Why Credit Card 'Minimum Payment Due' Does Not Help

Credit cards are a useful financial instrument that enables you to pay for purchases, manage cash flow, and increase your credit score. If you carefully establish your credit limit (pay your bills on time and in full), you should avoid interest and penalties. However, most cardholders too often fall into the pattern of simply paying the minimum amount due.

Paying only the minimum amounts allows the account to stay in good standing but will not eliminate the debt. Paying only the minimum amounts may seem manageable, but will accrue interest, additional fees, then additionally lead you into a long-term cycle of debt.

What is Credit Card Minimum Amount Due?

Minimum Amount Due or MAD is the minimum payment on a credit card is the lowest amount you must pay by the due date to avoid late fees. This keeps your credit bill payment from being considered late. This amount is usually around 5% of your total balance, including interest and fees. When you pay at least the minimum balance, you will not incur an immediate penalty. However, if you are only paying the minimum, you are not paying off the total amount owed which continues to be charged interest.

Example

As an example, if you owe Rs.50,000, your minimum payment is likely to be around Rs.2,500. While a minimum payment may seem more manageable in the short run, if this becomes a habit and the minimum due is paid every month, you could see your total debt grow in a few months.

Purpose of Minimum Amount Due

Credit card minimum payments exist to provide the cardholder flexibility and convenience, especially in the event they are unable to pay the full balance due. Minimum payments exist to provide cardholders with more manageable credit card use and prevent financial ramifications.

Financial Flexibility:

Minimum payments allow you to make a smaller payment towards your account balance rather than full repayment if you are unable to afford a complete payment. This flexibility will allow your credit card account to stay in active status, will help you to maintain your credit score, and will potentially allow you to comfortably pay for critical bills as necessary.

Short Term Relief:

Minimum payments can also provide relief in the short term during unplanned events like income disruption, an unexpected medical expense or required repair expenses. Paying a minimum for several months will help avoid negative financial implications while managing short-term cash flow problems.

Avoiding Penalties:

One of the best ways to avoid late fees, and additional interest charges on your credit card account, is simply to make at least the minimum payment on the balance due. This is necessary to establish and maintain a clean credit history.

Ease of Repayment:

Minimum payments allow you to pay your credit card back in an organized manner, reducing the burden of having to repay a large balance either all at once or at least pressured to do so in a short time frame.

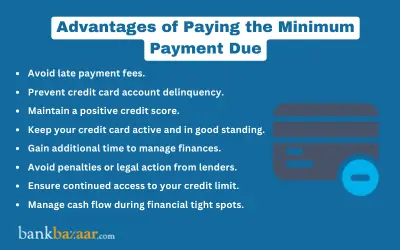

Advantages of Paying the Minimum Payment Due

Here are the main advantages:

- Avoidance of penalties and late fees: By making MAD payments on time, you will not incur large late payment fees.

- Avoids negative credit reporting: Banks cannot report you as a delinquent to credit bureaus if paid on time.

- Averages protecting your credit score: As long as you are paying at least the minimum due, you will not take the hit of missing payments on your credit score.

- Keeps your account active: Make sure your credit card is active and available for all purchases without restriction.

- Avoidance of legal or lender action: By keeping up with the minimum payment, you are protected from recovery notices or action by lenders.

- Keeps a strong repayment history: This contributes toward building a positive repayment experience which strengthens your overall credit.

- Ensures uninterrupted services: Avoid a situation where your banks or creditors may block your services and disable EMI conversion, add on cards, or even redemption of reward points.

- Provides flexibility when cash is tight: If you find yourself low on cash (for any reason), paying your minimum amount due helps you purchase time and keep your account active.

- Prevents compounding of penalties: Stops the repeated late fees from accumulating month after month.

How Does the Minimum Amount Due Work?

The minimum amount due means the amount of the monthly payment that you have to make in order to keep your account in good standing and not incur fees. It also provides a guide for cardholders to have cash to use during times when it may be hard to pay off the available balance.

Purpose of the Minimum Due:

- Avoid late fees and continue to have a good credit score as a result.

- Provides a little flexibility in cash flow for emergencies or when money is tight i.e., medical bills, car repairs, or an unexpected expense, without losing the money you have.

Interest and Debt Implications:

- While you can make the monthly payment as agreed to not incur a penalty, you have still have not paid off the whole debt.

- The outstanding balances will accrue interest and most likely the total paid back will be much higher over a long period of time due to accruing interest.

Bank Internal Policies:

- The bank that issued you the credit card may raise your interest rates if you continue to challenge the payment due date or only make partial payments.

- You need to know their minimum payment policy to ensure you understand long-term credit card costs.

Safe Usage:

- The payment due should only be viewed as a temporary option, and never as the strategy for repaying debt.

- Whenever possible and you have the means to pay more than the minimum due to reduce your debt faster and reduce the amount of interest accumulated.

How is the Minimum Amount Due Calculated?

The issuing bank determines the minimum amount due utilizing multiple components to ensure that making partial payments still counts towards the amount owed.

