SBI Home Loan Eligibility Calculator

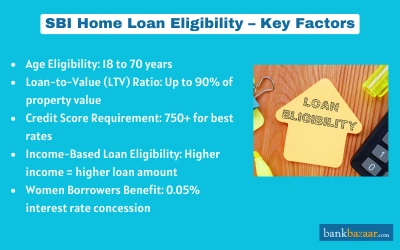

State Bank of India (SBI) home loan eligibility is based on a simple set of criteria that makes the home loans accessible to a wide demographic of people. There are a variety of home loan schemes with attractive interest rates and repayment tenure to meet varying requirements.

SBI Home Loan Eligibility Criteria

Age | 18 to 70 years |

Employment Type | Salaried individuals Non-salaried business people or professionals |

Loan-to-Value (LTV) Ratio | 80% to 90% |

The home loan eligibility criteria for State Bank of India are as given below:

- SBI Flexipay Home Loan: The maximum age to apply for this loan is 45 years and 70 years is the maximum age for repayment.

- SBI Privilege Home Loan: This home loan scheme is exclusively for State and Central Government employees including public sector banks and Public Sector Undertakings (PSUs) as well as individuals who have pensionable service.

- SBI Shaurya Home Loan: This home loan scheme is exclusively for employees of the defence services who are offered longer repayment tenures and lower interest rates than the general public.

- SBI Smart Home Top Up Loan: The eligibility criteria for this, apart from the other criteria, is a CIBIL score of over 550. There should also be no other top-up loans that are active and a regular repayment history of over one year after completion of any moratorium.

- SBI Home Loans to Non-Salaried - Differential Offerings: Apart from the existing eligibility criteria, the following have to be met: If the applicant is a partner in a partnership firm or the proprietor of a proprietorship firm or one of the Directors in a Company, then the company or firm should have been existent for a minimum of 3 years, earned a net profit in the last two years, any existing credit facilities should be standard and regular, and if the proposed property is acquired in the joint names of the Proprietary firm and the Proprietor, the firm should be debt-free or an existing borrower of the bank.

- SBI Tribal Plus: The minimum age of entry for this home loan scheme is 21 years and the maximum age is 60 years. The maximum loan tenure is up to 15 years.

SBI Home Loan Eligibility Based on Salary

State Bank of India’s home loan eligibility depends on a number of factors such as the age of the applicant, credit score, and income or salary.

The SBI home loan eligibility calculator given below shows you the loan amount that you are eligible for based on different ranges of monthly income considering an interest rate of 8.25% p.a. – 11.30% p.a., which is the starting interest rate, and a maximum repayment tenure of 30 years, and assuming there are no other financial commitments towards the Equated Monthly Instalments (EMI) towards other loans.

SBI Home loan Eligibility Based on Age

State Bank of India’s home loan repayment tenure goes up to 30 years. The younger the individual is when the home loan is taken, the more number of years they have to repay the loan and vice versa. Given below is the maximum eligible tenure for SBI home loans according to different ages:

Applicant’s Age | Maximum Eligible Tenure |

21 years to 30 years | 30 years |

31 years | 29 years |

32 years | 28 years |

33 years | 27 years |

34 years | 26 years |

35 years | 25 years |

36 years | 24 years |

37 years | 23 years |

38 years | 22 years |

39 years | 21 years |

40 years | 20 years |

41 years | 19 years |

42 years | 18 years |

43 years | 17 years |

44 years | 16 years |

45 years | 15 years |

SBI Home Loan Eligibility Based on Value of Property

The Loan to Value (LTV) ratio is the quantum of loan that is disbursed based on the value of the property that you intend to purchase. The LTV ratio for different loan amounts is as given below:

Loan Amount | LTV Ratio |

Up to Rs.20 lakh | 90% |

Loans above Rs.20 lakh | 80% |

SBI Home Loan Eligibility Based on Credit Score

Your home loan eligibility is dependent on your credit score. The higher your credit score, the lower your interest rate and vice versa. Here are the ratings for different credit scores:

Rating | Credit Score |

Good | 750 and above |

Average | 600 - 750 |

Poor | Below 600 |

SBI Home Loan Eligibility for Women

The eligibility criteria for women are the same as for other applicants although women borrowers are given an interest rate concession of 05 basis points.

SBI Home Loan Eligibility for Co-Applicant

State Bank of India accepts co-applicants provided they have a regular source of income or salary with documents to be furnished as proof of salary or income.

Factors Affecting SBI Home Loan Eligibility

SBI home loan eligibility is determined by the factors given below:

- Applicant’s age

- Applicant’s credit score

- Applicant’s salary or income source

- Indian citizenship status

FAQs on SBI Home Loan Eligibility

- Are NRIs eligible for SBI home loans?

Yes, State Bank of India provides home loans for NRIs.

- What are the eligibility criteria for SBI's balance transfer of home loan or top-up loan?

The eligibility criteria for SBI’s balance transfer of home loans or top-up loans are the same as that of regular loans – the applicant should be an Indian citizen/NRI and be between 18 and 70 years of age.

- How does SBI decide my home loan eligibility?

SBI decides your home loan eligibility based on your age, income or salary, credit score, etc.

- How can I increase my chances of being eligible for SBI's home loan?

You can increase your chances of being approved for a State Bank of India home loan by adding a co-applicant who has a regular source of income, has a good credit score, and fits the age and Indian citizenship criteria as well.

- How will I know if my eligibility criteria have been met for SBI home loans?

You will be informed if you have cleared the eligibility criteria for SBI home loans through the in- principle sanction that will be provided through the bank’s official website during your application process or through the bank’s official mobile application.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.