment of GHMC Property Tax is 31st July and 15th October.

- An interest of 2% p.m. will be charged if you delay the payment of GHMC Property Tax.

Greater Hyderabad Municipal Corporation Zones and Circles

S.NO | Name of Zone | Name Of circle |

1 | L.B. Nagar | Kapra, Uppal, Hayathnagar, L.B.Nagar Zone, SaroorNagar |

2 | Charminar | Malakpet, Santoshnagar, Chandrayangutta, Charminar, Falaknuma, Rajendra Nagar |

3 | Khairathabad | Mehdipatnam, Karwan, Goshamahal, Musheerabad, Amberpet, Khairatabad, Jubilee Hills |

4 | Serilingampally | Yousufguda, Serilingampally, Chandanagar, RC Puram, Patancheruvu |

5 | Kukatpally | Moosapet, Kukatpally, Qutbullapur, Gajularamaram, Alwal |

6 | Secunderabad | Malkajgiri, Secunderabad, Begumpet |

Hyderabad Property Tax Exemptions

The taxation of all non-agricultural lands, buildings, and structures is required. Some properties may be completely exempt from taxation, even though the tax rate changes depending on how the property is utilized (or at least receive some concessions).

- Properties owned by military servicemen, or ex-servicemen are 100% exempt from taxation.

- Places of religious worship are 100% exempt from taxation.

- Residential buildings, occupied by their owners, whose annual rental value is no more than Rs.600 are 100% exempted from taxation.

- Recognized educational institutions (up to std. X) are 100% exempted from taxation.

- Following the creation of a field report by the tax inspector, vacant properties will be granted 50% concessions as "vacancy remission."

Rebates and Penalties from GHMC Tax

- In order to reward taxpayers who file their taxes on time, the GHMC holds a lucky draw. One lucky winner who enters the competition and pays his taxes on time will receive a lucky draw reward worth Rs.20,000,000.

- In an effort to encourage the construction of "green buildings," GHMC has taken the lead. Building owners will earn tax breaks if their structures feature rainwater collection systems and rooftop solar panels for power backup and heating.

FAQs on GHMC Property Tax

- What is the official web address to pay GHMC property tax online?

The official website to pay GHMC property taxis https://www.ghmc.gov.in/Propertytax.aspx.

- Is it possible to pay GHMC house tax Offline?

Property tax GHMC payment can be made either online or offline mode.

- What is the last date to pay the GHMC Property Tax?

The last date for the half-yearly payment of GHMC Property Tax is 31st July and 15th October.

- Where to find GHMC Tax Payment Details?

You must enter the circle number and other information, such as the PTIN number, the owner's name, and the door number, on the GHMC website under the "find your property tax" option to learn about tax payment information.

- What happens if you delay the GHMC house tax payment?

The interest of 2% per month on the due amount is the penalty if you fail to pay Property tax GHMC.

- When should we pay the Hyderabad property tax?

The deadlines for biannual property tax payments are July 31 and October 15. Two percent interest is added to the tax amount each month if you wait to pay.

- How is property tax determined?

The annual value (AV) of the property is multiplied by the current property tax rate to determine the property tax. Each and every home has an AV. This property's AV is calculated using market rents for comparable or related properties.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.