NEFT - National Electronic Funds Transfer

What is NEFT?

National Electronic Fund Transfer, or NEFT, is electronic funds transferring method used widely for making transactions through banks in India. These transactions are generally processed within 30 minutes, but there could be certain cases in which it may take longer for the amount to reflect in the beneficiary's account.

Transferring funds across the country from one bank to another or within banks is a part of our daily lives and helps us manage financial emergencies more effectively. In the era of modernisation, customers need not visit the bank and stand in a long line and fill in forms to transfer money. To make fund transfers faster, secure, and seamless, National Electronics Fund Transfer (NEFT) has been introduced, which is a nationwide electronic fund transfer system.

How Does NEFT Work?

Here are the following details of how NEFT fund transfer work:

- The beneficiary details need to be provided to initiate the NEFT fund transfer through either mobile banking, net banking, or offline banking.

- To process the NEFT fund transfer, you need to add beneficiary in case the beneficiary details are not added to the sender’s account.

- The transaction details are sent to the NEFT clearing center, after the NEFT transaction is initiated to sort and batch the transaction received from the banks.

- The transaction is settled in hourly batches and settlement files are sent to the banks after clearing the transaction.

- The fund is then credited to the beneficiary account after the settlement files received by the beneficiary bank, which happens either on the same day or next morning depending on the transaction time.

- To ensure transparency in the transaction, confirmation message or notification is sent to both the sender and recipient.

- The transaction can be tracked to various banking channels by the sender.

NEFT Transaction Timings

For online transactions, NEFT services are available 24/7 throughout the year. Fund transfers can be initiated at any time using net banking or mobile banking platforms.

NEFT is available 24x7, including weekends and holidays, for both online (mobile/internet banking) and offline (branch) transactions. However, some smaller banks may have branch-specific timings for cash-based NEFT deposits.

NEFT Transfer Limits

The RBI does not mandate any minimum or maximum limit for NEFT transactions. However, banks may impose daily/per-transaction limits based on account type (e.g., Rs. 10 lakh for retail users, higher for premium accounts). Check with your bank for specifics.

NEFT Charges and Fees

The Reserve Bank of India (RBI) has waived all NEFT transaction fees for online transfers (via mobile/internet banking) since 2019. However, some banks may charge minimal fees for offline NEFT transactions initiated at branches (typically Rs. 5–25 + GST). Recipients are never charged.

NEFT charges can vary from bank to bank. While some banks charge a flat Rs. 2.50 for transfers up to Rs. 10,000, others may include additional taxes. Depending on your account type, some banks might offer free NEFT transfers within the same bank, adding further convenience. Always check with your bank for specific charges related to your transactions.

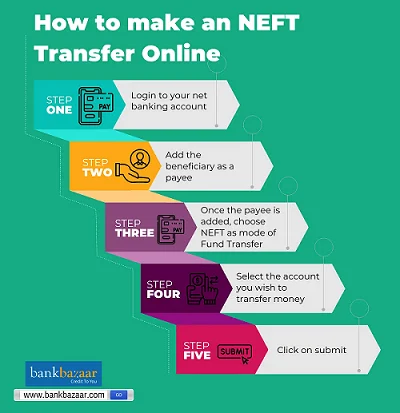

How to make an NEFT Transfer Online?

The procedure for National Electronic Funds Transfer (NEFT) is mentioned below:

Step 1: First login to your net banking account. If you do not have a net banking account then register for it on the website of your bank.

Step 2: Add the beneficiary as a payee. To do so, you have to enter the following details about the beneficiary in the 'Add New Payee' section:

- Account Number.

- Name.

- IFSC Code.

- Account Type.

Step 3: Once the payee is added, choose NEFT as mode of Fund Transfer.

Step 4: Select the account you wish to transfer money from, the payee, enter the amount that you wish to transfer, and add remarks (optional).

Step 5: Click on submit.

How to Transfer Funds Through NEFT Offline?

The following are the steps to transfer funds through NEFT offline:

- Collect the NEFT form from the remitting branch

- Provide the remitters and beneficiary’s detail in the form

- The detail required are:

- Account number

- Account name

- IFSC Code

- Branch name

- Bank name

- Account type of the remitter and beneficiary

- Remitters need to provide PAN card in case the transaction amount exceeds Rs.50,000.

