Second-Hand Bike Loan / Used Two-Wheeler Loan

The price of a new bike or scooter can be high, and hence looking to avail a loan for the same may not be a feasible financial option. Hence, in such cases, you can look to buy a second-hand two-wheeler vehicle for yourself.

The cost of the vehicle will be lower, and you can take a loan for the same. There are various lenders in India which offer second-hand two-wheeler loan to their customers.

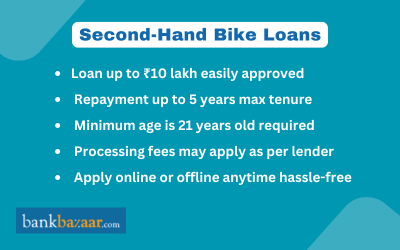

Features of Second-Hand Two-Wheeler Loans

- Loan Amount: Most lenders will offer you a loan of up to Rs.10 lakh. However, the loan amount you can avail yourself of will depend on factors such as the cost of the vehicle, repayment tenure, your credit score, etc.

- Interest Rate: Lenders in India offer attractive interest rates for second-hand bike loans. The interest rates vary from lender to lender and you must check them to see if they are feasible for you.

- Tenure: The repayment tenure offered is up to five years by most lenders in India.

- Eligibility: The minimum age of eligibility can be 21 years. However, in some cases, you can avail a two-wheeler loan if you are 18 years, while the maximum age of eligibility is 65 years.

- Monthly Income: There has to be a certain amount of money you should be drawing on a monthly basis as your salary. While most lenders may require you to earn a minimum of Rs.12,000 per month, some may consider you eligible for loan if you draw a minimum amount of Rs.18,000 per month.

- Processing Fee: After you take a loan, you might need to pay a processing fee. Although for second-hand bike loans, some banks may not charge you a processing fee, other lenders may levy one.

- Pre-Closure Charges: You might need to pay a pre-closure charge on taking a second-hand bike loan, as you can choose to repay the loan before the completion of tenure.

Process to Apply for Second-Hand Bike Loans

How to Apply for a Second-Hand Bike Loan Offline

- You can visit the nearest branch of the bank from whom you wish to avail a second-hand two-wheeler loan.

- Fill in the application form and submit it along with all the necessary documents.

- A bank representative will assist you with the application process.

Steps to Apply Online for a Used Two-Wheeler Loan

The process that must be followed to apply for a second-hand bike loan online is mentioned below:

- Visit the official website of the lender.

- Under used two-wheeler loan or second-hand two-wheeler loan, click on ‘Apply’.

- Enter the relevant details.

- A customer care representative from the lender will call you to process the request.

Documents Required for Used Two-Wheeler Loan Application

- Identity proof such as PAN card, voter id card, etc.

- Address proof such as Aadhaar, Passport, utility bills, etc.

- Proof of age such as Aadhaar, birth certificate, etc.

- Proof of income such as bank statement, salary slip, Form 16. some lenders now accept e-income proofs

- Quotation of the two-wheeler vehicle.

Things to Keep in Mind Before Applying for a Second-Hand Two-Wheeler Loan

Given below are the list of things you must keep in mind before applying for a second-hand two-wheeler loan:

- Set a Budget: The loan amount that you are looking to avail must be within your budget so that you can repay it in easy EMIs.

- Maintain a Healthy Credit Score: You must ensure that you maintain a healthy credit score if you are looking to take a loan since having one makes it easier for the lender to sanction your loan application.

- Compare Different Loan Options: Compare the two-wheeler loan schemes offered by lenders including the rate of interest and other benefits offered to see which of them will be suitable for you as per your requirements.

- Select a Trustworthy Lender: Always look to avail a loan from a lender who is trustworthy and offers a variety of loan options to their customers. It is always recommended that you take a loan from a bank account you have an existing account with, as the lender may offer you a loan at a lower interest rate and assist you with the repayment method.

- Apply Online: Applying for a loan online is easy and hassle-free and takes only a few minutes for the application process to complete. If you are not comfortable applying online, you can visit your bank's nearest branch to apply offline.

Lenders that Offer Second-Hand Bike Loans

Some of the lenders that offer second-hand two-wheeler loans are mentioned below:

- IDFC First Bank

- AEON Credit Service India

- Bajaj Finserv

- ICICI Bank

- Shriram Finance

FAQs on Second-Hand Bike Loans

- Can I apply for a second-hand two-wheeler loan jointly?

Yes, you can apply for a second-hand two-wheeler loan jointly.

- Is collateral required while availing a second-hand two-wheeler loan?

Hypothecation of your vehicle will be enough and hence you won't need to submit any collateral.

- What will happen if I fail to repay my loan?

If you fail to repay your loan, the lender will confiscate your vehicle.

- Can I sell my bike if I have still not cleared my loan?

Unless you have cleared the loan you cannot sell the bike since it is considered to be the property of the lender. Once you have cleared the loan, you can then sell the bike.

- Can I transfer my two-wheeler loan?

Most lenders do offer the option of transferring your loan. You will have to get in touch with a representative of the lender to discuss the transfer of two-wheeler loan process.

- Will a down payment need to be made to avail a pre-owned two-wheeler loan?

Yes, a down payment must be made to avail a pre-owned two-wheeler loan.

- Is it possible to apply for a pre-owned two-wheeler loan online?

Yes, you can apply for a pre-owned two-wheeler loan online.

- Will a processing fee be levied in case I avail a second-hand bike loan?

Yes, a processing fee may be levied in case you avail a second-hand bike loan.

- Will a pre-closure fee be levied on a second-hand bike loan?

Yes, a pre-closure may fee be levied on a second-hand bike loan.

- Can I apply for a pre-owned two-wheeler loan by visiting the bank branch?

Yes, you can apply for a pre-owned two-wheeler loan by visiting the bank branch.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.