HDFC Personal Loan Status

HDFC Bank offers online and offline modes to check the status of the personal loan loan application. You can stay up-to-date with the loan application status through the different ways offered by the bank. The customers can contact the customer care department for any queries related to personal loans:

The customers can contact the customer care department for any queries related to personal loans: Toll-Free Number: 1800 22 1006 |

What are the Methods to Check HDFC Bank Personal Loan Status?

There are a number of methods which can be used to check the status of your HDFC Bank Personal Loan status. You can use any one of the following methods, as per your convenience:

- Through your HDFC Bank Account Number

- Through your mobile number which is registered with the bank

- Checking online using your reference number or proposal number

- Through the HDFC mobile application

- Through offline mode

- Through BankBazaar portal

What are the Details Required to Check HDFC Bank Personal Loan Status?

You can track the status of your HDFC Bank personal loan by providing the reference number you have received at the time of application. You will receive this number in an SMS from the bank. It is necessary to save this number for future reference. You must also provide your registered mobile number to receive the application status.

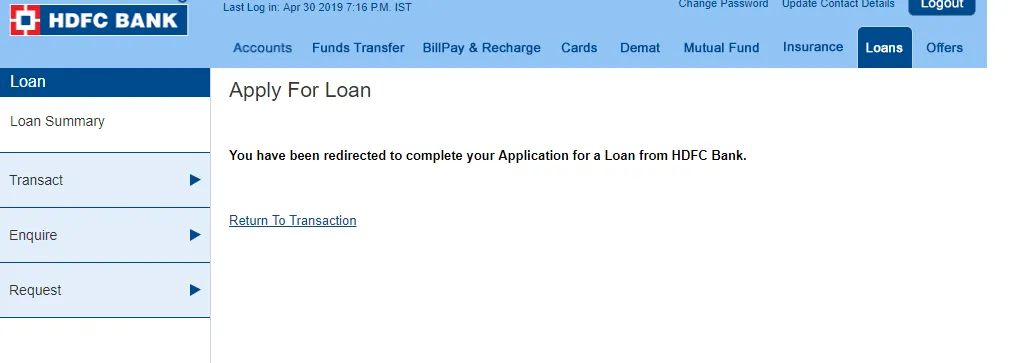

How to Check HDFC Personal Loan Status Online Using HDFC Bank Account?

If you are an existing customer of HDFC Bank, you can sign in to the account and check the status of your loan. You may do this using the following steps:

- Click on the net banking link on the official website of HDFC Bank

- Enter your details and log in to the website.

- Once you have logged in, locate the 'loans' section on the menu bar.

- Track Loan Application form through HDFC website

- If you have already applied for a loan, you find the link to track the status of your application in this section.

- If you haven't applied for a loan already, you may apply for a new loan under this section.

How to Track HDFC Personal Loan Status with Your Mobile Number?