Details Required for Fund Transfer via NEFT

The following are the details of the beneficiary required for fund transfer through NEFT framework:

- Name

- Account number and type

- Bank name and branch name

- Branch’s IFSC code

How to Track NEFT Transaction Status

The following are the steps to track the NEFT transaction status:

- The NEFT Transaction status can be tracked by both the remitter and beneficiary by contacting the customer care centre of the remitting bank

- The details of the customer care are available on the website of the remitting bank

- To speed up the transaction status tracking process, the customer needs to provide the following details:

- Unique Transaction Reference (UTR) number or transaction reference number

- Date on transaction has been made.

Difference Between NEFT, UPI, and RTGS

The following are the differences between NEFT, UPI, and RTGS:

Details | NEFT | UPI | RTGS |

Maximum Transfer Value | No limit | Rs.2 lakh | No limit |

Minimum transfer value | Rs.1 | Rs.1 | Rs.2 lakh |

Transfer timing | Up to 30 minutes | Immediate | Immediate |

Service time | 24 x 7 | 24 x 7 | 24 x 7 |

Payment mode | Online and offline | Online | Online and offline |

Details Required | Account number and IFSC Code | Account number and IFSC Code | |

Inward Transaction Charges | Nil | Nil | Nil |

Beneficiary Registration | Yes | No | Yes |

NEFT Transaction Limits Set by Popular Banks

Different banks have different NEFT transaction limits. Here are the general limits for a few popular banks:

Bank Name | Minimum Limit | Maximum Limit (Per Day) |

SBI | ₹1 | ₹10 lakhs (Retail users) |

HDFC Bank | ₹1 | ₹25 lakhs |

ICICI Bank | ₹1 | ₹10 lakhs |

Axis Bank | ₹1 | ₹15 lakhs |

Kotak Mahindra Bank | ₹1 | ₹5 lakhs (Retail net banking) |

Note: These limits may change based on account type and customer profile. It's always best to confirm with your bank.

Common Errors in NEFT Transfers and How to Avoid Them

Error | Impact | How to Avoid |

Wrong IFSC code | Funds may go to the wrong branch or fail | Double-check the IFSC code before confirming |

Incorrect account number | Money may go to the wrong person | Recheck account number carefully |

Not adding beneficiary properly | Transfer may fail | Add beneficiary correctly and wait for activation |

Entering incorrect transfer amount | May lead to payment failure or rejection | Review amount before proceeding |

Making transfer after bank's NEFT cut-off time | Delay in processing | Check your bank’s NEFT timing |

Refund Process for Cancelled or Reversed NEFT Transfers

If an NEFT transaction is successfully cancelled or reversed, the refund process typically follows these steps:

- Confirmation from the Receiving Bank: The bank receiving the funds will verify the cancellation request before initiating a refund.

- Processing Time: Refunds usually take a few days, depending on the banks involved and interbank settlement times.

- Notifications and Updates: Banks provide updates via email, SMS, or internet banking notifications regarding the refund status.

- Credit Back to Your Account: The refunded amount will be reflected in your bank account once it is processed. This can either be verified through your bank statement or by reaching out to the bank's customer service.

How to Pay Credit Card Bill using NEFT?

Step 1: Log in to your bank's internet banking account

Step 2: The next step is to add the credit card as a beneficiary. For this you should know the IFSC code of your credit card

Step 3: Proceed to enter the credit card number as the account number and other relevant details Process

Step 4: Once the credit card is registered as a payee, go to the 'NEFT Funds Transfer' option and make a fund transfer towards your credit card by entering the bill amount

How to Add a Credit Card as a Beneficiary for NEFT Credit Card Bill Payment?

Step | Detail | Process |

1 | Payee name | The name of the payee/beneficiary will be the same as the name printed on the credit card |

2 | Payee account number | This will be the credit card number printed below the name |

3 | Bank name | The name of your bank |

4 | IFSC code | You can get the IFSC code for your credit card by contacting your credit-card issuing bank |

Banks Providing NEFT Facility

Some major banks that offer the NEFT facility are listed below:

