Credit Card Protection Plan (CPP)

Credit cards have always played a significant role in our lives, be it either for an all-time fund access or just a thing to boast about. Till the time it is safely packed in our wallet, it gives us a sense of purchasing power and confidence. The dreaded moment when you lose your precious credit card, your world comes crashing down. There are many ways to handle this situation if you are not already in the middle of a panic attack.

The traditional way of handling this incident would be to call the customer care requesting to block your credit card. However, if you are one of those who take pride in more than one credit card, then the calls could seem endless. Therefore, Credit Protection Plan (CPP) is one of the best options to keep your card safe in advance.

What is Credit Card Protection Plan?

Credit Card Protection Plan acts as an insurance plan for credit cards, debit, retail, and membership and retail cards, in case of theft, loss or fraud on the cards. It requires the cardholder to pay a fixed yearly fee to use the service. In India, this service is provided by two service providers - Credit Protection Plan (CPP) and OneAssist. They offer various card protection plans for different cards based on information such as credit limits, etc.

Features of Credit Card Protection Plan

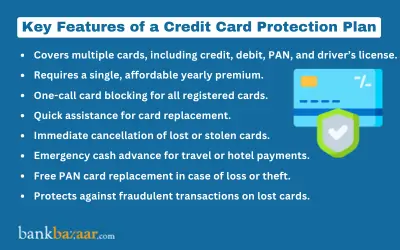

Single Insurance Plan: Credit Card Protection services are single insurance plans that offers coverage for more than one card, be it credit card, debit card, PAN card or Driver's License.

Economical and One-time Premium: CPP service providers require cardholders to pay a minimal premium yearly for subscribing to the service. The annual premiums for these services are as low as Rs.899.

Easy Blocking: For subscribing to the plan, all you need to do is register your card's details. Once registered, in case of theft or loss of card, all you are required to do is call the service provider and all your cards linked to the plan are blocked. You do not have to go through the herculean task of calling each bank, asking to block the cards, in case of loss of multiple cards.

Card Replacement Assistance: The card protection plan also provides assistance in replacing the misplaced cards.

Quick Card Cancellation: The CPP service provider connects with the concerned banks of your credit and debit cards in order to initiate an immediate process of cancellation of your misplaced cards. The expenses incurred in unauthorized transactions in case of stolen cards are also paid for, by the CPP service provider.

Emergency Financial Assistance: If you lost your credit card or debit card or any other card overseas, CPP services offer emergency cash advance for settling unpaid hotel bills or arranging travel tickets. If you are within the country, emergency assistance from the CPP service provider reaches the cardholder within 24 hours, while if on a trip abroad, it takes about 48 hours to get assistance. There is no interest charged on the emergency cash advance provided you under this plan, however you are required to repay the amount in full within 28 days.

PAN Card Replacement for Free: You are also eligible for a fraud protection feature under the CPP, where your PAN Card is also protected against loss, theft, fraudulent online use, etc. In this case, the CPP service provider ensures your PAN card is replaced when lost, within the shortest time span. There is no charge for this replacement as it is done by the CPP provider on your behalf.

Applying for a Card Protection Plan

Subscribing for a CPP is very easy, it usually involves the following steps:

- Fill an application form for the chosen card protection plan. Application forms are available online on the service provider's or banks registered website.

- Pay the premium amount as per your card and as offered by the service provider. Generally, the premium is required to be paid in full and at the beginning of the plan.

- Once the service provider receives the premium amount, a welcome pack is sent to the cardholder. The welcome pack comprises of a registration form, confirmation letter as well as terms and conditions of the membership.

- Cardholder should register each card that is under the protection plan by giving all the details of the cards and sending it back to the CPP provider.

Things to Remember before Subscribing to CPP

Opting for a CPP is a great idea, provided you are sure if it will benefit you. Some of the points to look out for, while applying for a credit card protection are:

- While selecting the card protection plan, ensure you know the list of banks that are tied up with the providers.

- Find out about all the plans being offered as each CPP may differ depending on the bank as well as your card.

- Find out the maximum damage loss that you will incur against the plan you are choosing.

- Also, know the maximum reimbursement that can be availed on your plan.

FAQs on Credit Card Protection Plan

1.Is it mandatory to have a credit card protection insurance?

No, it is not mandatory to opt for the credit card protection insurance.

2.In case I opt for the credit card protection plan, will a fee have to be paid?

Yes, you will need to pay a premium in case you opt for the credit card protection plan.

3.Can I cancel the Card Protection Plan?

Yes, the Card Protection Plan can be cancelled by calling the customer care of the bank. However, you must call the customer care from the registered mobile number.

4.In case I have opted for CPP with State Bank of India, what are the contact numbers?

In case you have opted for CPP with State Bank of India, the contact numbers are mentioned: 1800 419 4000 (toll-free) and 6000-4000 (the city code must be entered before 6000)

5.Should the emergency travel assistance be repaid?

Yes, the emergency travel assistance must be repaid within 28 days.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.