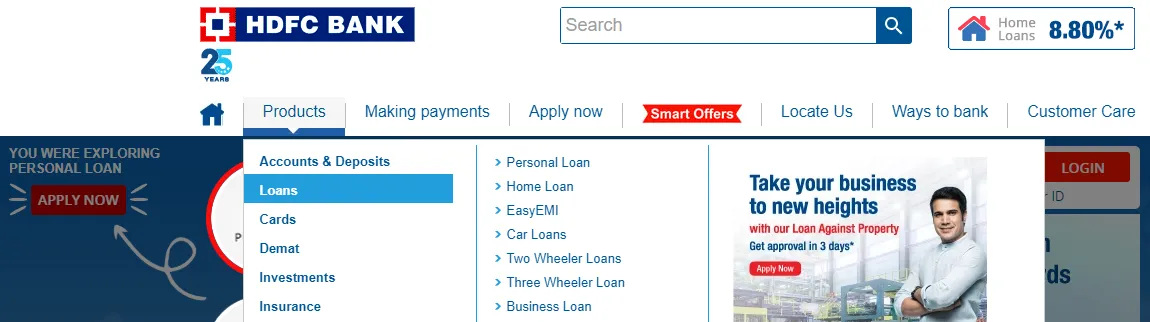

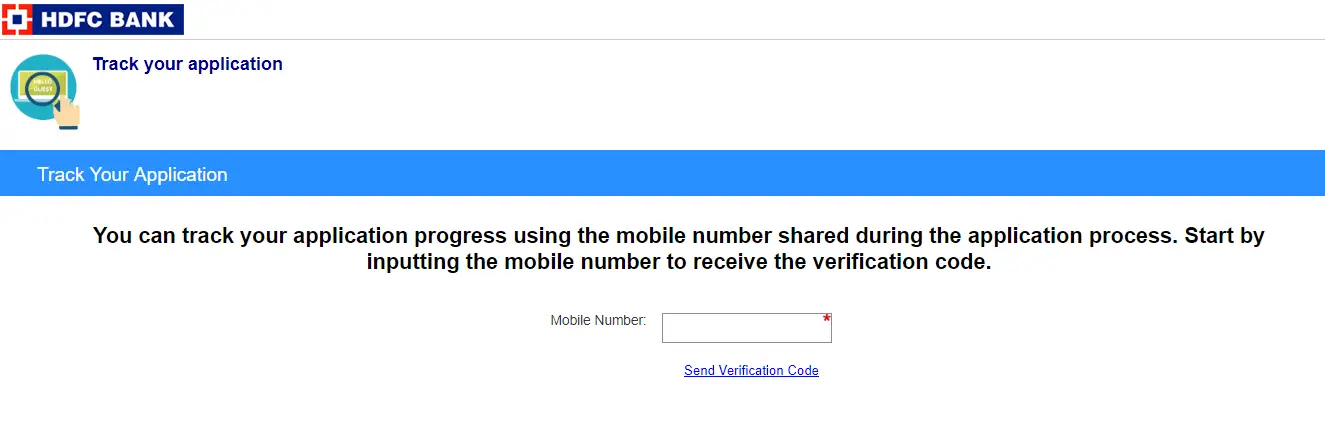

When you are applying for a loan with HDFC Bank, you need to provide your mobile number to the bank. Any further communication with the application will be done through this number. Hence, the bank offers an easy way for customers to track the status of their loan application with the help of their mobile numbers. The steps to track the status of your loan application are given as follows:

- Visit the official website of the HDFC bank.

- Under the menu 'products', click on 'loans' and then 'personal loans'.

- Once you click on 'personal loan', you can find the personal loan page with all the details about your personal loan.

- On this page, find a 'floating menu' at the bottom of the page and click on 'track personal loan request'.

- Once you click on it, a new page will open to request your mobile phone number.

- You need to enter your mobile number to receive the verification code sent by the bank.

- Once you fill in the verification code, the status of your personal loan will be provided by the bank.

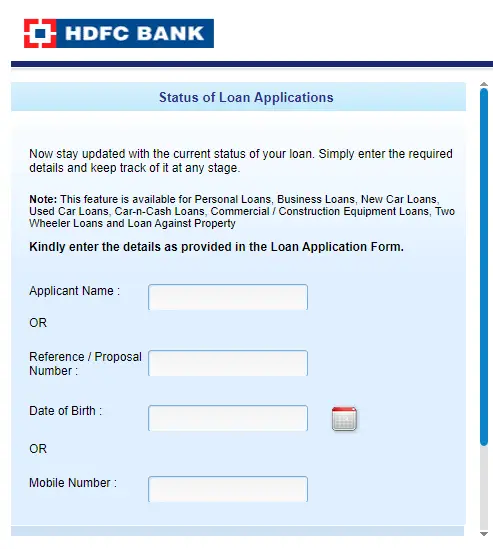

How to Check the Status of Your Personal Loan using Your Reference or Proposal Number?

- Click on the link https://leads.hdfcbank.com/applications/misc/LST/loantracker.aspx

- Enter either the name of the applicant or the reference/proposal number. You will then have to enter either the date of birth or the mobile number of the applicant. Click on 'Submit'.

- You will then have the option of checking the status of your personal loan.

How to Check the Status of HDFC Personal Loan through the Mobile App?