- State Bank of India

- ICICI Bank Limited

- IndusInd Bank Limited

- Bank of Baroda

- HDFC Bank Limited

- Axis Bank Limited

- Central Bank of India

- Bank of India

- Canara Bank

- Indian Bank

- Kotak Mahindra Bank

- IDBI Bank Limited

- RBL Bank Limited

- Union Bank

- DCB Bank Limited

- Federal Bank Limited

- Bank of Maharashtra

- AU Small Finance Bank

- DBS Bank Limited

- HSBC Limited

- IDFC First Bank Limited

- Punjab National Bank

- Standard Chartered Bank

- Utkarsh Small Finance Bank

- Indian Overseas Bank

- Bandhan Bank Limited

- Yes Bank Limited

- UCO Bank

- City Union Bank Limited

- Equitas Small Finance Bank

Limitations of NEFT

While NEFT is a widely used payment method, it does come with certain drawbacks:

- Transaction Limits: The maximum amount per NEFT transfer is Rs. 2 lakh. Additionally, banks impose their own daily transfer limits, making it less suitable for bulk transactions.

- Processing Delays: NEFT does not offer instant fund transfers. Transactions are processed in half-hourly batches, so it may not be ideal for urgent payments.

- Transaction Charges: Although the Reserve Bank of India does not charge for NEFT transactions, individual banks may impose fees. For smaller payments, UPI could be a cost-free alternative.

- Cool-off Period: After adding a new beneficiary via net banking or mobile banking, there is a waiting period before initiating a transfer, usually ranging from 30 minutes to 4 hours.

- Limited Bank Support: Both the sender and recipient must have accounts with NEFT-enabled banks. However, some smaller banks do not support NEFT, restricting its accessibility.

How Secure is NEFT Transfer?

In India, NEFT is a popular method for transacting funds. In order to ensure its sеcurity, thе Rеsеrvе Bank of India (RBI) has laid down strict guidеlinеs and intеrnational standards. The RBI has incorporated a dedicated network, along with encryption and authentication measures, to ensure NEFT transactions are secure. Read on to know more about the ways NEFT is secured:

- Encrypted Transactions: The NEFT transactions are encrypted from end-to-end. This process makes sure that the sensitive information such as account numbers and transaction details are securely transmitted between the sender and the receiver's banks. Furthermore, this encryption helps prevent unauthorised access to the transaction data.

- Authentication Protocols: The NEFT transactions have multi-level authentication. This typically involves OTPs (One-Time Passwords) or transaction passwords. These authentication measures add an extra layer of security, reducing the risk of fraudulent transactions.

- Secure Banking Networks: The NEFT transactions are processed through a secure network maintained by the Reserve Bank of India (RBI). These networks adhere to stringent security standards and protocols to safeguard the integrity of transactions.

- Transaction Limits and Monitoring: NEFT transactions often have predefined limits on the amount that can be transferred in a single transaction or within a specified time frame. Moreover, banks use specialised monitoring systems to detect and prevent suspicious activities, enhancing the overall security of NEFT transactions.

- Transaction Confirmation: Upon completion of an NEFT transaction, both the sender and the receiver receive confirmation from their respective banks. This confirmation includes details such as the amount transferred, the date and time of the transaction, and the beneficiary's account details, providing assurance to both parties that the transaction was successful.

- Regulatory Oversight: NEFT transactions are subject to regulatory oversight by the Reserve Bank of India (RBI) and other relevant authorities. These regulatory bodies establish and enforce guidelines to ensure the security and reliability of electronic fund transfers, thereby fostering trust in the NEFT system.

- Fraud Detection and Resolution: In the case of unauthorised or fraudulent transactions, banks do have a system in place to investigate and resolve such incidents promptly. In most cases, the loss of money is reimbursed.

Key Features of NEFT

Mentioned below are some important features of NEFT:

- It allows electronic fund transfers from one bank account to another.

- NEFT transactions can be carried out on all seven days of the week, including Saturdays, except on bank holidays.

- Online NEFT transfers are available 24/7 throughout the year.

- There is no fixed minimum or maximum limit for NEFT transactions, though some banks may impose a daily transaction cap based on transfer timings.

- When conducted through bank branches, NEFT transactions are processed in batches at scheduled intervals during working hours.

- Both the sender and the recipient must have bank accounts for an NEFT transfer.

- Online NEFT transfers do not incur any charges, as banks do not levy fees for such transactions.

- If a transaction fails or remains incomplete, the amount is usually refunded to the sender's account.

Benefits of Using NEFT for Fund Transfer

NEFT offers a lot of benefits. Let's look into a few of these:

- The system allows the one-way cross-border transfer of funds from India to Nepal. This is under the Indo-Nepal Remittance Facility Scheme.