- Percentage of Outstanding Balance: Usually, the minimum due amount is around 5% of the total outstanding balance. This means that regardless of whether you pay off the entire balance due or not, you will contribute a small amount to the credit owed monthly.

- Interest and Fees: Any interest accrued from unpaid balances charged to the credit line will be added to the minimum due. The bank may also charge additional fees, such as late payment fees to those charges. This tells you that the minimum due is not a static amount from month to month as it can change based on how many charges and how much interest is accruing month over month.

- EMI Instalments: If you converted any purchases into Equated Monthly Instalments (EMIs), the monthly instalment amount is calculated into the minimum due. This ensures that the EMIs are included but allows you to have a minimum due amount which is less than the entire Credit Card balance.

- Past Dues: Any amounts outstanding from prior periods will carry over to the new minimum due. This ensures that any missed payments from prior months and any current charges are now included in the overall minimum due and cannot be overlooked.

Calculation of Minimum Amount Due

As is the case with many credit card companies, the Minimum Amount Due is generally 5% of the balance outstanding as calculated on statement date. If you have converted your purchases to EMI or if you have enabled the EMI balance transfer option, the same will also be added to your Minimum Amount Due. Also, if there are any unpaid Minimum amount from the previous credit card statement cycle, it will also be added to the minimum due for current month.

Let us consider an example for minimum amount due calculation and make some assumptions for the same.

- The fee for late payment is Rs. 500.

- The credit card statement is generated at the 5th of every month.

- Interest rate is charged at 3% every month

- The payment is to made on or before 26th of every month.

The following example will show how the minimum amount due is calculated.

Date | Transaction Details | Transaction Amount | Remarks |

July 15 | Purchase | Rs. 10, 000 | Interest Free Credit period. |

August 5 | Statement | Rs. 10, 000 | Due date is August 26. Minimum Amount Due is Rs. 500 (5% of Rs. 10, 000) |

August 20 | Payment | Rs. 500 | Minimum Amount Due Payment |

August 25 | Purchase | Rs. 15, 000 | No interest free credit period |

September 5 | Interest | Rs. 682 | On purchase |

September 5 | Service Tax | Rs. 95 | Service tax on interest |

September 5 | Statement | Rs. 25, 278 | Minimum Amount Due is Rs. 1263.90 (5% of Rs. 25, 278) |

September 26 | No payment is made. Late payment fee will be applicable. | ||

September 30 | Late Payment Charges | Rs. 684 | Including service charges. |

October 5 | Interest Charges | Rs.. 778 | |

October 5 | Service Tax | Rs. 109 | Service tax on interest |

October 5 | Statement | Rs. 26, 848 | Minimum amount due Rs. 2,542 including the previous due of Rs.1, 263.9 |

The fact that late payment penalty was not charged in August since the minimum amount has already been paid is obvious. Also, the interest has been charged on the amount unpaid from the purchase date and not from the due date or statement date. Hence, by making the minimum due payment, you cannot avoid the high interest. Also, if you do not make the minimum payment by due date, late payment penalty will also be charged.

Disadvantages of Paying only the Minimum Payment Due

- One major advantage of making regular, full payments of your credit card outstanding is that you get interest free credit period for up to two months. Not only that, you will also get up to three weeks' time to clear the outstanding amount after statement is issued.

- You will not be offered any interest-free credit period if you have paid only the Minimum Amount Due (MAD) and not the credit card outstanding in full. Rather, you will be charged an interest amount from the date of purchase.

- The interest amount will also keep accumulating till you settle the dues. So, even if you have paid the Minimum Amount Due and have avoided paying any penalty for late payment, you will not be able to enjoy the benefits of interest free credit period.

Consider an illustrations to see how interest is charged on credit cards and how paying just the Minimum Amount Due every month will lead to accumulation of interest:

Date | Transaction Details | Transaction Amount | Remarks |

July 15 | Purchase | Rs. 5, 000 | Interest Free Credit period |

July 30 | Purchase | Rs. 5, 000 | Interest Free Credit period |

August 5 | Statement | Rs. 10, 000 | Due Date - August 26 Minimum Amount Due is Rs. 500 (5% of Rs. 10, 000) |

August 8 | Purchase | Rs. 8, 000 | Interest Free Credit period |

August 20 | Payment | Rs. 10, 000 | Full Payment |

August 25 | Purchase | Rs. 15, 000 | Interest Free Credit period |

September 5 | Statement | Rs. 23, 000 | For bills on August 8 and August 25 Due Date is September 4 Minimum amount Due (Rs. 1, 150) |

September 12 | Purchase | Rs. 10, 000 | Interest Free Credit period |

September 26 | Payment | Rs. 1, 150 | Minimum Amount Due paid Interest Free credit period for August 8, 25 and 12 will be reversed. Interest will be charged from the date of purchase. |

September 30 | Purchase | Rs. 5, 000 | No Interest Free Credit period |

October 5 | Interest | Rs. 1, 679 | Interest Charged for all purchases from date of purchase. |

October 5 | Tax | Rs. 235 | Service tax on interest |

October 5 | Statement | Rs. 38, 764 | Statement Amount Rs. 23,000 - Payment of Rs. 1, 150 + Purchases Rs. 15, 000 + Interest Amount Rs. 1, 679 + Service Tax |

From the above example, it can be understood that for bills on August 8, no interest was charged in the statement dated September 5. However, because only the Minimum Amount Due was paid, the interest free credit period was taken back and interest was charged.