The bank has a mobile app for usage by its customers. Customers can use this app to check their account balance, credit card balance, etc. This app can also be useful in tracking the status of your loan. HDFC has a different app for managing its loans. You can download the HDFC Loan Assist application from Google Play to keep track of your loans. You can use this application as follows:

- Once you have downloaded the application, you can check out the list of loan products offered by HDFC Bank.

- If you have already applied for the loan, you can choose the personal loan option in this app and check your application status.

- Once you have provided the necessary details, the status of your loan application will be provided to you.

How to Check the HDFC Personal Loan Status Offline?

In addition to the online methods given above, the bank also offers a few offline methods for customers to check the status of their loans. The best way to do this offline is by visiting the branch office of HDFC. All the top cities in India have multiple locations of HDFC branches. When you visit the branch office, you need to provide the reference number that was given to you at the time of loan application. With this application number, the bank official will be able to provide you the status of your loan.

You may also avail the services of the bank's customer service department to check the status of your loan. You can use the toll-free number 1800 258 3838 to reach out to the customer service department. When speaking to a representative, you must provide your registered mobile number and the loan application reference number. With these details, the representative will be able to track your loan status and provide it to you.

How to Track HDFC Personal Loan Status via BankBazaar

Customers can also apply for a personal loan through BankBazaar website or mobile application. In this way, they can check out the best offers available in the market and apply online instantly. If you have applied for a loan through BankBazaar, you can easily keep track of your loan application by following these simple steps:

- Visit the official website of BankBazaar.

- On the top right corner of the home page, you can find the 'Track Application' button.

- When you click on it, you will be redirected to a new page.

- On this new page, you must enter your loan application ID and mobile number.

- After entering these details, click on 'Track Application'.

- You may also choose to log in to the site with your Google ID or Facebook ID and then track the personal loan application status.

The status of your loan will be displayed immediately after you enter the necessary details and click on the track application button.

How to Contact HDFC Personal Loan Customer Care?

HDFC bank personal loan customer care executives can be contacted by at the listed below numbers depending on the city of your residence:

- Pune: 020-6160 6161

- Mumbai: 022-61606161

- Kolkata: 0522-6160616

- Jaipur: 033-61606161

- Indore: 0141-6160616

- Hyderabad: 040-61606161

- Delhi and NCR: 011-61606161

- Cochin: 0484-6160616

- Chennai: 044-61606161

- Chandigarh: 0172-61606161

- Bangalore: 080-61606161

- Ahmedabad: 079-61606161

FAQs on HDFC Personal Loan Status

- Which is the best way to know the status of my loan application?

There are many ways to keep track of your loan application status. However, the online method is the easiest one for customers. Here, all you have to do is visit the website of the bank and enter your details.

- I checked my loan application online, and it was rejected. What could be the possible reason for rejection?

There are many reasons why your loan application could be rejected. The most common reason is poor credit history. If you have defaulted on your loan earlier, you are likely to have a low credit score. In this case, your loan application will be rejected by the bank.

- My application status says that it is accepted. What is the next step?

The bank will contact you soon with further details about the loan. Once the formalities are over, you can receive the loan amount in your bank account soon. If you don't receive any communication from the bank, you may contact the bank's customer service department and enquire about the delay.

- What can I do if my loan status is not available online?

For most customers, the loan status will be displayed immediately. However, in some rare cares, your status may not be updated by the bank. In this case, you can contact the customer service and enquire with them. You may use the toll-free number 1800 258 3838 to reach out to the customer service department. You may also check the number of your specific city by checking the customer care section on HDFC's official website.

- How can I track my HDFC personal loan status?

HDFC bank personal loan applicants can check the status of their personal loan on the website of the bank by using either their application name, application reference number and date of birth and mobile number.

- How long does it take for HDFC Bank to disburse a personal loan?

HDFC Bank promises disbursal of personal loans in 10 seconds for pre-approved customers and within 4 hours from approval for other customers.

- How long does it take to get a personal loan approved?

HDFC Bank approves personal loans within a few hours from the submission of the required documents.

- How can I check my HDFC Bank personal loan status?

You can check your HDFC Bank personal loan status on the website of HDFC Bank or at the nearest branch of HDFC Bank. Applicants can check the status of their personal loan using their reference number and mobile number.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.