- With NEFT, you can easily transfer funds from one bank account of any branch to another account.

- It avoids the need for a physical instrument to transfer funds.

- There is no need for any physical presence of parties.

- NEFT is easy, simple and efficient.

- Money can be transferred via NEFT on holidays and weekends as well.

- You can initiate internet banking from any location.

- The confirmation of a transaction will be received via email and SMS notifications

- The real-time transactions of NEFT give assurance to both parties.

Prerequisites for Making an NEFT Transfer

You need to fulfill the below-mentioned criteria before you make a NEFT transfer:

- The beneficiary should have a current or savings bank account to be able to make NEFT transfer

- NEFT transfer can also be done through mobile or internet banking

- For offline NEFT transfer, for people who do not have an account, the remittance value is restricted to Rs.50,000.

What is NEFT Inward Transaction?

The following are the steps to perform inward NEFT fund transfer:

- RBI's website describes the NEFT process as a payment system which allows one-to-one funds transfer. Under the facility of NEFT, you can transfer funds electronically from one bank branch to another individual. You can also make an NEFT payment to a firm or corporate, which has an account with any bank branch in India.

- If you do not have a bank account, you can always deposit cash using the NEFT facility. These cash remittances will be restricted to a maximum of Rs.50,000 for each transaction.

- The settlement of fund transfer requests in an NEFT system can be done every half an hour. Note that there are twenty-three half-hourly settlement batches and these run from 8:00 A.M. to 7:00 P.M on every working day of the week (except for the 2nd and 4th Saturdays of every month).

- The receiver will get the amount for the NEFT transactions within two business hours.

Can NEFT Transactions Be Unsuccessful?

Although NEFT transactions are generally reliable, there is a possibility that a transfer may fail. This can happen if wrong details, such as the recipient's IFSC code, are provided to the bank, which can prevent the transaction from being processed successfully.

However, there is no need to worry in case of a failed transaction. If the amount is not credited to the beneficiary but it is debited from your account, the money will be refunded to your account automatically by the bank.

It is suggested that you wait at least two hours after initiating the transfer. If the transaction status remains unclear after this period, you can contact your bank for assistance.

Other Ways to Check NEFT Transaction Status

You can track the status of your NEFT transaction using the following methods:

- SMS Notification: When initiating an NEFT transfer, you must add the recipient as a beneficiary and provide your mobile number. Once the transaction is processed and the amount is credited, you will receive an SMS update confirming the transfer.

- Email Confirmation: While setting up an NEFT transfer, you are required to enter your email address. This allows you to receive email notifications regarding your transaction status. Once the recipient's account is credited, an email will confirm the successful transfer.

- Bank Visit: NEFT transactions are generally processed within two hours. If you do not receive an SMS or email confirmation and the transaction remains unverified, you can visit your bank branch to check its status.

Who Can Use NEFT?

The following is the list of eligible users of NEFT:

- Account holders and non-accountholders of the bank

- A person without any bank account can also make NEFT fund transfer by depositing cash at the nearest branch of the remitting bank

- Non-account holder can make NEFT fund transfer of amount below Rs.50,000 per transaction

How to Cancel an NEFT Transfer Offline

If you need to cancel an NEFT transaction after initiating it, you must act quickly. Here's what you should do:

- Contact Your Bank Immediately: You can reach out to your bank by visiting your nearest branch or reaching out to your bank's customer service as soon as possible. Provide details such as the transaction reference number, beneficiary details, and your account information.

- Submit a Written Request: Most banks require a written request for cancellation. Mention the reason for cancelling the transaction clearly and include all important details.

- Provide a Valid Reason: Cancellation is typically allowed in cases of incorrect beneficiary details, duplicate transfers, suspected fraud, or other legitimate concerns.

- Act Fast: The chances of putting a stop to your NEFT transaction are much higher if you request cancellation as soon as possible, as NEFT transactions are processed in batches. However, cancellations depend on bank policies and whether the funds have already been credited to the recipient's account.

Steps to Cancel an NEFT Transfer Online

Step 1: Log in to Your Banking Portal

Access your bank's internet banking or mobile banking platform. Alternatively, you can visit the nearest branch for assistance.