Ways to Get Out of the Minimum Payment Trap

Only making the minimum payment on your credit cards can be enticing, but it ultimately creates more debt and a higher interest rate that clients will pay.

To avoid falling into the minimum payment trap, follow this simple plan:

Step 1: Pay More than the Minimum

Your first objective should always be to pay above the minimum payment. Paying a few hundred a month can substantially lessen the interest charged and how long you will pay your debt. The greater payment you make today, the lesser balance you will owe tomorrow.

Step 2: Develop a Reasonable Budget

You should build a monthly, sensible budget that considers paying the credit card(s) owed. Give light of your spending, and make allowances in your budget for spending less on things such as dining or subscriptions and then apply that money toward your card. This will create a steady discipline in your actions.

Step 3: Use a Consistent Repayment Method

You can go with either of two methods for the repayment process:

Snowball method: The snowball method recommends only paying off small balances first. This feels good to pay off small debts first and become free of obligations. This method can also be useful because it motivates people to continue to pay off debts.

Avalanche Method: The avalanche method recommends paying off the highest interest first. This method is, by nature, a higher tax decision. It is simply a mathematically smarter choice. You should decide which method fits your personality and repayment.

Stage 4: Look for Balance Transfers

If hefty interest is pulling you down, you may want to think about transferring your balance onto a card that offers a lower interest rate or has a temporary 0% promotional rate. A balance transfer card can provide some breathing room but be sure to examine the transfer fees and how long the promotional rate lasts.

Stage 5: Look for Professional Support.

If paying back your debt has become overwhelming, you should contact a credit counsellor. They can assist you with developing a repayment plan, negotiating with lenders if necessary, and provide you with useful advice necessary to get on the path to long term financial health.

The Hidden Risks of Minimum Credit Card Payments

To receive at least a slight payment each month from their cardholders, credit card companies establish a minimum amount due. This minimum is typically 2-3% of your balance and makes it look like you can afford to repay it easily.

For example, if your balance is Rs.1,000, your minimum due could be Rs.20-Rs.30. While you think you can afford to make these minimum payments, relying on minimum payments will create longer-term challenges.

Interest Costs

The major issue of paying only minimum payments is the interest charges on your credit card(s). Credit card interest rates are often very high at 15% to as much as 25% or more on an annual basis. When you do not pay off your balance in full, you have an outstanding amount on your credit card, and that amount will continue to earn interest.

As time goes on, interest charges will be compounded, which means you can end up paying much more than the original purchase price. The small monthly payment you think you have made ended up being a large financial burden.

Longer Debt Cycle

When you make only the minimum payment, it turns the repayment process from months to years. The majority of your payments will go toward interest and not reduce your overall balance. As a result, you're stuck in debt for a longer period of time, and what was a manageable payment cycle could then feel nearly endless for repayment.

Detrimental Impact on Your Credit Score

The amount of credit you have available (i.e.; cumulative limit of credit cards) versus the amount of credit you are using to pay off debt is called the credit utilization ratio, and this is a huge portion of calculating your credit score.

If you are only paying the minimum, then your balance is still high, and your credit utilization continues to stay high. Eventually, your credit score will drop, making it difficult to qualify for a loan, a credit card, and/or low-interest rates.

Financial Anxiety

Carrying large amounts of debt each month can be stressful financially. You lose the ability to ‘manage’ unforseen developments and you lose financial flexibility overall. Emergencies like unexpected medical bills and car repairs are more difficult to deal with, and the more you think about being and feeling ‘stuck in debt,’ it becomes overwhelming.

Can you just keep paying the Minimum Amount Due Every Month?

Yes, you can keep paying just the Minimum Amount Due every month, which helps avoid late fees and protects your credit score. However, this means you’ll be charged high interest on the remaining balance, and you lose the interest-free period on new purchases. Over time, this can lead to increasing debt and financial strain. Therefore, paying only the minimum should be a short-term solution during emergencies.

FAQs on Minimum Amount Due

1.What is the minimum amount due (MAD)?

Minimum payment due is a small portion of the total outstanding bill which is you need to pay to the bank even if you not able to the pay the complete bill amount.

2.How to calculate minimum payment due amount?

The minimum payment due is fixed at 5% of the entire outstanding balance which is calculated on the date when the credit card statement is sent to the cardholders.

3.What are the advantages of paying the minimum amount due?

Paying the minimum amount due on time shows that the cardholder needs to pay only the interest amount when needed without any sort of additional charges. Not only this, if you successfully pay the minimum amount due within the due date, your credit score will not be affected.

4.What will happen if I pay only the minimum amount due for a few months?

If you pay only the minimum amount due for a few months, you need to pay high interest on your outstanding amount. Moreover, you will not get any interest free credit period. Apart from this, the bank will reduce your credit limit.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.