Step 2: Locate the Transaction

Go to the section displaying recent transactions or fund transfers and find the NEFT transaction you wish to cancel.

Step 3: Initiate Cancellation

If online cancellation is available, follow the on-screen instructions to request cancellation. Otherwise, inform a bank representative to proceed with the request.

Note: The NEFT cancellation process varies by bank. For detailed assistance, contact your respective bank's customer care number.

Top Bank Pages with IFSC Code Details

IFSC Top Pages

Conclusion:

NEFT is a safe, easy, and affordable way to transfer money between banks in India. It is available 24/7 and supported by many banks, making it a popular choice for both individuals and businesses. With no minimum limit and a simple online process, NEFT allows you to send money quickly and securely. Understanding its benefits, charges, and process can help you use NEFT more effectively for your financial needs.

FAQs on NEFT

- What is NEFT?

Expanded as National Electronic Funds Transfer, NEFT is an electronic fund transfer process, through which money can be sent from one bank account to another.

- Is IFSC code a must for all NEFT transactions?

Yes. It is mandatory to provide the IFSC code along with other details to initiate fund transfers.

- Do all banks have NEFT facility?

No. Not all banks are part of the NEFT network.

- How can a customer check if their bank or the beneficiary's bank supports NEFT transactions?

The information about all NEFT-enabled banks is available on the Reserve Bank of India (RBI) website.

- What happens if IFSC code is wrong for NEFT?

If IFSC code is wrong in an NEFT transaction, you could lose money.

- Is beneficiary's name important for making a NEFT transaction?

Yes, the name of the beneficiary is mandatory to make a NEFT transaction.

- What is the NEFT limit per day?

For NEFT transfers of cash, the Reserve Bank of India (RBI) has neither established a minimum (which might be as low as INR 1) nor a maximum sum. It enables banks to choose the NEFT maximum limit they wish.

- What is the difference between NEFT & RTGS?

Real-Time Gross Settlement is often known as RTGS, whereas NEFT stands for National Electronic Funds Transfer. In the NEFT payment mechanism, monies are settled in batches every half-hour. RTGS is a continuous and real-time fund transfer settlement system.

- How long does it take for NEFT transactions to be settled?

Most credits reflect within 30 minutes, but delays may occur due to bank processing or incorrect details.

- What are the details required to make a NEFT transaction?

A bank's IFSC code, as well as additional details such as bank account number, bank branch, and account holder's name, are required to initiate a NEFT transfer.

- What happens if an NEFT transaction is initiated after 7 PM?

NEFT transactions can be done after 7 pm by the users but settlement of batches is done in every 30 minutes. The clearance of the fund transfer happens within one hour to 24 hours.

- Is NEFT available 24x7, including weekends and bank holidays?

Yes, NEFT is available 24*7 and 365 days a year. Users can avail NEFT service any day in a year, irrespective of the holidays.

- Is NEFT possible on Sunday?

Yes, NEFT is possible on Sundays, provided it is not a national holiday, and the day is designated as NEFT holiday by the Reserve Bank of India.

- Can NEFT be Cancelled?

NEFT transactions can be cancelled within 30 minutes of initiation if the amount hasn’t been processed. Contact your bank immediately via customer care or branch visit. For erroneous transfers, file a dispute with proof (UTR number, screenshots) to initiate a reversal.

- How long does an NEFT transfer usually take to reflect in the recipient's account

It would take around two hours on a working day for NEFT transfer to be completed.

- Are there any transfer limits for NEFT transactions?

No, there is no capping on NEFT transfer.

- Can I transfer money to a bank account outside India with NEFT?

No, you cannot transfer fund outside India with NEFT. The NEFT fund transfer facility is only available for NEFT-enabled banks within India.

- What happens if I write the wrong account number of the beneficiary?

In case you write wrong account number then the money will be disbursed to the provided account number only. But in case the account number entered is invalid then the amount is credited back to the sender’s account.

- Whom should I approach for complaints related to NEFT transactions?

You can reach out to the bank regarding any transaction-related queries that have been made through NEFT. But the query has not been solved within 30 days, then you raise the complaint under ‘The Reserve Bank-Integrated Ombudsman Scheme’.

- Do I need to add a beneficiary to send money through NEFT?

Yes, you need to add a beneficiary to send money through NEFT if the beneficiary is not added to your account. Adding beneficiary takes one to four hours after which you can transfer the fund.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.